This type of pension savings plays a key role not only in a country´s development but in increasing the income of Latin Americans during their old age. A panorama of experiences, challenges and opportunities.

By Valora Analitik for Grupo SURA*

Individual savings through private pension funds is, without a doubt, a driving force for stimulating the economy. This phenomenon is repeated within the framework of all those global economies that have a pension system aimed at making workers' savings more efficient and, in this sense, the Covid-19 pandemic left several lessons to be learned about the importance that workers´ savings represent within the framework of a strengthened financial system.

A large part of the reasons why the global economic crisis was not more critical at that time was based on the role of the financial system, one that ensured the ongoing injection of resources into the world economy. Against this backdrop, pension funds took on a significant role: the resources managed by third parties in these funds were kept in circulation on stock markets or even in the debt purchasing markets of some countries.

The case of Spain and Australia

Pension savings, through private funds, were vital for boosting the economy in a world that needed liquidity channels. To give just one example of this, the Bank of Spain, in a report for the year 2021, showed how the injection of funds, including pensions, have made it possible to finance the country´s government during the economic recovery stage.

So much so that, even with regard to the budget appropriations corresponding to 2022 , a sufficiently sound margin was achieved in order to ensure lower financing requirements, which allowed the Spanish government to focus on paying, for example, its other outstanding debt or improving household cash transfer programs as well as providing business incentives.

Another iconic example is that which is taking place in Australia, a country that has a three-pillar pension system: one state, one mandatory and private and the other voluntary. The private system, known as Superannuation, manages the bulk of workers´ savings in this country.

This system is largely handled by private funds which, in addition to being in charge of managing the retirement savings of Australian workers, is also the main motor for keeping the wheel of economic recovery turning.

Data from the Organization for Economic Co-operation and Development (OECD) shows that assets under management held by private pension funds in Australia come to USD 1.8 trillion, which not only represents about 130% of the country´s Gross Domestic Product (GDP) but also maintains a goal reaching 140% of this figure by the end of 2040.

It is worthwhile noting that this ratio translates into the fact that pension funds, based on the case of Australia as an example, serve as financiers in companies that operate in that same country, but that also invest in various economies, in state apparatuses and mechanisms, not to mention what all this represents for creating jobs.

The key role played in Latin America

Guillermo Arthur, Chief Executive Officer of the International Federation of Pension Fund Administrators (Federación Internacional de Administradoras de Fondos de Pensiones - FIAP), affirmed that today, more than ever, the role of pension funds in financing national governments has translated into better investment opportunities and lower unemployment rates.

This is based on the goal that pension funds have with regard to securing workers' funds and making these produce income in such a way that, even in a volatile environment, these would generate returns adjusted to the needs of their fund members.

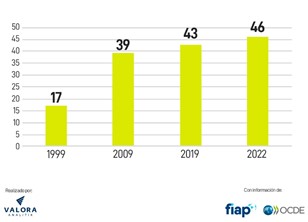

Number of countries that have adopted different modalities of individual capitalization systems.

Arthur recalled that the joint efforts carried out between governments and pension funds have helped to strengthen developing segments of the economy, such as infrastructure. Public financing, that is carried out through managing pension savings, is vital for ensuring the amounts of budgetary appropriations that are needed in order to guarantee adequate funds for the subsidies that were introduced in the post-pandemic era, this among other government programs.

Just to get an idea, and based on the case of Colombia, the country's director of Public Credit, César Arias, made special mention of the role that pension funds have played in contributing to the amount of investor appetite for Colombian sovereign debt, even in complex moments of uncertainty, given the war between Russia and Ukraine and the results of the presidential campaign.

Against this backdrop, out of the total amount of Treasury Bonds (TES) issued by Colombia between December 2021 and April 2022 (COP 22.47 trillion), pension funds were the ones that purchased the lion´s share of the country´s public debt, with about COP 8.33 trillion .

Arthur, with regard to this phenomenon, affirmed that this same trend is being repeated both in developed economies and in those that are in the process of becoming so, which shows, among other things, that Governments are able to regain investor confidence, despite the fact that their countries lost their investment grades in 2021, which is what happened with several Latin American countries.

