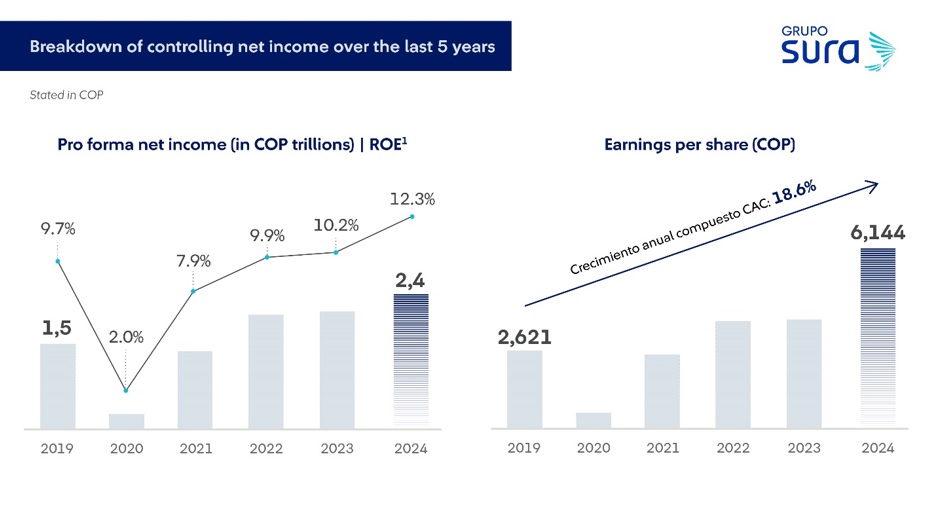

- Recurring net earnings per share came to COP 6,144, (USD 1.51) and adjusted return on equity (adjusted ROE[1]) amounted to 12.3% for an increase of 210 bps compared to 2023.

- The Board of Directors approved a proposed dividend of COP 1,500 (USD 0.37) per share for 2025, representing an increase of 7.1%, this to be submitted to the General Assembly for their approval.

- Grupo SURA continues to prioritize initiatives that shall allow the Company’s value to become more visible to its shareholders The Projected Spin-Off and the closing of the Nutresa transaction are worth noting in terms of the shift in the Company’s ownership structure; plus, progress was made with the new Liquidity Builder program with regard price formation.

This Thursday Grupo SURA reported to the market its consolidated financial results at the end of 2024, highlights of which include a controlling net income of COP 6.1 trillion (USD 1,492 million), for a growth of 294.5%, which, upon excluding the effects of the Nutresa transaction, reached COP 2.4 trillion (USD 596 million) for an increase of 24.6%. This final result reflects our focus on profitability and the strength of our sound portfolio of companies focused on providing their financial services in a total of 10 countries, attending more than 76.5 million clients

Grupo SURA's year-end earnings were driven by revenues totaling COP 37.2 trillion (USD 9,137 million), 5.4% more than for 2023, of which COP 29.3 trillion (USD 7,191 million) were recurring. This figure reflects the growth in premiums on the part of Suramericana, higher fee and commission income in the case of SURA Asset Management as well as revenues obtained via the equity method from Bancolombia (COP 1.5 trillion/USD 377 million) and Grupo Argos (COP 766 billion/USD 188 million).

"2024 was a very positive year for Grupo SURA in which we obtained COP 6.1 trillion (USD 1,492 million) in net income, thereby reflecting the profitable growth of our investments. We also proposed an operation that would allow us to move towards a more straightforward and specialized structure. We are convinced that this will allow us to continue to make the value of our Company more visible and more tangible to our thousands of shareholders, with the backing of a portfolio of investments that are showing a high growth potential in Latin America.” explained Ricardo Jaramillo Mejía, Chief Executive Officer of Grupo SURA.

"Last year we achieved an adjusted ROE of 12.3%, that is to say 210 basis points higher than for 2023, along with recurring net earnings per share reaching a record high of COP 6,144 (USD 1.51) and a compound annual growth of 18.6% over the last five years. This year we project receiving COP 2.2 trillion (USD 544 million) in cash including dividends from our portfolio investments, which gives us the strength and flexibility to continue making headway with our strategy," stated Juan Esteban Toro, Grupo SURA´s Chief Corporate Finance Officer.

The Company's Board of Directors approved a proposed dividend of COP 1,500 (USD 0.37) per share, representing a 7.1% increase compared to the previous year, which shall be submitted to the General Assembly of Shareholders for their approval at their Annual Shareholders' Meeting to be held on March 28 at Plaza Mayor (Medellin).

