In recent years, the Latin American financial sector has undergone a significant change given a growing recognition of the risks relating to climate change, which has prompted greater action in response to this situation.

By Valora Analitik for Grupo SURA*

In Latin America, as in other regions across the globe, there is a heavy economic dependence on natural resources as well as sectors such as agriculture, energy and infrastructure. This has made climate risk management a priority for the private sector and, by extension, for all types of financial institutions, from commercial banks to institutional investors. Understanding and mitigating environmental risks are now critical to safeguarding the region's economic and financial stability.

This is why consolidating information reporting standards relating to sustainability management has become an imperative for organizations throughout the region, according to Beatriz Ocampo, Grupo Bancolombia´s Sustainability Manager.

Among these is the Global Reporting Initiative (GRI), a non-profit organization that has been operating on an international scale since 2000. The aim of this institution is to define methodologies for measuring and reporting on the performance of organizations by means of sustainability reports. Since back when it was first founded, it has introduced different forms of environmental, social and economic metrics aimed at ensuring transparent and consistent levels of performance on the part of companies this in order to inform and, in turn, adequately communicate their results to their stakeholders (employees, suppliers, shareholders, investors, regulators, among others), notes Miss Ocampo.

In addition to the GRI, other standards have begun to position themselves such as the SASB, the TCFD or more recently the Taskforce on Nature-related Financial Disclosures (TNFD), aimed at companies disclosing their handling of nature-related risks and opportunities. In fact, Grupo SURA participated in a TNFD pilot program at the end of 2023, as part of its commitment to monitoring, measuring and reporting environmental, social and governance (ESG) information.

Lina María Uribe, Grupo SURA´s Head of Sustainability, emphasizes that these programs "are relevant to the extent that they facilitate the disclosing of the progress being made by companies with regard to their commitments and their handling of material sustainability risks. They are also useful for identifying best practices as well as opportunities in this regard, while facilitating their measurement based on indicators that allow for companies to carry out comparative analyses with regard to other players in the same sector".

Therefore, financial institutions are integrating climate considerations into their decision-making processes, from assessing credit risk to planning long-term investments. This allows them to protect their assets from the impact of climate change and gives them a competitive advantage by anticipating and adapting to market trends.

Ms. Uribe added that this is a key factor, because "we are seeing a growing awareness among the different actors in the region's financial system of the importance of this issue. At the same time, more advances are being made in different countries with regard to regulatory issues and more research initiatives are being carried out for designing methodologies that are allowing the sector to better understand its risks in the face of this phenomenon, given the effect of their systemic nature on the economy. However, there are still important challenges being posed, among these, the ability to standardize the quantification of financial risks derived from climate change".

Projections and key issues for sustainable investing in emerging markets

According to the International Monetary Fund (IMF), private climate financing should play a leading role in the efforts of emerging and developing economies for limiting greenhouse gas (GHG) emissions and containing climate change while addressing its effects.

While estimates may vary, these economies must collectively invest at least US$1 trillion in energy infrastructure between now and 2030 and between US$3 trillion and US$6 trillion across all sectors each year until the year 2050 for mitigating climate change, this through substantial reductions in GHG emissions.

Furthermore, between US$140 billion and US$300 billion shall be required each year until the year 2030 in order to be able to adapt to the physical consequences of climate change, such as rising sea levels and worsening droughts. Depending on the effectiveness of the mitigation measures adopted, these figures could increase dramatically to between US$520 billion and US$1,750 trillion each year after the year 2050.

Therefore, the IMF stresses the need to implement innovative financing instruments as well as to broaden the investor base, increase the participation of multilateral development banks and development-focused finance institutions, and strengthen climate-related information.

