Carry out a reasonable and responsible interpretation and application of the tax regulations.

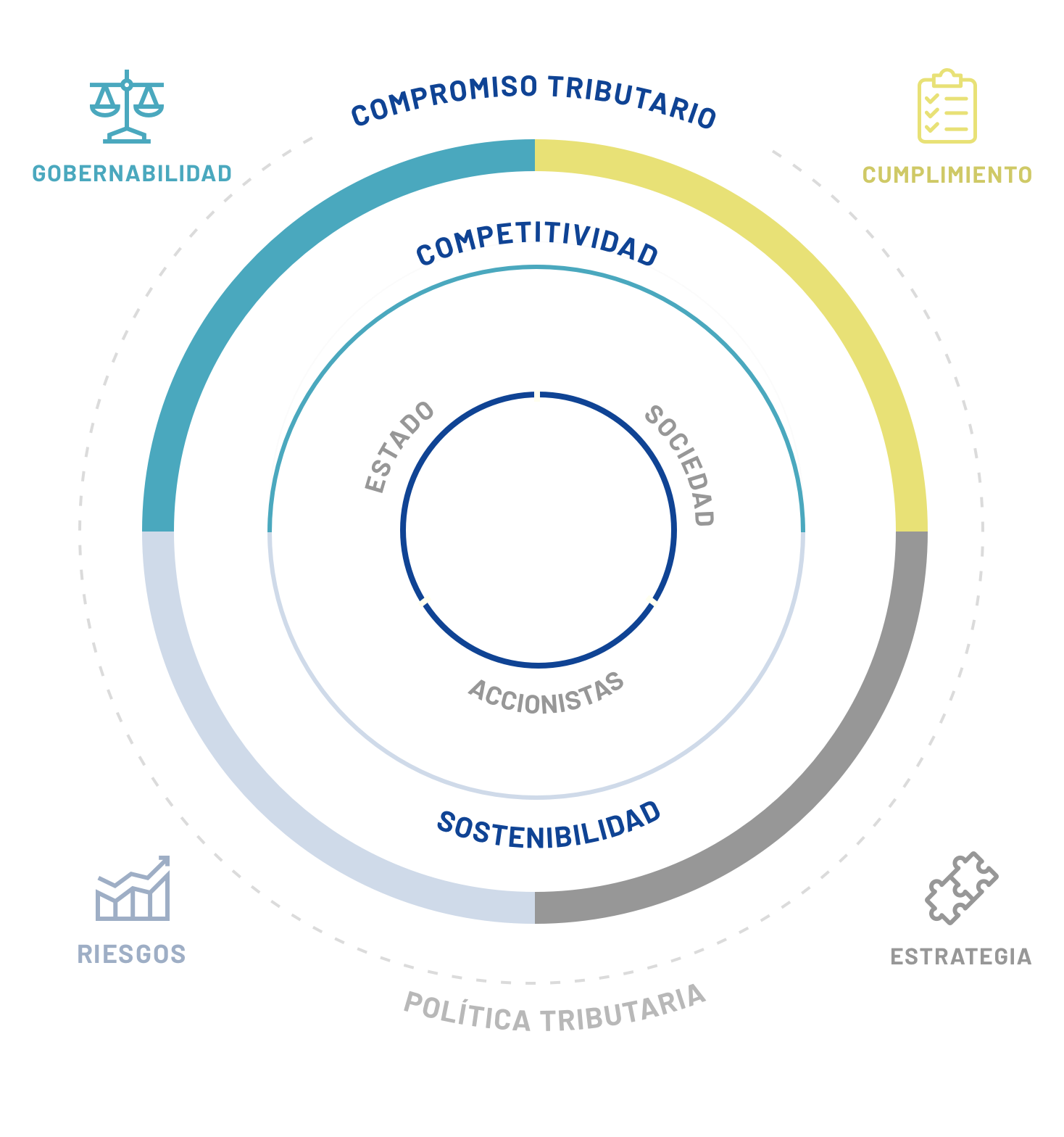

Tax commitment

We are aware of our obligations and responsibilities

We made a commitment to the State and to a transparent business management through a framework tax policy because we are convinced that those resources will be reflected in local and regional development.

