Spin-off Agreement with Grupo Argos

Here you can consult the official information from Grupo SURA regarding the Spin-off Agreement signed on December 18, 2024, and the implementation of this transaction that reorganizes Grupo SURA’s ownership structure, deepens the specialization of its investment portfolio in financial services. Its execution benefits all shareholders, ensures fair treatment throughout the process, and is subject to the relevant corporate and regulatory approvals.

Learn what this operation is about

Spin-off operation between Grupo SURA and Grupo Argos

Videoconference of December 19, 2024, with shareholders and the investment public

Process and benefits that the spin-off will bring

Frequently Asked Questions about the Agreement

Why did Grupo Argos and Grupo SURA agree to cease being reciprocal shareholders?

Because it allows both companies to have a more straightforward shareholding structure as well as to specialize in their respective sectors, which is in keeping with today´s global capital market trends as well as the current views on the part of investors. In the case of Grupo SURA, the evolution of our ownership structure allows us to continue to focus our portfolio on the financial service sector, this based on our three main investments all of which have built up a strong footprint in Latin America, these being SURA Asset Management, Suramericana and Bancolombia.

What is the impact of this transaction with Grupo Argos for Grupo SURA´s shareholders?

This agreed option guarantees equal treatment for all holders of both ordinary and preferred shares in the two companies from start to finish.

In simple terms, with this transaction, each of Grupo SURA´s shareholders shall maintain their original shares, and shall also receive a number of Grupo Argos shares equivalent to the economic stake it previously held in said company through Grupo SURA. Furthermore, Grupo SURA's current shareholders shall increase their economic stakes, since the Company will have a smaller number of shares outstanding once this transaction is completed.

How long will it take to carry out this operation?

The carrying out of this spin-off transaction is dependent on the relevant corporate and regulatory approvals being obtained. Therefore, we initially estimate that this process could take all of 2025 and part of 2026. At Grupo SURA our intention is to move forward as efficiently and as quickly as possible, for the benefit of all our shareholders.

How can shareholders and the market be informed of the progress of this operation?

As the milestones of this transaction are reached and the corresponding progress is obtained, we shall be communicating with our shareholders and the market in a timely manner through the Relevant Information mechanism on the web page of the Colombian Superintendency of Finance Shareholders may also consult a specific section dedicated to this operation on the gruposura.com website as well as the Company's social media accounts (X and LinkedIn). Our Investor Relations team is also at hand to attend both our shareholders as well as market agents.

Why was an absorption spin-off option chosen and what are its benefits?

The option agreed between both companies and approved by their respective Boards of Directors is both regulated and efficient from the financial and legal standpoints as well as the time it would take to complete. It also guarantees equal treatment for all the Company's shareholders, maintains the same rights that each one had before the transaction and increases their economic stakes.

What are the main steps that have to be taken to carry out this operation?

