- Controlling net income recorded a comparable increase of 14.1%[1]. Recurring earnings for each of the Company’s shares rose by 61%[2] compared to 2023.

- Revenues rose by 29.2% to COP 26.0 trillion[3], due to increased premiums in the case of Suramericana, higher fee and commission income and returns on investments in the case of SURA Asset Management, as well as the revenues received from the portfolio’s associated companies.

- Grupo SURA's adjusted return on equity climbed to 12.2%[4] on a 12-month trailing basis, which reflects the levels achieved by Suramericana (12.5%), SURA Asset Management (11.3%) and Bancolombia (15.7%).

This past Thursday Grupo SURA reported its consolidated results for this past third quarter, highlighting a controlling net income that totaled COP 5.7 trillion3. This was mainly due to a growth in operating income, the efforts in terms of expense controls and efficiencies on the part of our subsidiaries with their different lines of business, as well as an increase in revenues obtained via the equity method from our portfolio's associated companies.

In this context, Grupo SURA is moving forward in structuring the transaction to cease to have cross shareholdings with Grupo Argos, this in keeping with a Memorandum of Understanding signed between both companies at the end of last October. This shall result in Grupo SURA being able to focus its portfolio on its three main investments: Suramericana (insurance), SURA Asset Management (pension savings and investments) and Bancolombia (banking and financial services).

“These third quarter results demonstrate the strength of our different lines of business and the progress made with the profitability of our investments to create added value for all our shareholders. In this respect, by evolving our ownership structure and focusing our portfolio on providing financial services we will be able to continue projecting Grupo SURA as a benchmark investment manager in Latin America going forward,” stated Ricardo Jaramillo Mejía, Chief Executive Officer of Grupo SURA.

