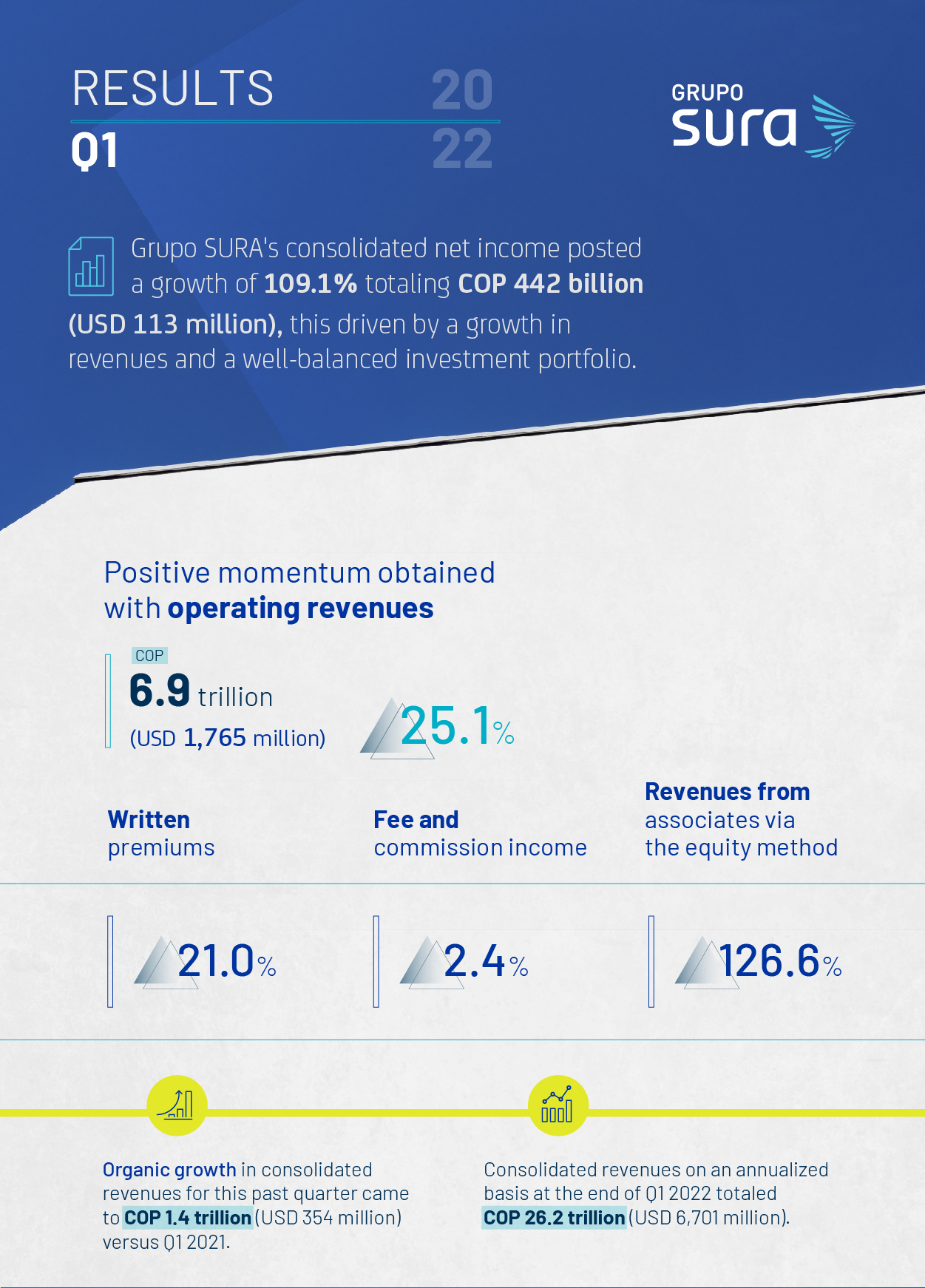

• The Company posted consolidated revenues of COP 6.9 trillion (USD 1,765 million) at the end of Q1 2022 for a growth of 25.1% compared to the first quarter last year.

• This level of results was driven by revenues obtained from associates via the equity method as well as a double-digit growth on the part of Suramericana.

• Grupo SURA shall receive COP 1.1 trillion in dividends in 2022, now that the shareholders of our different investments have approved their respective dividend distribution proposals.

Grupo SURA has reported to the market its financial results corresponding to Q1 2022, which amply demonstrate the importance of having a growing investment portfolio that is also well-diversified in terms of industries and geographies.