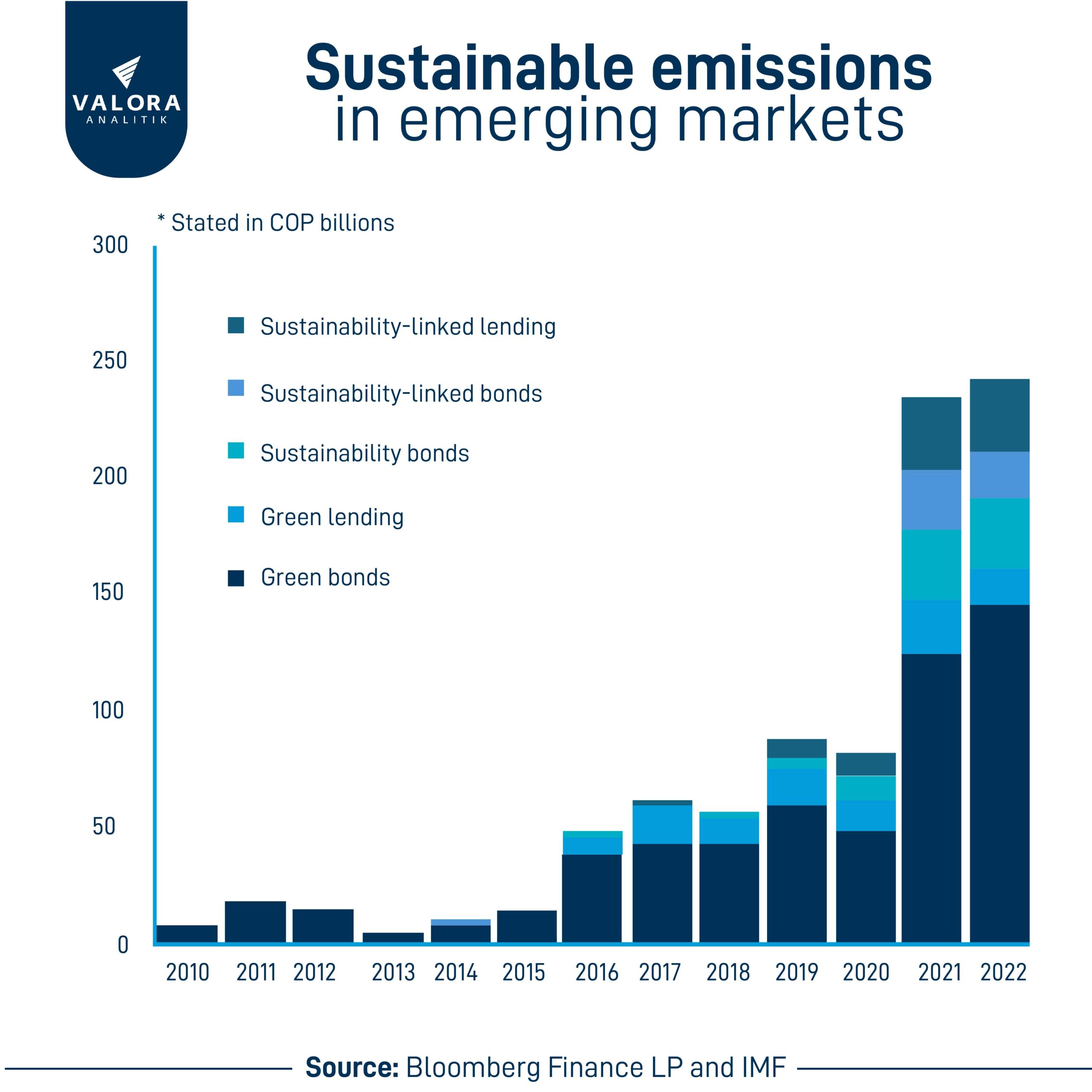

In this regard, there is evidence of an increase in private sustainable financing in emerging and developing economies which rose to US$250 billion in 2022, a record level.

Even so, private financing needs to at least double this amount by 2030 in a period when low- or zero-emission infrastructure projects are far from widespread and the impact of the world's fossil fuel industry is still significant despite the signing of the Paris Agreement.