Esquema de gestión de impuestos e interacción

Indicators of responsible management

Taxes, fees and contributions

403.1

Millions of dollars, paid in 2023

Profit percentage

48.4%

Destination to pay taxes in 2023

Countries

11

Where we pay taxes

Relationship

Build fluid, transparent and responsible relationships with the different tax authorities in the countries in which we operate, based on the principles of good faith, trust and loyalty.

Cooperate to diligently provide accurate and complete information to the authorities.

Encourage the exchange of proposals with tax administrations with the aim of contributing to the improvement and strengthening of tax systems.

Materiality

Materiality of issues that have positive or negative fiscal impacts is defined as the lower number between USD5 million, 5% of the actual or profits budgeted for the period, or 2% of the previous year’s equity.

Situations for which materiality must be evaluated include:

Interpretation and application of tax regulations that lead to uncertain fiscal positions, as well as those proposed for the promulgation of the regulation.

Business reorganizations, mergers, divestments, splits, joint venture operations, or any associative operation.

Operations among related parties subject to the transfer regime.

Operations that give rise, produce, or lead to a contingency or litigation related to tax matters. Dividend flows among the companies.

Governance

The policy shall be approved by our Board of Directors and, after approval, it must be approved by the corporate boards of directors, and finally by the boards of directors or equivalent bodies in each of our affiliates.

The financial vice presidents or managers and tax areas in each company will ensure compliance with the laws, internal regulations, and the policy.

We and all our affiliates will be responsible for aligning any initiatives and other actions required for compliance.

Certain situations must be reported to the corporate tax areas:

Issues that meet the definition of materiality.

Any matters with tax implications that are presented to the boards of directors of the companies.

Fiscal situations that involve a negative reputational impact.

Taxes and contributions paid by the Company

We voluntarily publish our reported figures in the Country-by-Country Fiscal Report (CbCR).

| Country | Grupo SURA | SURA ASSET MANAGEMENT | SURAMERICANA |

| Argentina | – | – | 20,44 |

| Bermuda | – | – | – |

| Brazil | – | – | 6,73 |

| Chile | – | 37,31 | 5,89 |

| Colombia | 5,87 | 22,55 | 136,42 |

| El Salvador | – | -3,31 | 1,73 |

| Mexico | – | – | – |

| Panama | – | 43,04 | 6,45 |

| Peru | – | – | 5,28 |

| Dominican Republic | – | 24,78 | – |

| Uruguay | – | – | 4,23 |

| United States | – | 0,05 | 12,32 |

| Total | 5,87 | 124,42 | 199,49 |

| Total (Millions of USD) | 329,78 |

| Country | Grupo Sura | Sura Asset Management | Suramericana |

|---|---|---|---|

| Argentina | – | 0,00 | 6,15 |

| Bermuda | – | – | 0,06 |

| Brazil | – | – | 8,94 |

| Chile | – | 31,16 | 5,22 |

| Colombia | 13,58 | 43,67 | 170,64 |

| El Salvador | – | 8,55 | -2,80 |

| Mexico | – | 60,30 | 15,24 |

| Panama | – | – | 2,92 |

| Peru | – | 19,34 | – |

| Dominican Republic | – | – | 1,46 |

| Uruguay | – | 3,39 | 15,30 |

| United States | – | – | – |

| Total | 13,58 | 166,42 | 223,14 |

| Total (Millions of USD) | – | – | 403.14 |

| País | 2022 | 2023 |

| Argentina | 20.44 | 6.15 |

| Bermuda | – | 0.06 |

| Brasil | 6.73 | 8.94 |

| Chile | 5.89 | 5.22 |

| Colombia | 136.42 | 170.64 |

| El Salvador | 1.73 | -2.80 |

| México | – | 15.24 |

| Panamá | 6.45 | 2.92 |

| Perú | 5.28 | – |

| República Dominicana | – | 1.46 |

| Uruguay | 4.23 | 15.30 |

| United States | 12.32 | – |

| Total (In millions of dollars) | 199.49 | 223.14 |

| País | 2022 | 2023 |

| Argentina | – | 0.00 |

| Bermuda | – | – |

| Brasil | – | – |

| Chile | 37.31 | 31.16 |

| Colombia | 22.55 | 43.67 |

| El Salvador | -3.31 | 8.55 |

| México | – | 60.30 |

| Panamá | 43.04 | – |

| Perú | – | 19.34 |

| República Dominicana | 24.78 | – |

| Uruguay | – | 3.39 |

| United States | 0.05 | – |

| Total (In millions of dollars) | 124,42 | 166,42 |

| País | 2022 | 2023 |

| Argentina | – | – |

| Bermuda | – | – |

| Brasil | – | – |

| Chile | – | – |

| Colombia | 5.87 | 13.58 |

| El Salvador | – | – |

| México | – | – |

| Panamá | – | – |

| Perú | – | – |

| República Dominicana | – | – |

| Uruguay | – | – |

| United States | – | – |

| Total (In millions of dollars) | 5.87 | 13.58 |

Income, profit and taxes paid by Company

We voluntarily publish our reported figures in the Country-by-Country Fiscal Report (CbCR).