Operating revenues for Q1 rose by 25.1% to COP 6.9 trillion (USD 1,765 million). All in all, the Company achieved a organic growth in its revenues of COP 1.4 trillion (USD 354 million) during this first quarter. This increase in revenues was underpinned by the good levels of performance posted by Suramericana, mainly in the Life and Health Care insurance segments, as well as an all-time high in revenues obtained via the equity method, these reaching COP 543 billion (USD 139 million), given higher contributions mainly from Bancolombia and Grupo Nutresa. Consolidated revenues over the last twelve months reached COP 26.2 trillion (USD 6,701 million).

"These first-quarter results demonstrate how Latin Americans prefer and trust in the different lines of business that make up our portfolio, thereby allowing us to continue to advance towards our goal of sustainable profitability. Just in the first quarter alone, we achieved an organic growth in consolidated revenues of COP 1.4 trillion for a total of COP 6.9 trillion, a sign of the sound momentum that the different lines of business that comprise our investment portfolio are enjoying at the present time", stated Gonzalo Perez, CEO of Grupo SURA.

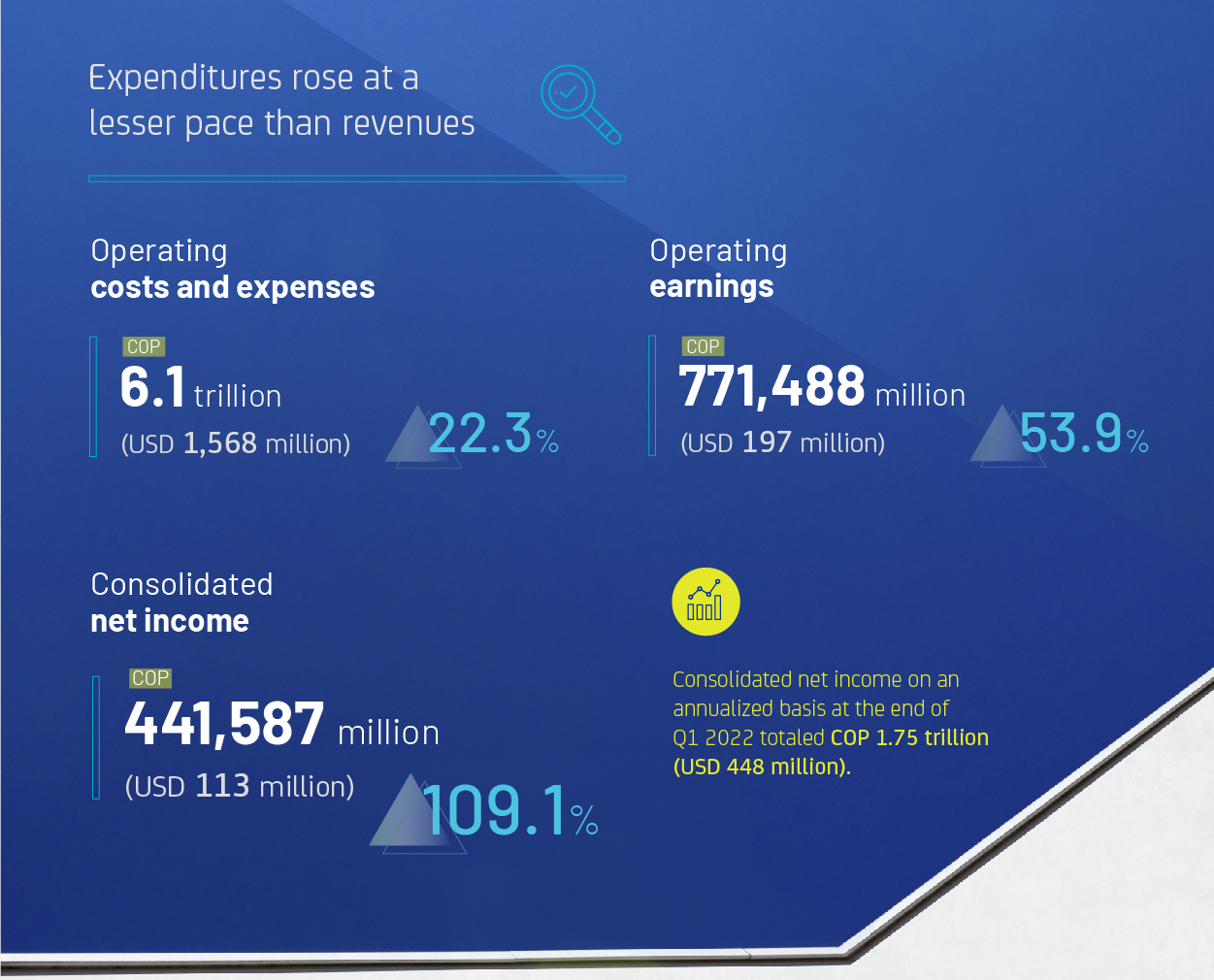

Operating expense increased 22.3% for the period, this due to an increase with Suramericana’s claims rate, specifically in the Car solution, given difficulties with the auto parts supply chains. On the other hand, this increase in expense was also due to our subsidiaries resuming their investments and projects, that had been temporarily suspended due to the pandemic. However, it should be noted that the growth in expenses continues to be lower than the increase in revenues, thereby helping to drive up operating earnings, which ended up at COP 771 billion (USD 197 million), for an increase of 59.3% compared to Q1 2021.

"We obtained a financial performance for this last quarter in keeping with our expectations of a recovery, along with a record high of COP 1.75 trillion in consolidated net income over the last 12 months. This demonstrates, once again, the advantages of having a diversified, well- balanced investment portfolio as well as the benefits of our efficiency efforts. The contributions of both Suramericana and our investments in Grupo Nutresa and Bancolombia for this past quarter were significant factors in being able to present a good balance sheet," stated Ricardo Jaramillo, Grupo SURA´s Chief Business Development and Finance Officer.

Consequently, Grupo SURA ended the first quarter with a consolidated net income of COP 442 billion (USD 113 million), for an increase of 109.1% compared to the same period last year. Also, upon observing the Company’s net income over the last twelve months we see that it now stands at COP 1.75 trillion (USD 448 million), which is an all-time high for the Company. Controlling net income increased by 121% compared to the first quarter of last year totaling COP 429 billion (USD 110 million).