In larger emerging markets with more functional bond markets, investment funds - such as the Amundi green bond fund, backed by the World Bank's private sector financing arm - are a good example of how to attract institutional investors, such as pension funds. This fund class can be replicated and expanded to encourage emerging market issuers to generate a greater supply of green assets so as to be able to attract a wider range of international investors.

In less robust economies, the role of multilateral development banks will be crucial for financing essential projects, so it shall be necessary to channel more climate financing through these institutions.

In this regard, the IMF believes that a first step would be to broaden its capital base and rethink ways of approaching risk appetite through partnerships with the private sector, this backed by transparent governance and performance oversight.

Multilateral development banks could therefore take better advantage of equity financing, which currently accounts to only 1.8% of the resources committed to climate financing in the emerging and developing economies. Their capital can also attract much larger amounts of private financing, which currently represents 1.2 times the amount of resources that the institutions themselves allocate.

Leaders in sustainable investment and risk management in Latin America

Against this backdrop, there are several examples of progress being made in financially- focused organizations throughout the region that are adopting a proactive approach for identifying, assessing and mitigating the risks associated with climate change.

These include:

Grupo SURA

Grupo SURA has stood out for the headway it has made in terms of its natural capital management (allocation of its companies' capital for incorporating environmental criteria, mitigating impacts and promoting a transition towards best practices), this Group being one of the region´s leaders in 2023.

