- This final result reflects a growth in all of Suramericana's segments as well as SURA Asset Management's expense controls and the amount of revenues obtained via the equity method from associates pertaining to Grupo SURA's investment portfolio.

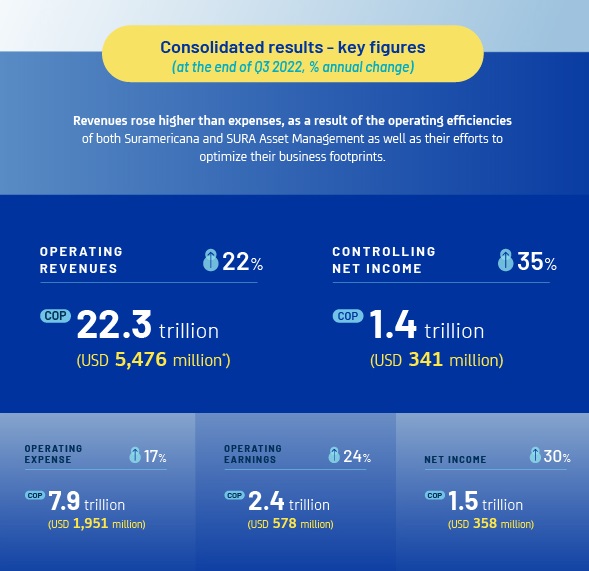

- Revenues rose by 22%, or COP 4.1 trillion more than in the first nine months of 2021.

Grupo SURA reported to the market its consolidated results for this past third quarter, where operating earnings totaled COP 22.3 trillion (USD 5,476 million*) as of September 2022, for a 22% increase compared to the same period last year, this equivalent to COP 4.1 trillion.

This was driven by three factors: (i) the positive levels of commercial performance with all of Suramericana's insurance segments; (ii) SURA Asset Management's ability to sustain its fee and commission income, amid the amount of volatility prevailing on the capital markets; and (iii) a 59% increase in Grupo SURA's revenues obtained via the equity method from its associates, especially Bancolombia, Grupo Nutresa and Grupo Argos.

This level of earnings went hand in hand with controls at subsidiary level over operating expense as well as greater efficiency efforts to offset rising claims rates, particularly in the Mandatory Health Care and Car Insurance solutions. Consequently, operating earnings rose by 24% as of September 2022, and controlling net income, which is attributable to Grupo SURA, amounted to COP 1.4 trillion (USD 341 million), for an increase of 35% compared to the same period last year.

"The positive results achieved during the third quarter reflect the confidence that both individuals and companies have placed in the products, solutions and services of the companies that make up our portfolio, as well as the efficiency efforts of both Suramericana and SURA Asset Management. This only goes to confirm the benefits of a well-diversified portfolio while allowing us to advance with our goal of sustainable profitability", stated Gonzalo Perez, CEO of Grupo SURA.

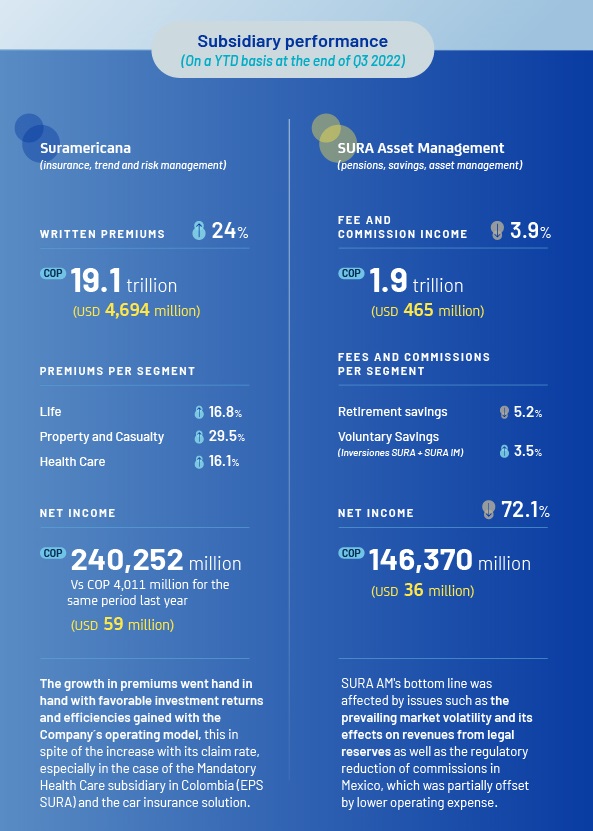

Suramericana, for its part, posted revenues from written premiums amounting to COP 19.1 trillion (USD 4,694 million), for 24% increase compared to the same period last year, thanks to growths in the Life, Health Care and Property and Casualty segments, while the claims rate increased, particularly in the case of our Mandatory Health Care subsidiary, EPS SURA, with more subscribers joining up, as well as the car insurance solution. All this concluded with a recovery with our YTD net income figure that came to COP 240,252 million (USD 59 million), this also driven by returns on investment income.

As for SURA Asset Management, it is worth noting its resilient streams of fee and commission income, which totaled COP 1.9 trillion (USD 465 million) at the end of Q3, for a decline of 4% compared to the same period last year, taking into account the impact of the amount of volatility prevailing on the capital markets as well as the regulatory reduction in fees and commissions in Mexico. These impacts were partially offset by expense controls and higher productivity levels ending up with a YTD net income of COP 146,376 million (USD 36 million).

"In the midst of greater volatility on the capital markets, higher inflation throughout the region and rising interest rates, we see that the levels of operating performance on the part of our subsidiaries are not just reflected in the results we are presenting, but also in their ability to optimize their business footprint, based on their capabilities and the efficiencies obtained with their operating models”, stated Ricardo Jaramillo, Chief Business Development and Finance Officer.

Sustainability performance assessment

Grupo SURA ranked among the top 1% of companies from the Diverse Financial Services and Capital Markets sector, according to S&P Global's Corporate Sustainability Assessment (CSA), which reviewed the performance of 533 organizations.

The Company maintained its leadership in areas such as financial inclusion, risk and crisis management, business ethics, attracting and retaining human talent as well as corporate citizenship. This assessment also identified opportunities for improvement in the areas of diversity, seniority and experience on the part of the Company´s Board of Directors, as well as with its decarbonization strategy.

Statement of Comprehensive Income, restated using the average exchange rate for Q3 2022: COP 4,069.3; Figures taken from the Statement of Financial Position based on the exchange rate corresponding to the end of Q3 2022: COP 4,590.5