Furthermore, the Company is set to receive another all-time high of COP 1.1 trillion (USD 299 million) in dividends during 2022, this based on the dividend distribution proposals that were approved by the shareholders of our subsidiaries and portfolio investments. This represents an increase of 67.7% compared to the dividend income recorded in 2021. This liquidity shall allow Grupo SURA greater financial flexibility and capacity for the Company's deleveraging, investment and shareholder remuneration plans.

Financial results on an individual subsidiary level

Suramericana (specializing in insurance and trend and risk management) ended the first quarter of 2022 with a 21.4% increase in written premiums, totaling COP 5.6 trillion (USD 1,427 million), given the positive levels of performance obtained with the Life (16.7%), Health Care (27.2%) and Property and Casualty (15.8%) insurance segments. On the other hand, this subsidiary obtained investment income of COP 376 billion (USD 96 million), for a growth of 88.8%.

During the period, this subsidiary posted an increase in its claims rate this mainly due to its Car solution. This increase was partially mitigated by the reduced impact of the pandemic across the region; in fact, Covid claims declined by 60.5% compared to the same quarter last year and by 11.4% compared to Q4 2021. All in all, net income came to COP 104 billion (USD 26.7 million).

On the other hand, SURA Asset Management (an expert player in the regional savings, investment and asset management sectors) posted COP 609 billion (USD 156 million) in fee and commission income, corresponding to a decline of 1.9%, this being in line with current expectations, due to issues such as the regulatory cap on commissions charged in Mexico along with losses in value on the global capital markets, which impacted the funds' own investments (reserve requirements), this compounded with the depreciation of Latin American currencies against the dollar, which produced a negative exchange difference.

However, it is worth noting the growth in Assets under Management (AUM) since these rose by 1.5% for the Retirement Savings segment (pensions) and another 4.9% for the voluntary segment, the latter handled by Inversiones SURA (voluntary savings for individuals) and SURA Investment Management (regional platform for the institutional segment). This was made possible in spite of the authorized withdrawals from the private pension systems in Chile and Peru, as well as prevailing market volatility. It is worth mentioning that Inversiones SURA has already amassed two million clients throughout the region. In the light of the above SURA AM recorded a net loss of COP 47 billion (USD 12 million) in the first quarter.

Restated figures in US dollars: Figures taken from the Company´s Statement of Comprehensive Income, restated using the average exchange rate for Q1 2022: COP 3,913; Figures taken from the Statement of Financial Position based on the exchange rate corresponding to the end of Q1 2022: COP 3,756.