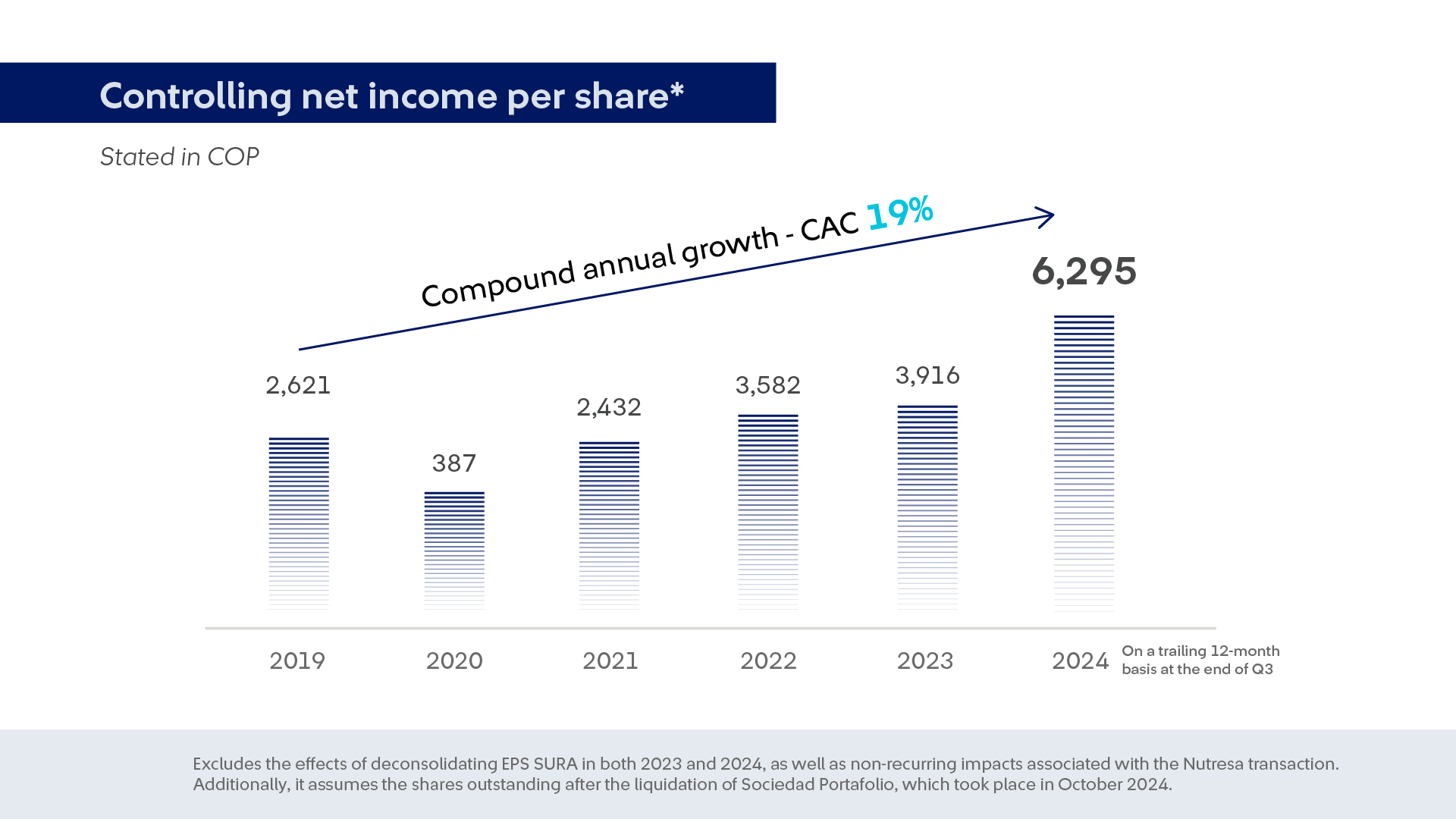

With the level of controlling net income as posted at the end of Q3, Grupo SURA’s adjusted return on equity (Adjusted ROE) for the last twelve months stood at 12.2%4. Likewise, the Company’s adjusted earnings per share2 for this same period reached an all-time high of COP 6,295, this driven by higher margins on the part of the different lines of business that make up our portfolio, as well as the increase resulting from a lower amount of outstanding shares, after the Nutresa-Grupo SURA share swap and the winding up of the Sociedad Portafolio.

“The Company's recurring earnings per share rose by 61% on a LTM basis. This reaffirms the sound position, good operating dynamics and competitive position of our investments, enabling us to continue growing profitably,” stated Juan Esteban Toro Valencia, Grupo SURA´s Chief Corporate Finance Officer.

Regarding the financial results of our subsidiaries, SURA Asset Management posted a controlling net income of COP 881 billion at the end of Q3, for a growth in local currencies of 7.2% this compared to the same period last year. This is the result of a double-digit growth in fee and commission income, with an operating margin of 34.2%, as well as higher returns on legal reserves in the case of its Savings and Retirement segment. As a result, return on equity (adjusted ROE) for the last twelve months increased to 11.3%[5].

On the other hand, Suramericana posted a net income of COP 522 billion, for an increase of 41.1%[6] compared to the same quarter last year. This was driven by the growth in premiums in the Life Insurance despite the decline in investment income as a result of lower inflation rates throughout the region. Likewise, the accumulated retained claims ratio remained stable (59.4%). The adjusted ROE of this subsidiary came to 12.5%[7] on a trailing 12-month basis at the end of Q3.

Recent Highlights:

- In October, the Colombian Stock Exchange authorized a liquidity builder program for Grupo SURA’s ordinary and preferred stock, this for the purpose of helping to improve the market performance for both types of shares.

- In S&P Global's Corporate Sustainability Assessment, Grupo SURA outperformed last year´s result having obtained a total score of 69 out of 100, which is higher than 98% of the organizations in its sector while excelling in the fields of sustainable investment and risk management.

- SURA advanced to become the fifth organization with the best reputation in Colombia among 786 other companies that were evaluated, this according to the Merco Empresas 2024 ranking. Likewise, the leaders of the SURA Companies in Colombia were included among the 100 most valued in this independent firm's ranking.

- SURA was an official partner of the COP 16 on Biodiversity, where it promoted and participated in different events underscoring the role of financial services for the purpose of mobilizing resources, as well as developing products and solutions aimed at preserving and regenerating our ecosystems.

[1] To facilitate comparability, this change excluded: 1) the effects of having de-consolidated our Health Care subsidiary EPS SURA in 2023 and 2024, in keeping with Suramericana's decision, after presenting its Progressive Dismantling Program; 2) non-recurring effects associated with the Nutresa transaction.

[2] Excluded the effects of having de-consolidated our Health Care subsidiary EPS SURA in 2023 and 2024, and non-recurring effects associated with the Nutresa transaction.

[3] Proforma consolidated figures exclude the health care subsidiary EPS SURA.

[4] ROE is adjusted for: 1) the amortization of intangibles from acquisitions being added to net income; 2) equity excludes valuations of associated companies and cross-shareholdings between Grupo Argos and Grupo SURA; 3) non-recurring impacts on net income associated with the Nutresa transaction in 2023 and 2024 and impacts from sale of insurance companies in Argentina and El Salvador are returned; 4) the Nutresa investment was excluded from equity as of Q3 2023; 5) excluding the health care subsidiary EPS SURA for 2023 and 2024.

[5]SURA AM’s ROE excludes the amortization of intangibles.

[6]Accounting variation

[7] Suramericana's adjusted ROE excludes the effects of having sold off its operations in Argentina and El Salvador (2023) along with the amortization of intangibles.