- The dividend declared at the Annual Shareholders´ Meeting this year came to COP 1,280, which is 63% higher than the dividend corresponding to 2022, this is to be paid in four installments.

- The Company plans to improve its leverage by reaching a net debt-to-dividends received ratio of fewer than three times the latter by the end of 2023.

- The General Assembly of Shareholders also approved a new share buyback program worth COP 300 trillion and delegated the Board of Directors with the task of defining the respective terms and conditions.

Medellín. March 31, 2023, This Friday, Grupo SURA's 2023 Annual Shareholders' Meeting declared a dividend payment of COP 1,280 per share. This represents an increase of 63% with respect to the amount approved for 2022 and corresponds to a total of COP 741,413 million to be distributed among more than 16 thousand of the Company´s shareholders.

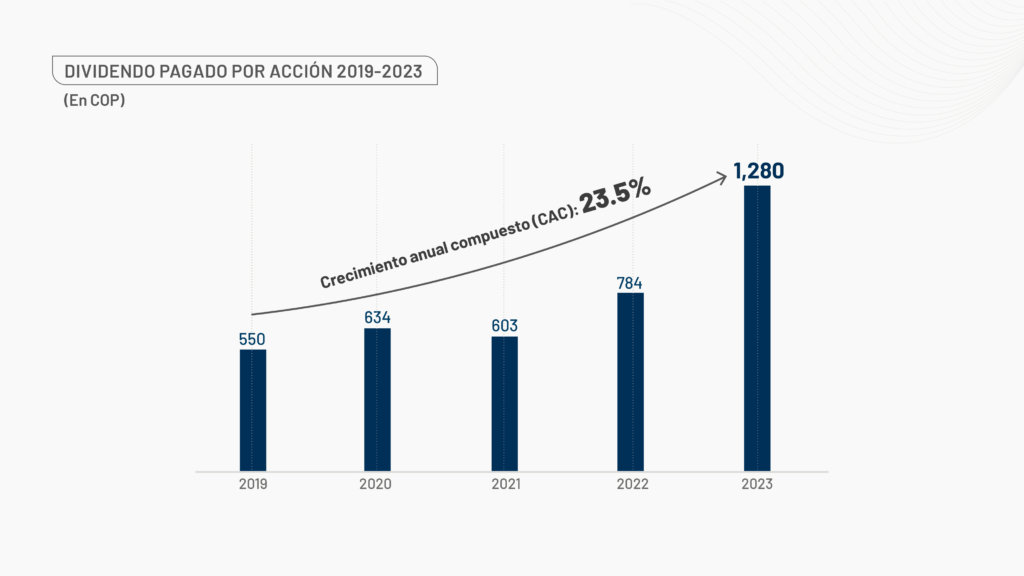

This dividend will be paid in four equal installments on April 12, July 4, October 2, 2023, and January 2, 2024, thus maintaining the historically upward trend of a dividend that remains higher than inflation in Colombia, which over the last five years has recorded a compound annual growth rate of 23.5%:

During the reading of the 2022 Management Report from the CEO and the Board of Directors Gonzalo Perez, stated: Our performance, challenges, and lessons learned over this past year confirm, once again, that we must preserve our way of doing business. The principles shared over the course of more than

78 years continue to guide and enlighten our actions and decisions since our corporate history has always shown us that results are just as important as the way in which these are achieved.

The 2022 Financial Statements, both consolidated and separate, were also explained and approved during this meeting. For his part, Gonzalo Pérez, Grupo SURA´s CEO, shared the Company's financial projections by the end of 2023, namely that Grupo SURA's controlling net income is expected to increase by between 10% and 15% based on the increase in dividends received; deleveraging shall continue with the net debt to dividends received ratio expected to fall to below 3 times the amount of dividends, which translates into greater financial flexibility. Return on Equity (adjusted ROE) is also projected to end up within a range of 9% to 10%.

Also, in order to move towards greater sustainable profitability through a well-balanced capital management, in 2023 the financial aspect shall go hand in hand with specific actions that create value for society: as for our human capital, we intend to expand our partnerships with universities and think tanks in order to provide knowledge to the Company's stakeholders and to society in general, in terms of our social capital, by strengthening our corporate citizenship through initiatives to strengthen issues such as citizen training, quality education and promoting cultural activities, and from the standpoint of our natural capital, by managing the reduction of our financed carbon footprint, this among other initiatives.

Finally, the Shareholders at this year´s Annual Meeting approved a new share buyback program for the Company in the amount of COP 300,000 million, this is based on a proposal presented by the shareholder Grupo Argos, with the Company´s Board of Directors being delegated with the task of defining the terms and conditions under which these repurchase operations shall be carried out. It should be noted that for the previous share buyback program, worth the same amount, the Company repurchased COP 55,151 million of its own stock.

“We have much to hope for in Colombia and the rest of Latin America, which while posing many challenges also offer enormous opportunities. We also wish to express yet again our gratitude to each and every one of our shareholders, employees, clients, advisors, distributors, suppliers, social, educational, and cultural partners, and so many others who believe in SURA, and who have accompanied us on this path, one carved based on a long-term vision so as to be able to continue growing hand in hand with people, organizations, the country, and the region,” concluded Gonzalo Perez.