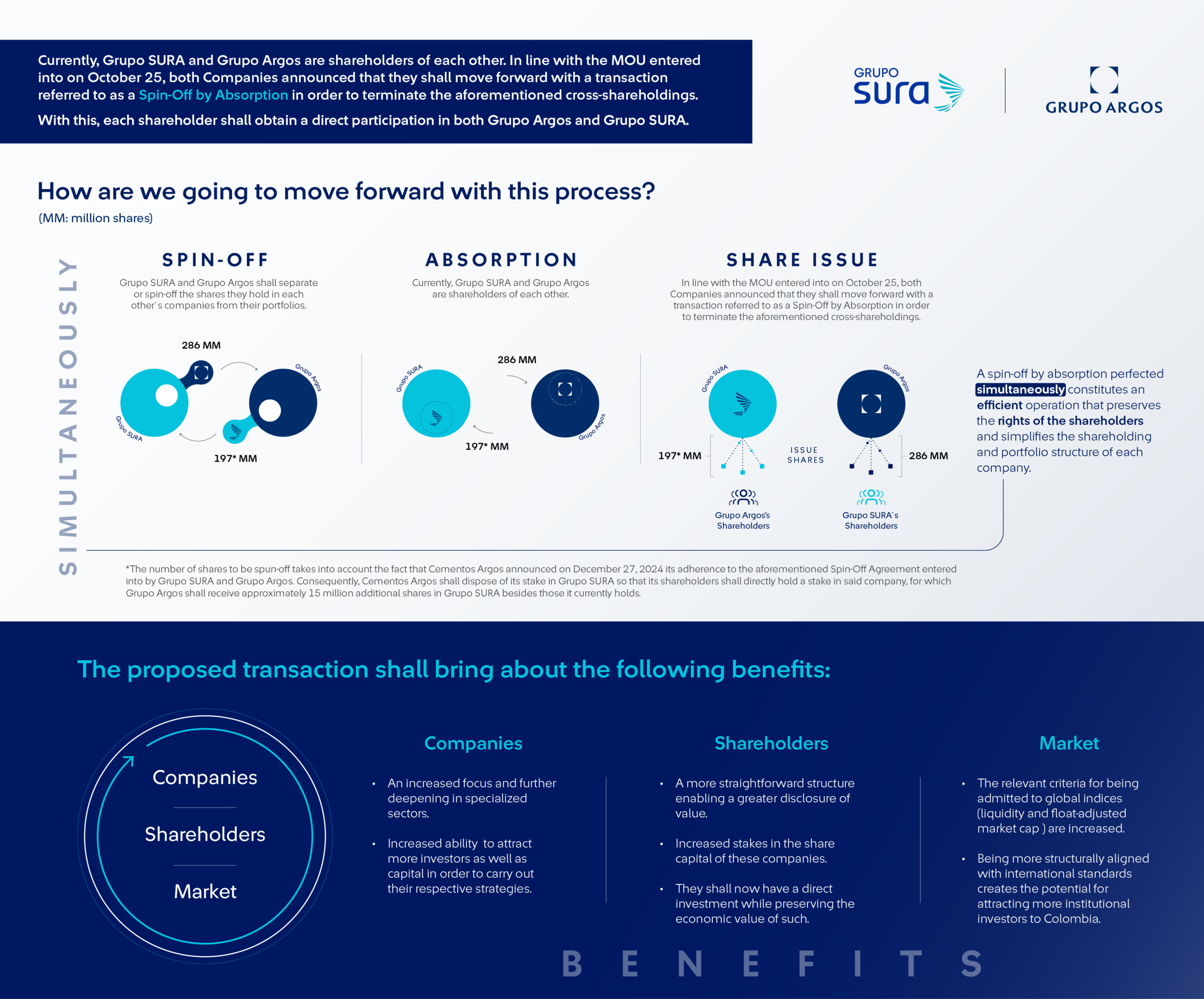

The execution of this transaction is subject to the corresponding regulatory and corporate approvals. With this in mind, and in compliance with all applicable regulations, we shall move forward with the execution of this transaction which, for explanatory purposes, consists of three components: spin-off, absorption and the issuing of new shares.

- In the spin-off stage, Grupo SURA will spin off or separate the shares it holds in Grupo Argos, and Grupo Argos will do the same with the shares it holds in Grupo SURA.

- In the absorption stage, each of the companies shall absorb the shares that the other spun off.

- In the final stage, Grupo SURA shall issue new shares to all of Grupo Argos´ shareholders, this equivalent to the number of shares just absorbed. Grupo Argos shall do the same, issuing the same number of shares it absorbed, to all of Grupo SURA’s shareholders.

Since Grupo SURA is a shareholder of Grupo Argos, the shares received when issued shall be cancelled. The same approach shall apply to the shares received by Grupo Argos upon being issued by Grupo SURA, which shall also be cancelled. With this, the economic stake held by each shareholder in the two companies will increase.

To summarize, at the end of this process, each of Grupo SURA´s shareholders shall retain their shares in the Company while also gaining a direct stake in Grupo Argos.

How was the number of shares that a Grupo SURA shareholder shall hold in Grupo Argos shares arrived at?

