In recent years, alternative assets have gained greater prominence on a global investment level. Latin America has been no exception to this growth, being a region with a vast economic potential and a diversity of opportunities.

By Valora Analitik for Grupo SURA*

Alternative assets are investments that do not fall into the traditional categories of stocks, bonds or cash. They include a wide range of instruments such as real estate, private equity, hedge funds, commodities, infrastructure, cryptocurrencies and even tangible assets such as art and wines. Their main characteristic is their low correlation with traditional markets, thereby offering diversification and a potential for earning higher yields, but they also can represent high levels of volatility with certain products.

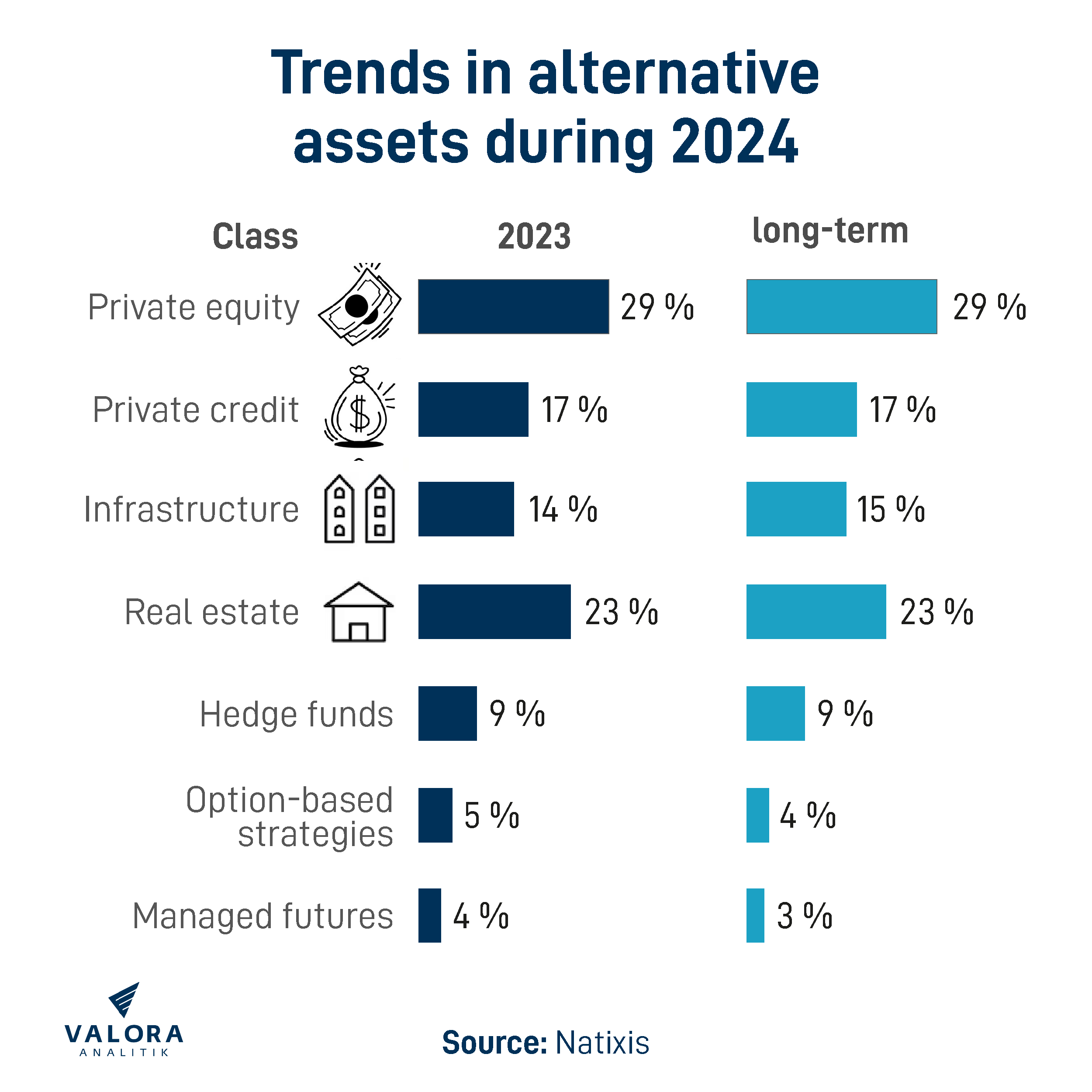

According to figures from Natixis Investment Managers, private and alternative investments have gained a prominent role in institutional strategies over the past decade and now account for 83% of all alternative allocations in institutional portfolios, including private equity (29%), private credit (17%), infrastructure (14%) and real estate (23%).

In this regard, Dave Goodsell, CEO of Natixis, explained that, although there exists a positive environment for the growth of these assets, 59% of institutional investors say that the growing popularity of private equity is making it difficult to find opportunities.

"Within the private and alternative asset classes, investors are most likely to make ESG (environmental, social and governance) investments in private equity (41%) and infrastructure (39%), rather than real estate and private debt," stated Goodsell.

