- This represents an increase of 525% and on a comparable basis, an increase of 12.9%[i], thereby reflecting a positive performance of Grupo Sura’s portfolio as well as the efficiency efforts of its companies.

- Operating earnings for the first half of the year closed at COP 22.5 trillion, with the pro forma figures reaching COP 18.6 trillioni[ii].

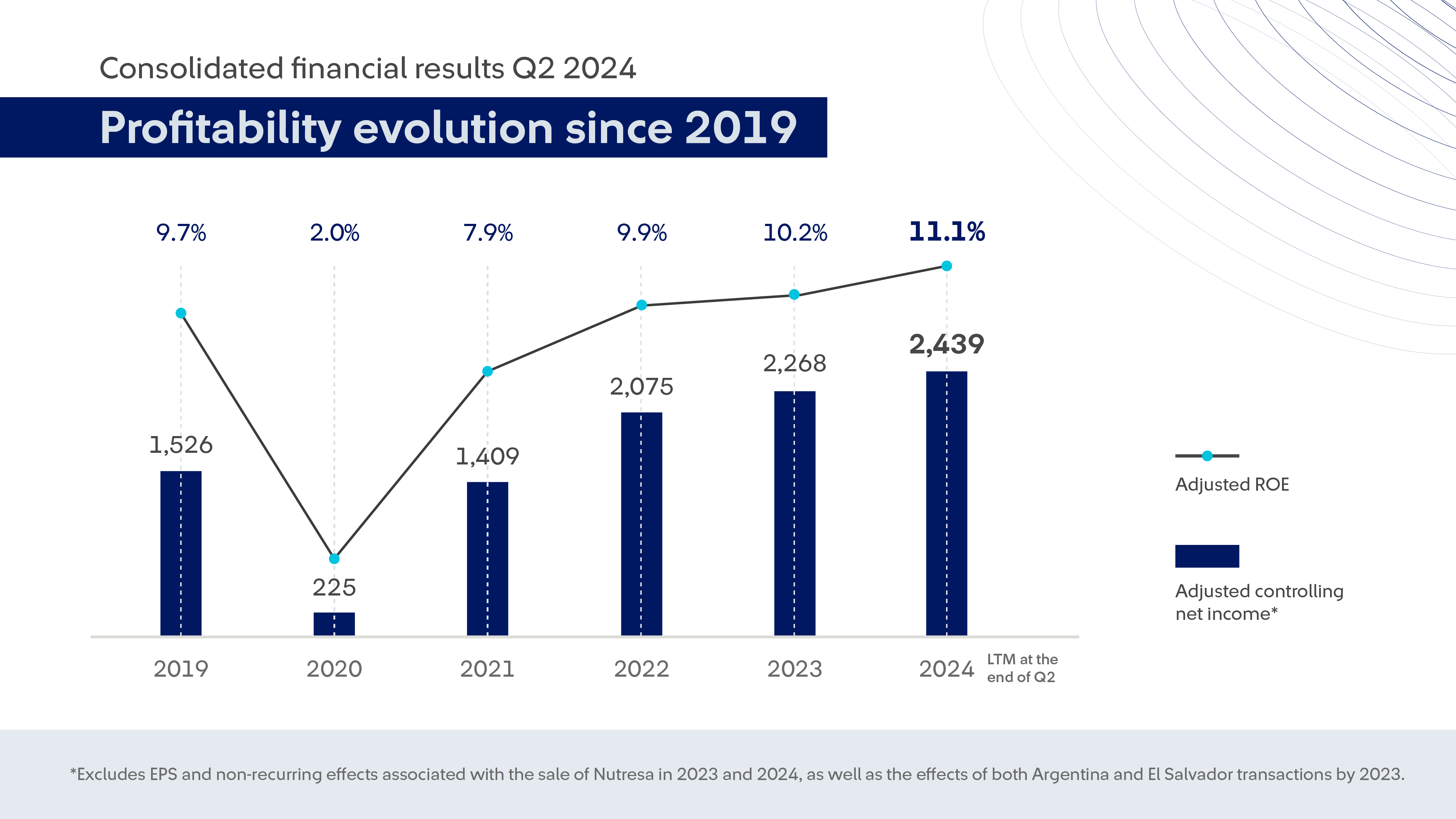

- Grupo SURA's adjusted return on equityii[iii stood at 11.1% while continuing to do well due to the performance of Suramericana, SURA Asset Management and our associated portfolio companies.