Subsidiary performance

SURA Asset Management This subsidiary ended the year with a controlling net income of COP 885 billion (USD 217 million) and assets under management (AUM) totaling COP 719 trillion (USD 217 million), plus an adjusted ROE[2] of 9.0% over the last twelve months. Fee and commission income amounted to COP 3.9 trillion (USD 965 million), 12.1% higher than for the previous year at constant rates, this driven mainly by Mexico, Colombia and Chile.

With respect to the performance of its different business segments, it is worth noting that the rate of return on its own investments in the Savings and Retirement business (yield) came to 9.5%. On the other hand, SURA Investments consolidated revenues of COP 408 billion (USD 100 million) along with a client base numbering 2.5 million. Consequently, with the growth in expenses remaining below that of revenues, the Company's operating income ended the year at COP 1.8 trillion, (USD 435 million) that is to say 12.3% higher than for the previous year at constant rates. Finally, the Company recorded a total of 23.4 million clients, thereby highlighting a positive sales performance along with a powerful value proposition.

Suramericana This subsidiary posted a total net income of COP 751 billion (USD 184 million), for an increase of 65% compared to 2023. Adjusted ROE came to 13.1% over the last 12 months, in keeping with the company's profitability strategy. Written premiums reached COP 20.7 trillion (USD 5,090 million), that is to say 6.6% higher than for the previous year at constant rates, this driven by the growth in the Life (9.7%), Health Care[3] (6.6%) and Property and Casualty (5.0%) insurance segments.

The efficiency efforts and focus on profitability on the part of Suramericana and its subsidiaries resulted in a technical result that scored a 23.4%[4] improvement with respect to 2023. This, together with the positive dynamics of all insurance segments, offset the natural decline in investment income amid an environment of lower inflation rates. This subsidiary ended the year with more than 20 million customers in seven countries throughout the region, 600 thousand of which are companies.

A more visible shareholder value

One of Grupo SURA's objectives is to make the Company's value more visible and tangible to all its shareholders, especially considering the lack of correlation between its fundamental value and market price. In this regard, the Company has been working on different initiatives, the following being most noteworthy:

- Shift in our ownership structure In 2024 the Company made progress in proposing a transaction to dispose of its cross-shareholdings with Grupo Argos. Last January, we published the Projected Spin-Off which shall be submitted for the consideration of our Shareholders at their upcoming Annual Shareholders' Meeting to be held on March 26. Also last year, the Nutresa - Grupo SURA share swap was completed. Both operations generate an accretion for all Grupo SURA shareholders.

- Better price formation conditions. In October, a liquidity builder program began operating, which has helped to reduce the spread between the bidding and offering prices of Grupo SURA's ordinary and preferred shares (bid-offer spread). Progress has also been made with regard to a liaising plan with analysts, investors and index providers in order to promote a better understanding of the Company's information.

This, together with a higher float that is expected with the proposed spin-off, as well as increased liquidity and greater investor interest in the Colombian equity market, are all factors that have favored Grupo SURA's share performance, which since the Spin-Off Agreement was announced has increased by 23.9% in the case of our ordinary shares and 60.8% for our preferred shares. This was clearly demonstrated in two recent news items: first, the increase in the participation of our ordinary stock in the MSCI Colcap index, and second, the fact that our preferred stock was admitted in the FTSE Global Equity Index.

Other highlights

- S&P Sustainability Yearbook 2025. This annual publication recognizes the top 780 companies out of a total of 7,600 on a global level, this after scoring above 98% of the companies belonging to our sector in the Corporate Sustainability Assessment 2024.

- Sustainable investing. SURA Companies have prioritized thematic investments in their sustainability efforts, these last year exceeding COP 47.1 trillion (USD 10,693 million) in the case of SURA Asset Management and COP 1 trillion (USD 247 million) for Suramericana.

- Merco ESG Responsibility. We were included in Merco Colombia's annual ranking as the most responsible organization in the insurance sector and fifth overall. In addition, with respect to the previous year, the Organization made progress in all dimensions namely social, environmental and ethics and corporate governance.

[1]ROE was adjusted for: the amortization of intangibles from acquisitions being added to net income; equity excludes valuations of associated companies and cross-shareholdings between Grupo Argos and Grupo SURA; non-recurring effects on net income associated with the Nutresa transaction in 2023 and 2024 are returned, as well as impacts from the sale of insurance companies in Argentina and El Salvador; the Nutresa investment was excluded from equity as of Q3 2023; and the health care subsidiary EPS SURA was also excluded in 2023 and 2024.

[2] SURA AM’s Adjusted ROE excludes the amortization of intangibles.

[3] Following the deconsolidation of EPS SURA, the Health Care segment now includes the IPS and Diagnostic Aids companies.

[4]This percentage change excludes the impact of having deconsolidated the health care subsidiary EPS SURA.