For his part, Mark Hempstead, Head of Alternative Investments for EMEA at J.P.Morgan, noted that the alternative investment universe has become quite broad and offers a huge variety of assets, investment styles, combinations, frameworks, models and vehicles. In fact, there are currently more than 20,000 private investment funds and more than 9,000 hedge funds, whose performance varies considerably, this based on data from the U.S. Securities and Exchange Commission.

Hempstead emphasizes that with alternative assets, the first step is always to determine what the plan is in terms of diversifying the portfolio, mitigating volatility, hedging against inflation, enhancing returns or a combination of all of these factors.

"Investor objectives may clarify their choice of alternative assets, given that some have a specific primary role in terms of investment portfolios, while the roles of others are multiple and varied in nature. For example, private equity can improve yields, while real estate can help reduce volatility and protect against inflation," he said.

No. of Micro-, Small and Medium-Sized Clients in Latin America

A report published the firm Preqin, recently acquired by BlackRock, revealed that the pandemic caused a temporary decline in Latin American activity, however, growth has now returned. The total alternative asset allocation monitored by Preqin of all Latin American investors exceeded USD 100,000 million, showing a 21% increase in exposure to the alternative asset market compared to 2020.

Preqin's report found that nearly 62% of the alternative assets under management belonging to Latin American investors are invested in both public and private pension funds. Therefore, pension funds are a key source of capital and these investors are willing to work with international fund managers.

Private equity managers, including family offices and wealth managers, represent another opportunity in Latin America. That said, fund managers seeking to raise capital from private equity investors throughout the region need to act strategically in order to gain brand recognition and a regional presence, as well as further educate investors in alternative assets.

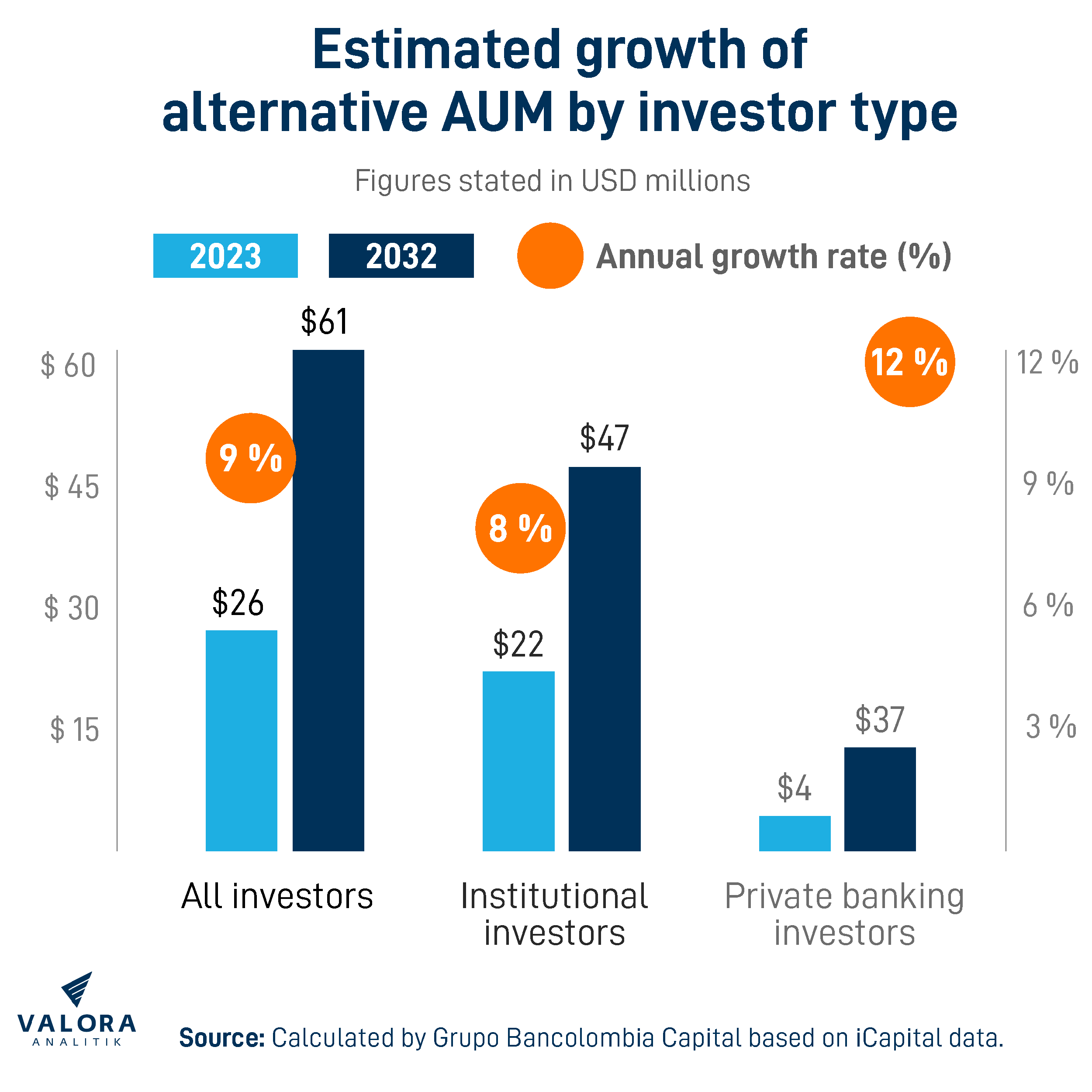

On the other hand, Bancolombia highlights the inclusion of alternative assets as a new source of returns, diversification and portfolio income. These benefits are increasingly driving the growth of these assets among different classes of investors.