Based on the criterion of guaranteeing equal treatment at all times, we proceeded to establish ratios or distribution ratios as follows: for Grupo SURA shareholders, this is equivalent to distributing approximately 286 million shares that the Company holds in Grupo Argos, among the 395 million outstanding shares belonging to Grupo SURA. This provides a ratio of 0.72 (286/395), which implies that for each Grupo SURA share held by current shareholders, Grupo Argos shall issue them with 0.72 shares. Once this transaction is completed, each of our shareholders will retain the shares they held in Grupo SURA, and for each of these shares they shall receive 0.72 shares in Grupo Argos. It is important to clarify that the final ratios shall depend on the number of outstanding shares held in the companies at the time this transaction is carried out and, therefore, said ratios may vary.

What kind of corporate and regulatory approvals are required for this transaction?

The transaction shall be submitted for the consideration of our own General Assembly of Shareholders , the General Assembly of Shareholders of Grupo Argos as well as the General Assembly of Bondholders. Should such approvals be obtained, said Transaction shall be submitted for the approval of the Colombian Superintendency of Finance as well as other pertinent authorities.

What is the effect of this transaction on Grupo SURA's financial statements?

In compliance with international accounting standards governing Grupo SURA, once the necessary corporate approvals are obtained, the investment in Grupo Argos S.A. shall no longer be recognized in the form of revenues obtained via the equity method on the consolidated financial statements and therefore shall be treated as an asset held for distribution to owners; therefore, the results of continuing operations in Grupo SURA's Statement of Income shall not reflect the results of this investment and in the Statement of Financial Position it shall remain as an asset until the transaction is carried out. It is possible that the transaction shall produce accounting profits based on valuation of the investment at fair value which shall be recognized in the Statement of Income.

How shall Grupo SURA's investment portfolio remain ?

Once this operation is fully completed, Grupo SURA shall be a company 100% focused on the financial service sector through its three main investments: its subsidiary SURA Asset Management, the regional leader in pension savings in terms of its volume of assets under management; its other subsidiary Suramericana, the fourth largest Latin American insurance company in terms of written premiums; and Bancolombia, the leading bank in the country with significant operations in Central America of which Grupo Sura is the main (non-controlling) shareholder.

Would this transaction modify the number of outstanding shares of Grupo SURA's ordinary and preferred stock?

Once this transaction is carried out , the number of outstanding shares will be reduced and all of our current shareholders will increase their economic stakes in the Company. Pursuant to the terms thus envisaged and subject to the required corporate and regulatory approvals, the number of Grupo SURA's outstanding shares shall total 328 million, 166 million ordinary and 162 million preferred shares.

Does this transaction with Grupo Argos affect SURA's business in any way?

It has no impact whatsoever on any of the lines of business comprising our portfolio, nor on the products, solutions and services we provide to our customers in Colombia and other Latin American countries. The companies belonging to the SURA Business Grupo and the SURA-Bancolombia financial conglomerate shall continue to focus on developing their strategies, paths to profitability as well as business plans.

Explore more about this transaction

Relevant Information

Corporate News

Press Articles

- El Tiempo: Grupo SURA's Plans Following Spin-off with Grupo Argos - December 27, 2024 (ESP)

- El Colombiano: Interview with the President of Grupo SURA on the Spin-off and Future of the Company - December 22, 2024 (ESP)

- Portafolio: Sura-Argos Shareholding Split Will Be Equitable for Shareholders - December 20, 2024 (ESP)

- El Colombiano: Details of the Shareholding Split Between Grupo SURA and Grupo Argos - December 20, 2024 (ESP)

- Teleantioquia Noticias: "Spin-off Announcement is Positive for Shareholders," Say Analysts - December 19, 2024 (ESP)

- Data IFX: SURA and Argos Move Toward Mutual Independence - December 18, 2024 (ESP)

- Revista Semana: Spin-off of Grupo SURA and Grupo Argos Announced - December 18, 2024 (ESP)

- "The Shareholding Split Was More a Tool Than a Goal," Says Ricardo Jaramillo - December 13, 2024 (ESP)

Investor Relations

If you need additional information beyond what is provided here, you can contact the following:

Investor Service Center

Carlos Eduardo González Tabares

Investment and Capital Markets Manager

Daniel Mesa Gómez

Director of Investors and Capital Markets