Multilateral agencies have issued moderate forecasts in a year in which the region's GDP growth is subject to inflation and the monetary and fiscal policies of each country.

By Valora Analitik for Grupo SURA*

Several multilateral and regional institutions have already revealed, at the beginning of 2024, their main economic forecasts for various regions, including Latin America.

In this regard, new projections on the part of the IMF show a drop of almost half a percentage point in the GDP growth estimate for Latin America, going from 2.3% to 1.9% in 2024. However, the region would improve with a possible 2.5 % growth in 2025.

Despite expectations of an impairment, IMF projections for Brazil and Mexico improved. In the case of Brazil, GDP growth rose from 1.5% to 1.7% in 2023 and remains at 1.9% for 2025. Estimates for Mexico´s economy rose substantially from 2,1% to 2,7% in 2023 with another 1,5% forecast for 2025.

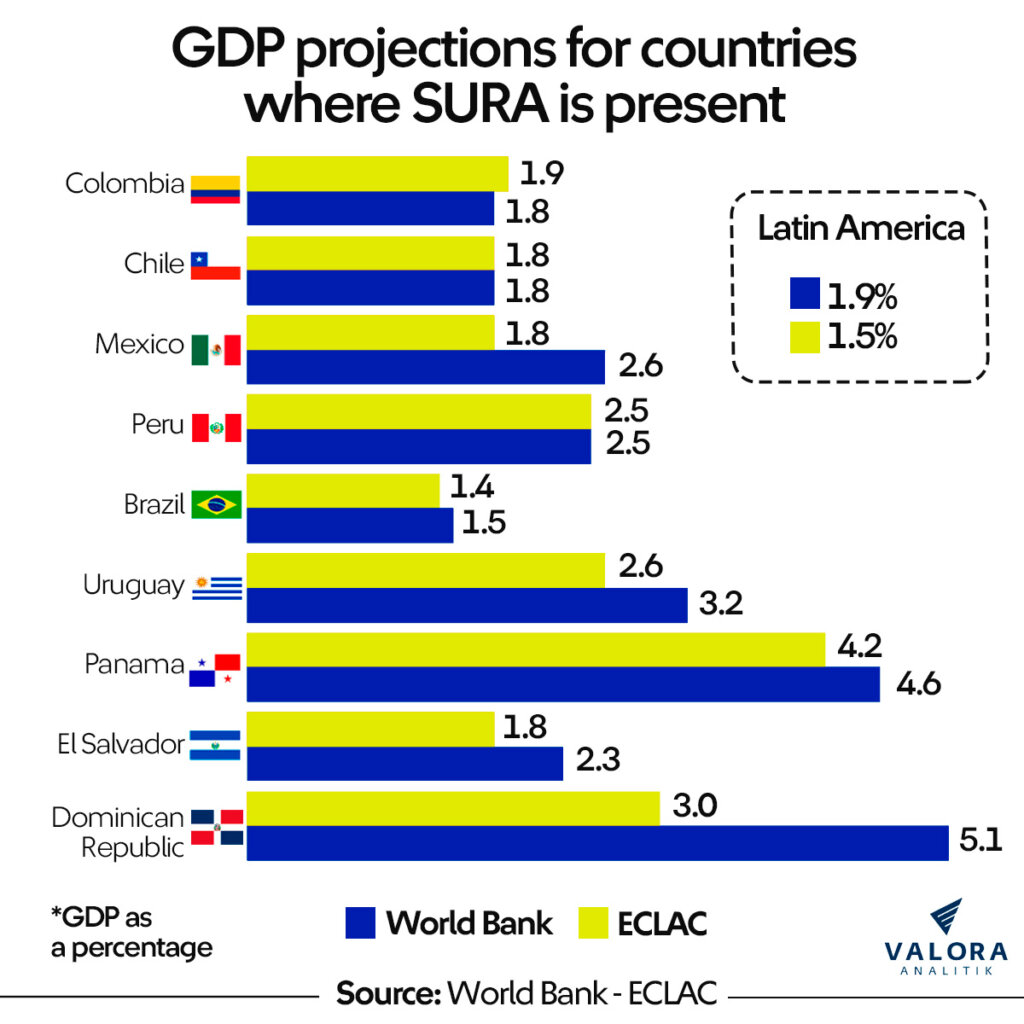

Projections on the part of the Economic Commission for Latin America and the Caribbean (ECLAC) indicate a growth of 2.2% for the region in 2023 and 1.9% in 2024 (the same as the IMF), which implies a slowing of regional growth when compared to the levels observed in 2022.

Meanwhile, the World Bank was a bit more positive, indicating that Latin America's GDP growth will increase to 2.3% in 2024 and 2.5% in 2025. Nevertheless, it did underscore the fact that as the world approaches the midpoint of what was expected to be a transformative decade in terms of development, a negative record will be broken at the end of 2024 with the last five-year period scoring the lowest GDP growth in the past three decades.

"Latin America has successfully weathered recent global shocks and performed soundly in 2022 and early 2023, although growth is weakening. This slowdown is the result of more restrictive policies being adopted to contain inflation as well as an impairment to the external environment, reflected, in, among other aspects, slower growth on the part of trading partners, less favorable external financing conditions and lower commodity prices," explained the Director of the IMF's Western Hemisphere Department, Rodrigo Valdés.

Inflation forecasts for the region

In terms of inflation, this is forecast to slow throughout the region, after standing at 7.8% in 2022, with the regional indicator (excluding Argentina and Venezuela) expecting to fall to 5% in 2023 and 3.6% at the end of 2024, this due to the weakening of external and domestic demand, the easing of global supply restrictions and the lagged effects of currency appreciation in some countries.