Bancolombia's Capital Market Structuring Department explained that an asset that has a more structural role in the economy and which has undergone a transformation in recent years is infrastructure. Participants in these investments are no longer limited to governments and large companies; individuals can now participate through specialized investment funds.

"Trends such as de-carbonization, de-globalization and digitalization shall create very attractive investment opportunities. We expect this asset to maintain positive levels of performance in the coming years and retain its attribute of stable flows regardless of the different moments in the economic cycle," he stated.

Some cases in the region

Latin America has experienced a remarkable growth in adopting alternative assets. Countries such as Brazil, Mexico, Colombia and Chile have seen a boom in infrastructure projects and real estate development, offering opportunities for real estate investors and infrastructure funds.

These are prominent segments within alternative assets in Latin America. Private equity firms invest in unlisted companies, that offer their capital and expertise in fostering growth, which is why this sector has been vital for developing startups and SMEs throughout the region.

The private equity market in Brazil, for example, has shown significant growth, driven by sectors such as technology, health care and agribusiness. Firms such as Patria Investimentos and Vinci Partners have spearheaded large investments, contributing to the country's economic development.

Recently, Patria, which is a partner of Grupo Bancolombia, acquired Nexus Capital, one of the leading independent alternative real estate asset managers in Colombia and which currently has approximately USD 800 million in AUM focusing on office, industrial and residential real estate.

In Mexico, venture capital has flourished with the emergence of numerous funds that support technology startups. The Mexican Private Equity Association has reported a steady growth in fund raising and in the number of transactions performed. At the same time, it is one of the markets with the greatest potential for nearshoring.

Gonzalo Falcone, CEO of SURA Investments, highlighted at a recent event in Chile the Company's presence within the region with close to USD 20,000 million in assets under management (AUM). Out of this total, some USD 7.700 million corresponds to the wealth management segment, another USD 10.900 million in corporate solutions and some USD 2.000 million in investment management.

After just one year after having been first founded back in 2023, SURA Investments has achieved a 25% growth in assets under management while consolidating its new brand. Likewise, Falcone mentioned that the capital market is a fundamental part of the economy because it is a way of channeling the resources of both individuals and companies towards infrastructure projects that benefit nations.

"This is one of Chile's great achievements because it was able to develop an infrastructure development plan through a sound management of savings and investment," he noted. At the same time, this executive highlighted the focus on infrastructure in Colombia, taking advantage of the opportunities provided by the implementation of the fourth generation (4G) highways as well as a new logistics supply chain infrastructure, such as the construction of Puerto Antioquia.

On the other hand, SURA Investments manages a real estate platform consisting of 12 funds distributed among Colombia, Mexico, Peru and Chile, totaling approximately USD 608 million in assets under management.

More specifically, and in spite of a challenging environment, the Colombian real estate sector has attracted significant investments, especially in housing and urban development projects in cities such as Bogota and Medellin. Real estate investment funds and trusts have facilitated investor access to this growing market.

However, in this and other markets, opportunities continue to open up in logistics assets such as data centers, warehouses and the residential rental segment, given the fact that most Latin American households postponed home purchases in 2023.

In Peru, infrastructure has been a key focus, with investments in roads, airports and energy projects. Some efforts to attract private capital have indeed been successful, resulting in large-scale projects financed by both local and international investors.

On the other hand, hedge funds have gained popularity in Latin America offering sophisticated investment strategies aimed at maximizing risk-adjusted returns. These funds use advanced techniques such as arbitrage, short selling and leverage. Chile, for example, has been a regional leader with regard to adopting hedge funds, thanks to a developed financial market and favorable regulations. In this country, institutional investors such as the AFPs (Pension Fund Management firms) have diversified their portfolios to include local and international hedge funds.

Art and collectibles have also emerged as an alternative asset class within the region. Cities such as Buenos Aires and Mexico City have established themselves as cultural and art centers, attracting collectors and investors. For example, the annual Zona Maco Art Fair in Mexico is the largest event of its kind in Latin America and attracts gallery owners, collectors and investors from around the world, offering a combination of capital appreciation and a tangible investment alternative.

Against this backdrop, alternative assets represent a significant opportunity for investors seeking diversification and higher yields. Private equity, real estate, infrastructure, hedge funds and commodities are some of the asset classes that have shown remarkable growth throughout the region. However, it is crucial that investors consider the associated risks, including political and economic instability and reduced liquidity for certain assets.

With a strategic approach and a thorough understanding of the market, alternative assets can offer attractive returns and help drive Latin America's economic development.

*This article was prepared by the Valora Analitik staff for Grupo SURA. Its content is of a purely journalistic nature and does not compromise any specific positions taken or recommendations made by our Organization.