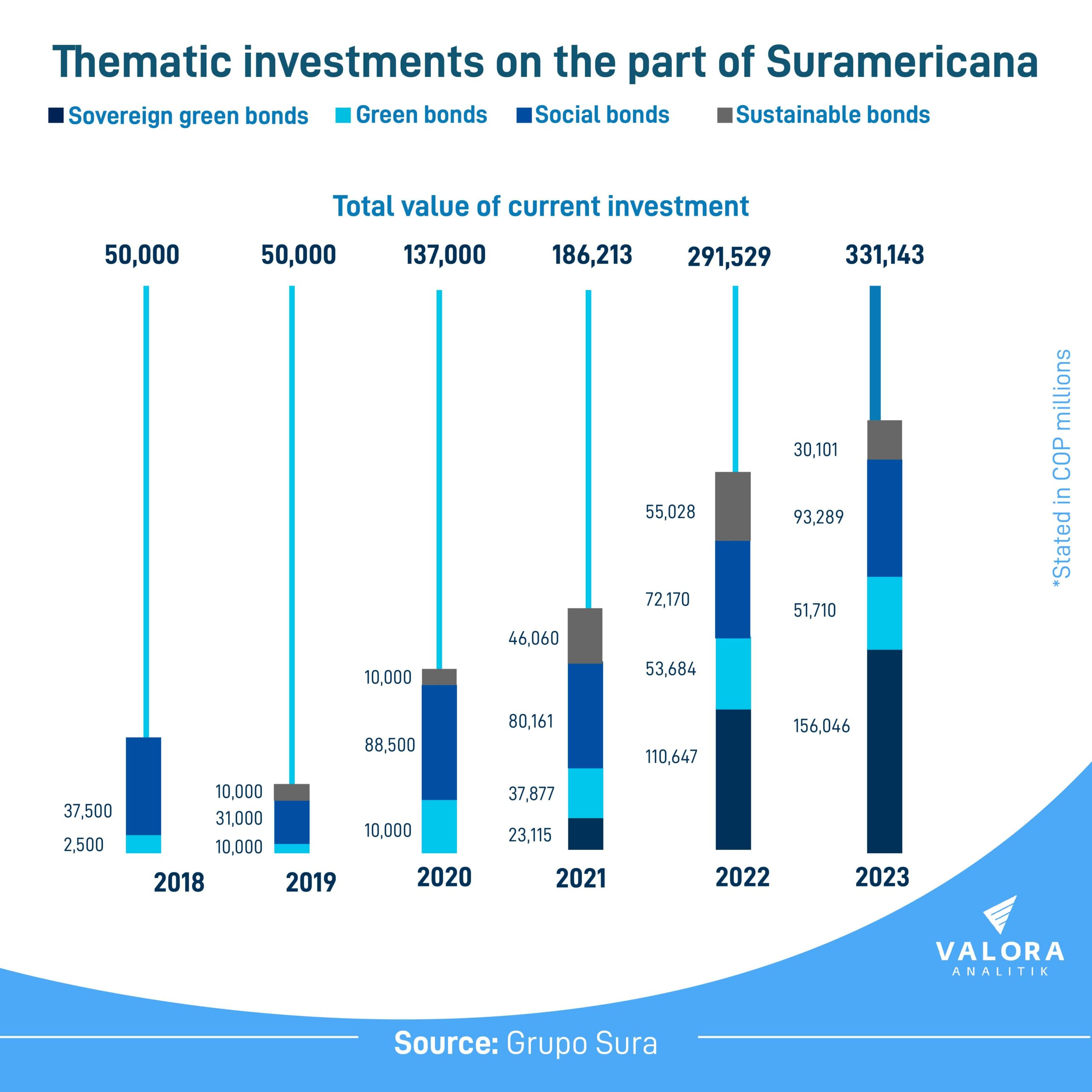

In this way, it has achieved important figures such as a 14% increase in thematic investments in 2023, including investments made by the portfolios of its subsidiary Suramericana and the latter´s own subsidiaries in Latin America, compared to the previous year.