| Country | Income | Profits Before Taxes | Income Tax | Current Tax | Deferred Tax | Income Tax Paid | Employees |

|---|---|---|---|---|---|---|---|

| Argentina | 378,5 | 0.80 | -0,00 | 3,81 | -12,81 | 0,21 | 537 |

| Brazil | 182.76 | 1.60 | 0.26 | 0.14 | 0.12 | 0.99 | 335 |

| Chile | 927.38 | 197.08 | 6.69 | 18.68 | -11.99 | 40.47 | 682 |

| Colombia | 5,170.86 | 283.03 | 54.77 | 15.95 | 38.81 | 27.63 | 30,023 |

| El Salvador | 135.68 | 5.31 | 2.65 | 3.42 | -0.77 | -2.18 | 286 |

| United States | 0.00 | -0.72 | 0.00 | 0.00 | 0.00 | 0.00 | – |

| Bermuda | 8.59 | -8.76 | 0.00 | 0.00 | 0.00 | 0.00 | – |

| Mexico | 548.28 | 147.27 | 18.93 | 28.21 | -9.27 | 27.15 | 656 |

| Panama | 121.85 | -8.33 | -0.93 | 0.01 | -0.95 | 0.04 | 436 |

| Peru | 98.52 | 40.83 | 9.37 | 14.33 | -4.96 | 18.68 | – |

| Dominican Republic | 65.30 | 3.52 | -0.01 | 1.13 | -1.13 | 1.13 | 265 |

| Uruguay | 125.75 | 29.87 | 2.63 | 1.65 | 0.97 | 3.58 | – |

| Total (In millions of dollars) | 7,763.53 | 691.48 | 85.36 | 87.33 | -1.97 | 114.10 | 33,220 |

| Country | Income | Profits Before Taxes | Income Tax | Current Tax | Deferred Tax | Income Tax Paid | Employees |

|---|---|---|---|---|---|---|---|

| Argentina | 4,65 | -162 | 0,00 | 0,00 | 0,00 | 5,92 | 8 |

| Brazil | 199.01 | 5.38 | 1.87 | 1.31 | 0.57 | 0.43 | 304 |

| Chile | 1,079.56 | 313.79 | 49.33 | 39.19 | 10.14 | 20.82 | 2,506 |

| Colombia | 6,160.75 | 693.63 | 244.45 | 100.86 | 143.58 | 124.82 | 25,155 |

| El Salvador | 49.80 | 21.32 | 6.40 | 7.62 | -1.22 | 2.94 | 627 |

| United States | 0.12 | -1.05 | 0.00 | 0.00 | 0.00 | 0.00 | – |

| Bermuda | 12.45 | -19.72 | 0.00 | 0.00 | 0.00 | 0.00 | – |

| Luxembourg | 0.00 | -0.03 | 0.00 | 0.00 | 0.00 | 0.00 | – |

| Mexico | 627.32 | 236.69 | 39.91 | 36.34 | 3.57 | 32.07 | 2,708 |

| Panama | 137.16 | 14.08 | 0.00 | 0.01 | 0.00 | 0.01 | 420 |

| Peru | 125.32 | 64.23 | 16.14 | 16.96 | -0.83 | 11.45 | 749 |

| Dominican Republic | 73.27 | 7.00 | 1.25 | 1.94 | -0.69 | 0.38 | 246 |

| Uruguay | 155.36 | 16.11 | 3.46 | 3.78 | -0.32 | 1.99 | 393 |

| Total (In millions of dollars) | 8,624.79 | 1,349.80 | 362.80 | 208.01 | 154.80 | 198.44 | 33,116 |

Investor Kit Q424

Download our investor kit, a tool that will allow you to easily utilize the figures of our organization.

Download