An example of this is Colombia where, according to Bancolombia's economic projections, inflation is expected to continue to decline progressively reaching 5.9% by the end of 2024. The weakness of its economy will be the main downward force in this area, while the increase in fuel prices and the El Niño phenomenon will be the main inflationary obstacles for this country.

Laura Clavijo, Bancolombia´s Head of Economic, Sector and Market Research, explained that this year will be a challenging one. However, it would also be a year "of recovery towards the end of the year, as long as there is a good outlook for disinflation and Central Bank being able to lower interest rates".

The region must also prepare for the impact of El Niño, as this climatic phenomenon could have a negative impact on economic activity, generating floods in countries such as Peru, and droughts in Colombia and Central America.

As inflation falls and growth slows, authorities will need to carefully calibrate monetary policies. The rapid response of the region's central banks was decisive in controlling inflation and most institutions are able to gradually relax the restrictive stance of their monetary policies, although they must remain alert to the risks involved.

Growth levers, fiscal measures, and interest rates

In order to promote sustainable growth in this type of environment, it will be necessary to adapt to the changing global landscape, according to the vision held by the main entities.

Energy transition presents an opportunity for all those countries throughout the region that enjoy abundant mineral resources, but appropriate investment frameworks will be needed to attract the necessary capital. Meanwhile, the adoption of new digital technologies requires a redoubling of efforts to improve the quality of education.

"In spite of the progress made in past decades, levels of poverty and inequality remain high throughout the region. Strengthening social cohesion must be a central aspect of any policymaking and reform program, and in this regard it will be necessary to reinforce social protection mechanisms and address the problem of insecurity," added Rodrigo Valdés from the IMF.

Andrea DiCenso, an analyst at Natixis, highlights a broad spectrum of opportunities in Latin America, focusing on Brazil, Mexico, Colombia, and Chile, these being a plus point for emerging markets given the potential valuations and great investment opportunities in sectors such as energy, agriculture, and infrastructure, among others.

The solvency of the financial sector as a lever for investing in other multiple areas of the economy is also important, since 2023 posed challenges in countries such as Colombia and Brazil, among others, and where rating agencies such as Fitch Ratings drew attention to items such as financial ratios, asset quality and financing costs in the midst of a challenging operating environment.

Fitch expects the financial sector throughout the region to remain stable in 2024 due to a slower GDP growth, declining inflation but which is still set to remain above the 3% target set by central banks in most countries, a slow decline in funding costs, and a gradual improvement in asset quality after peaking in the second half of 2023.

Furthermore, exposure to global markets and political uncertainty will likely continue to challenge economic growth. Consequently, sustained capitalization, resilient levels of profitability and adequate reserves would provide sufficient resilience for banks as they continue to navigate stress.

On the other hand, the IMF also warns that fiscal consolidation measures that governments have announced for 2024 and 2025 "may be delayed as many countries face growing calls for increased public spending in what is the most important global election year in history."

This could well boost economic activity, but also give rise to higher levels of inflation and increase the prospect of further shocks. Looking ahead, this agency pointed out that rapidly improving Artificial Intelligence could drive investment and trigger a rapid growth in productivity, although this does pose significant challenges for workers.

On the other hand, markets seem overly optimistic about the prospects for early rate cuts. If investors were to reassess their views, long-term interest rates would rise, putting renewed pressure on governments to implement faster fiscal consolidation measures that could affect economic growth, the IMF stated.

Global signals towards Latin America

These forecasts were made based on a global context in which economic activity showed a certain amount of resilience in the second half of last year, as supply and demand factors supported the major economies. However, this situation has yet to prove that it shall continue in 2024 since global players are keenly watching for the first moves of major central banks.

In fact, at the end of January, the International Monetary Fund (IMF) upgraded the global growth outlook for 2024 and foresees a "soft landing for the economy" along with an accelerated rate of disinflation.

On the demand side, increased public and private spending supported economic activity, despite tight monetary conditions, while on the supply side, higher labor force participation, repaired supply chains and cheaper energy and commodity prices helped the overall situation, in spite of renewed geopolitical uncertainties.

"This resilience is sent to continue. According to our baseline forecast, global growth will stabilize at 3.1 % this year, an improvement of 0.2 percentage points compared to our October projections, before rising to 3.2 % next year," stated the IMF in its overall analysis.

The IMF expects slower growth in the United States, where a tight monetary policy is still affecting the economy, and in China, weaker consumption and investment continue to weigh heavily on economic activity. Meanwhile, in the Euro Zone, the Fund expects activity to recover slightly after a challenging 2023, when high energy prices and tight monetary policies constrained demand.

"Many other economies continue to show great resilience, with growth accelerating in Brazil, India and the major economies of Southeast Asia," this multilateral agency noted.

"Now that inflation is receding, and growth is holding steady, the time has come to take stock and look ahead. Our analysis shows that a substantial proportion of the recent disinflation was due to a fall in commodity and energy prices, rather than a contraction in economic activity. We will have to remain attentive to the decisions of central banks," concluded the IMF.

All in all, the growth outlook for the mid-term in Latin America remains subdued. On a global level, emerging and developing economies are projected to grow by 4.4% on average, while the region's GDP is expected to expand at a slower rate, in line with the historical average recorded before the pandemic.

In order to be able to break out of this low-growth trap, "it is necessary to scale up productive development policies with a focus on the more dynamic strategic sectors, promote policies to encourage public and private investment, and adapt the financing framework to boost the mobilization of resources," concluded José Manuel Salazar, Executive Secretary of the United Nations´ Regional Commission.

*This article was prepared by the Valora Analitik staff for Grupo SURA. Its content is of a purely journalistic nature and does not compromise any specific positions taken or recommendations made by our Organization.