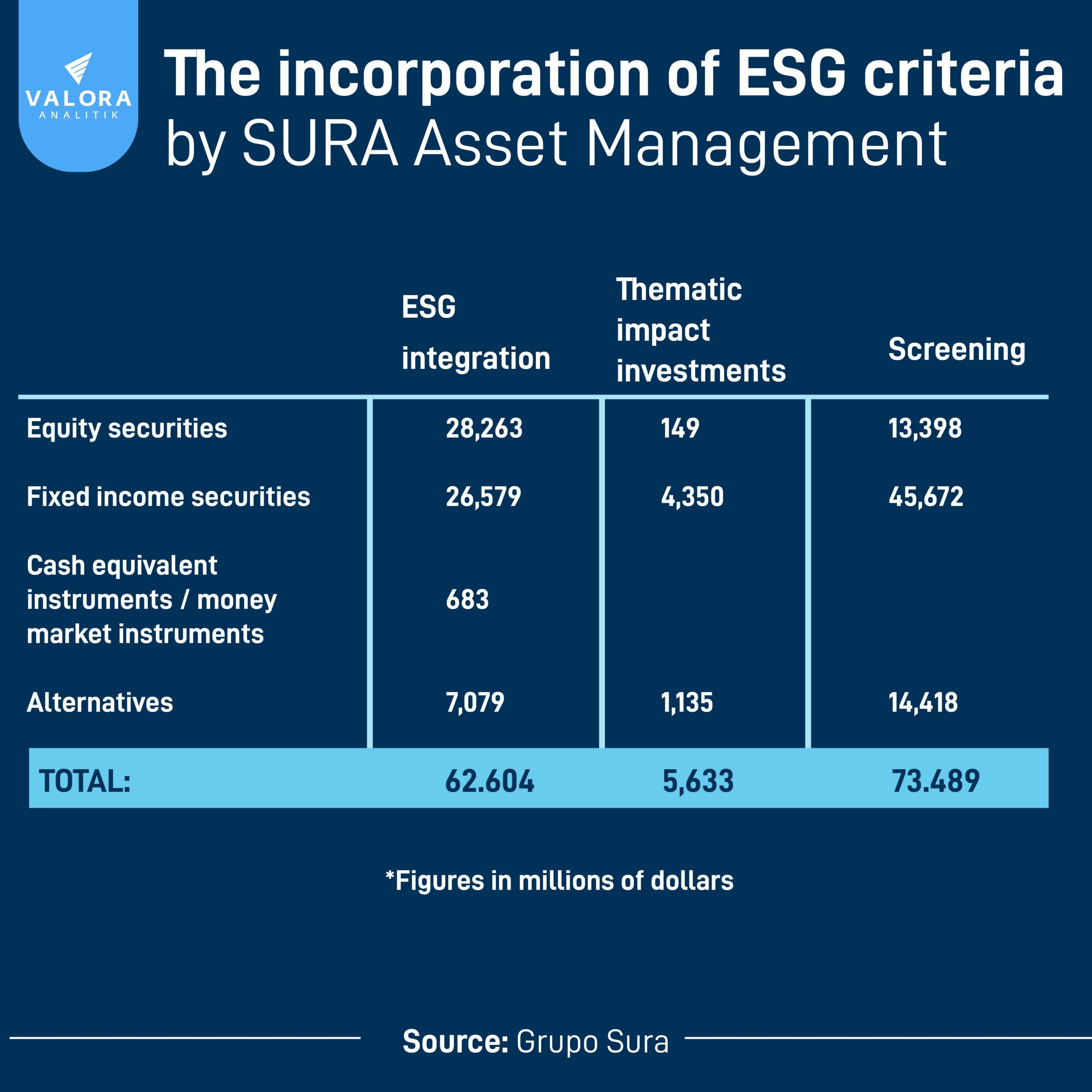

In turn, it achieved premium revenues of US$63.6 million in just the last year, from insurance solutions based on environmental criteria, and added US$124.3 million in assets under management of investment products based on sustainability criteria offered by SURA Asset Management.

This takes into account its Sustainable Investment Framework Policy, which establishes the principles through which the Companies belonging to the business group must make investment decisions that include environmental, social and corporate governance criteria, and in which four management approaches have been defined, namely active ownership, ESG integration, excluding and filtering direct investments as well as thematic and impact investments. In addition, Grupo SURA has put into place an ESG Manual for M&As (mergers and acquisitions).

CAF- The Development Bank of Latin America

CAF, the Development Bank of Latin America, has recognized the importance of climate risk management in its mission to promote sustainable development throughout the region. Through its Green Financing Program, CAF has earmarked resources for supporting projects aimed at mitigating and adapting to climate change in key sectors such as renewable energy, resilient infrastructure and sustainable agriculture.

During the COP28 in Dubai, CAF announced an investment of US$15 billion until the year 2030 for promoting adaptation measures and natural disaster risk management.

This amount triples the institution's investments in this area over the last five years and confirms its role as a leading player in regional climate action.

In addition, the bank has collaborated with governments and companies for developing climate risk management strategies on both domestic and corporate levels.

Bolsa de Valores de Lima (Lima Stock Exchange)

The Lima Stock Exchange has been another important player in promoting climate risk management in Latin America. By incorporating environmental, social and governance (ESG) criteria into its listing policies, this exchange has encouraged companies to report information regarding their climate risk exposure and management strategies. This has not only increased transparency and environmental information reporting on the Lima stock market, but has also facilitated access to sustainable investment opportunities, something that is expected to increase with the integration of the Colombian and Chilean stock exchanges into the new Nuam Exchange.

Consequently, climate risk management is becoming increasingly important for the financial sector in Latin America. As the region faces increasing challenges relating to climate change, financial institutions are taking a proactive approach to identifying, assessing and mitigating the associated risks.

The cases of these and other organizations demonstrate that the integration of climate considerations is not only possible, but also has the potential to positively impact financial institutions and society as a whole. Thus, effective climate risk management is not only a matter of corporate responsibility, but also an imperative need for ensuring a sustainable and adaptive level of development in Latin America.

*This article was prepared by the Valora Analitik staff for Grupo SURA. Its content is of a purely journalistic nature and does not compromise any specific positions taken or recommendations made by our Organization.