On Wednesday, August 14, Grupo SURA reported to the market its consolidated financial results for the second quarter of this year. At the end of this period, the Company posted a controlling net income of COP 5.1 trillion, representing a growth of 525% and a comparable variation of 12.9%i, over the same period last year.

This reflects the positive commercial dynamic, efficiencies and profitability efforts of Suramericana's insurance companies, SURA Asset Management's fund management firms, as well as the contributions from Bancolombia and Grupo Argos, Grupo SURA's portfolio associates, the latter through revenues obtained via the equity method. Consequently, the adjusted return on equity3 stood at 11.1% on a trailing 12-month basis ending at the end of Q2.

Operating income came to COP 22.5 trillion for a growth of 34.6%, or 14.3% at constant rates, excluding EPS and the effects associated with the Nutresa transaction. This result was mainly driven by the growth in written premiums obtained by Suramericana's Life and Property / Casualty segments, as well as the amount of fee and commission income from SURA Asset Management's Savings and Retirement (pensions) segment as well as its SURA Investments business (asset management for individuals and institutional clients).

Consequently, Grupo SURA generated consolidated operating profit of COP 6.8 trillion, for an increase of 25.7% in local currencies and upon excluding the aforementioned effects, our operating margin increased from 17.3% in 2023 to 18.1% on a trailing 12-month basis to the end of Q2.

"Our results for the first half of the year show the strength of our portfolio, which has become increasingly focused on the financial service sector, as well as the efforts of our SURA Companies in Latin America in continuing to increase their revenues, control expenses and improve operating margins. In this way, we remain committed to advancing our strategy and creating added value for our shareholders," stated Ricardo Jaramillo Mejía, Grupo SURA´s CEO.

Regarding the financial results of our subsidiaries, SURA Asset Management posted a controlling net income of COP 418 billion at the end of Q2, for a growth in local currencies of 7.2% with respect to the same period last year. This subsidiary’s fee and commission income came to COP 1.9 trillion, for an increase of 10.6% in local currencies for the first half of this year, this based on a 9.1% increase in the Savings and Retirement business, especially in Mexico and Colombia, as well as a 25.0% increase with the SURA Investments business, both in local currencies.

Continuing with a pro-forma analysis, Suramericana’s net income at the end of Q2 was COP 416 billion, for a comparable decline of 17.7% compared to the same period last year, this due, in part, to lower revenues from inflation-linked investments. Written premiums totaled COP 9.8 trillion, an increase of 9.3% in local currency, 50% of which corresponded to the Property and Casualty segment.

"The regional diversification of our subsidiaries is contributing significantly to the growth and strength of our portfolio, as reflected in our consolidated results. In fact, during the first half of the year, 75% of SURA Asset Management's fee and commission income and 38% of Suramericana's written premiums originated from their different lines of business outside Colombia," concluded Juan Esteban Toro Valencia, Grupo SURA’s Chief Corporate Finance Officer.

Recent Highlights:

- Last June, Juan Esteban Toro took over as Chief Corporate Finance Officer of Grupo SURA, after a decade serving as the Company’s Investment Manager.

- The ALAS20 initiative, which evaluates the public disclosure of sustainable practices and responsible investment, recognized SURA Asset Management as a "Leading Company in Sustainability" in Colombia and awarded the "Grand Prix Empresa" distinction as the best performing company in Latin America.

- In the 2024 edition of the Merco Talento ranking, SURA was recognized as the best insurance company and the sixth best organization to work for in Colombia, completing a decade-long ranking among the leading companies for its capability to attract and retain its human talent.

[i] To obtain these comparable figures, this variation excludes: 1) the effects of de-consolidating EPS SURA in both 2023 and 2024, in line with Suramericana's decision to deconsolidate said Company as of June 1st, 2024, after presenting the Progressive Dismantling Program last May; 2) the non-recurring effects of the Nutresa - Grupo SURA transaction.

[ii] The pro forma figures exclude the effects of EPS SURA's deconsolidation in 2023 and 2024.

[iii] Adjusted ROE: upon isolating the EPS in 2023 and 2024; net income also included the amortization of intangibles resulting from acquisitions; equity excludes the valuations of associated companies and cross-shareholdings between Grupo SURA and Grupo Argos; furthermore, the non-recurring impacts associated with the Nutresa - Grupo SURA share swap in 2023 and 2024 were returned, as well as the sale of Suramericana's operations in Argentina and El Salvador.