The point of all of this is to consider how the new macroeconomic scenario and high inflation rates could lower the contributions that pension funds make to the financing of national economies.

Kathryn Rooney, Head of Global Macroeconomic Research and Investment Strategy for the firm Bulltick Capital Markets, also explained at the most recent Asofunds Congress that, without a doubt, the present scenario of high prices and interest rate hikes could lead funds to, generally-speaking, turn their gaze towards markets that offer better investment opportunities.

This, in the end, means that, in keeping with the philosophy that pension funds have always upheld, these need to make the best investments in scenarios offering the highest returns so that this translates into greater pension savings for its fund members, and they may enjoy better pension incomes during their retirement.

A driver of retirement savings

However private pension funds not only play a leading role in sustaining the macroeconomic wheel: they are also sound, inclusive and open options for workers to amass the necessary savings for their old age.

In an interview with La Tercera, Janwillem Bouma, Chairman of the Board of Directors of the private pension fund in the Netherlands, Centraal Beheer APF, and leader of Pensions Europe, an entity comprising 24 pension fund associations in 17 countries in the European Union (EU), ensures that one of the tools that helps workers materialize their pension ideals is based on the options that a certain fund offers with regard to what is available within the financial system.

In this sense, the example of the Netherlands is based on banking or insurance products for private individuals in order to increase their contributions towards their pension savings while providing limited tax discounts for doing so. “This is important, mainly, for those people who do not accumulate (or have not been able) to sign up for a second pillar pension, for example, because (i) their employers are not affiliated with a pension fund; (ii) they do not have a permanent job; or (iii) they are self-employed,” Bouma told La Tercera.

And it is the individual pension contribution that continues to be a real option for obtaining returns on a person´s savings, even on the same pension. One of the options through which individual savings help achieve this goal are voluntary funds, these being mechanisms in which certain resources can be periodically deposited, and depending on the member's profile, these are subsequently invested in conservative, moderate or riskier funds.

This is how a person, who has already retired, can make their income produce returns in periods that can range from six months . The latter, however, exposes one of the most urgent shortcomings of Latin American workers, in that "they still lack a culture of effective voluntary savings," explained Arthur.

And it is important to create this kind of investment culture, and to firmly anchor this to options such as individual pension savings funds, because this entails a two-way benefit: the case of the Dominican Republic is a fine example of this. The Chief Executive Officer of the Dominican Association of Pension Fund Administrators (ADALF), Kirsis Jáquez, affirms that the individual capitalization system has contributed to 22% of the Dominican Republic’s economic growth since 2003.

Challenges posed to individual pension savings throughout the region

The main issue here is that there are still challenges ahead for individual pension savings to become an option that complements sources of financing for a person´s old age. Data collated by FIAP show that, in Latin America, pension contributors correspond to 33.8% of the Economically Active Population (EAP), while in the OECD countries the number climbs to 72.1%.

“This difference shows that only one in three workers, on average, is contributing to the pension system in Latin America, a phenomenon that is directly related to the degree of economic development and the informality of the regional job markets”, as set out by the aforementioned Institution.

This is a heterogeneous reality, added the document, even in the case of nations that have a relatively higher coverage such as Chile, Costa Rica or Uruguay as well as others in which such coverage constitutes a challenge, such as Colombia, Peru and El Salvador, where only between 17% and 26% of the Economically Active Population are covered.

Further to the above, we must add the fact that there is a lot of misinformation that tends to permeate what individual pension savings funds actually represent: one of these has to do with the resources accumulated for retirement purposes.

"Why the gap between what people expect and what they get? It turns out that in cases like Chile, only 18% have been paying into their pension funds for more than 30 years and, according to the International Labor Organization (ILO), it takes at least 30 years to acquire a full pension," explained Alejandra Cox, Chief Executive Officer of the Chilean Association of Pension Fund Administrators.

In the end, the main issue here is that, although there are shortcomings in being able to guarantee robust levels of pension savings, the truth is that the funds have mechanisms for protecting individual retirement savings, even in times of volatility, this while generating returns for savers.

*This article was prepared by the Valora Analitik staff for Grupo SURA. Its content is of a purely journalistic nature and does not compromise any specific positions taken or recommendations made by our Organization.