Recent GDP revisions on the part of entities such as the International Monetary Fund, the World Bank and ECLAC show a complex picture of mixed results for the region: while some indicators suggest an improvement, others point to persistent obstacles that could limit economic growth.

By Valora Analitik for GRUPO SURA*

The global economy is at an inflection point, facing both opportunities and significant challenges for the second half of this year as the international context remains complex.

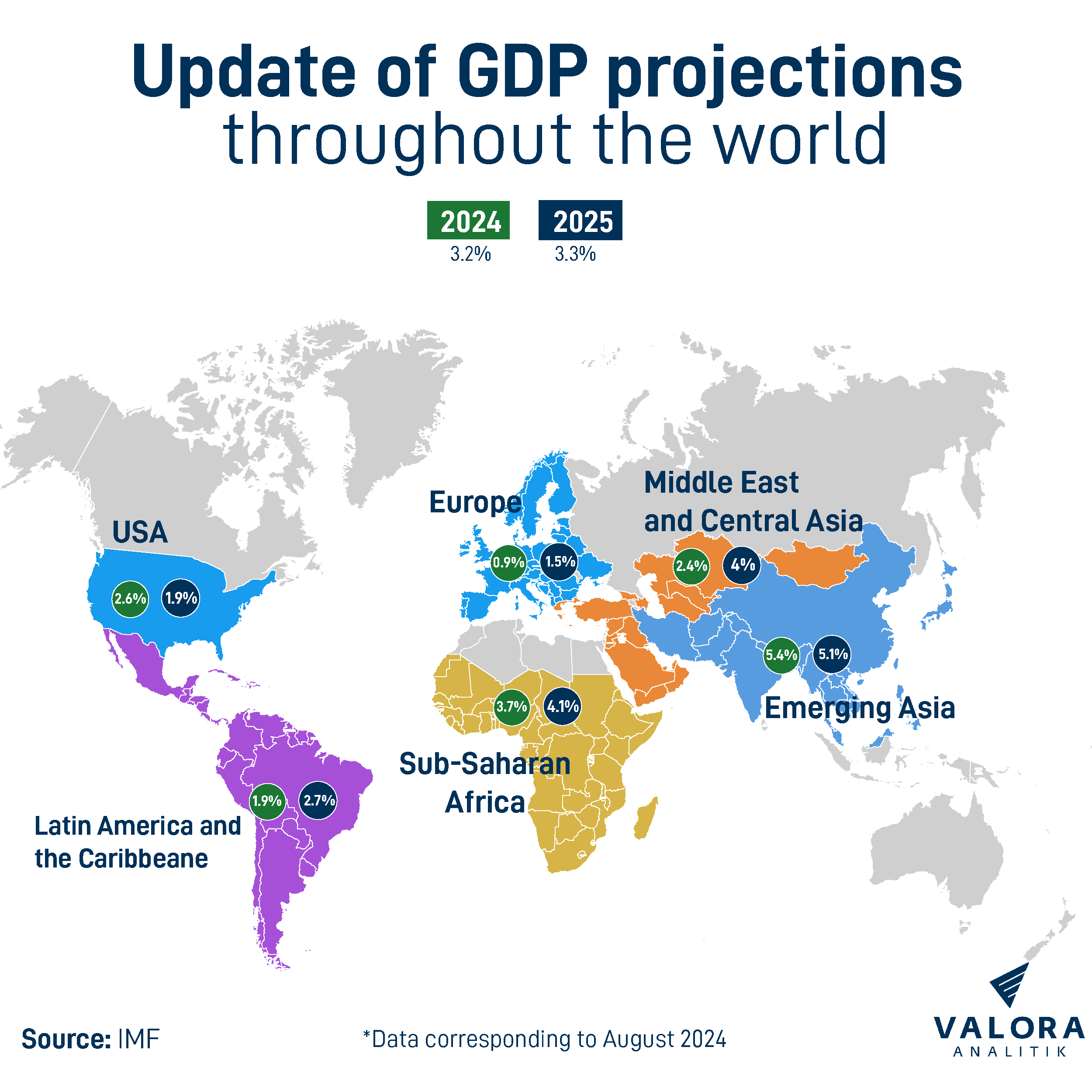

Global growth is projected at a modest 3.2% for 2024, according to the International Monetary Fund (IMF), marking a reversal from last year's 3.3%, but this latter figure would be the same as that projected to be reached in 2025.

While regions such as Emerging Asia, the Middle East and Central Asia are expected to post higher GDP growth rates in the short and medium term, Latin America is showing an intermediate trend, outperforming the major powers and developing regions, which are expected to grow at a slower rate.

The United States and Europe, on the other hand, show moderate growth rates due to a weak domestic demand, although the start of interest rate cuts by the European Central Bank and those expected by the Federal Reserve in the coming months could provide an additional boost to consumption.

China remains a key player in the global economy, but its growth is projected to end up below the government's target, with an estimated expansion of 4.8% for 2024.

The IMF highlights that this varied momentum of activity has reduced the difference in output between economies, "as cyclical factors diminish and activity better matches its potential."

Along with growth, the IMF warns that price inflation for services is slowing the amount of progress being made in terms of disinflation, which could complicate the normalization of monetary policy. They therefore emphasize the prospect of even higher interest rates, against a backdrop of escalating trade tensions and heightened political uncertainty.

And what about Latin America?

In its recent update for Latin America, the IMF highlighted inflation, productive activity and fiscal pressures as the most relevant factors.

In the eyes of this multilateral organization, the regional economy shall be highly conditioned by the fiscal possibilities arising from what the U.S. Federal Reserve is doing with its handling of interest rates. In other words, a great deal of economic activity shall depend on what happens with the appreciation of regional currencies, which, in general, have been showing a series of appreciation rates, given that inflation indicators in the United States and the major powers are falling more than expected.

The IMF report adds that "even in the midst of tighter monetary and fiscal policies, we are projecting relatively robust growth rates. Finally, as fiscal pressures ease and prices come down, the Latin American economy as a whole could perform better”.

Regarding these projections, Bancolombia's Head of Economic Research, Laura Clavijo, explained that these coincide with those of this financial entity in that they reflect a slow start to the year with important fiscal challenges, both throughout the region and in Colombia.

"We underscore the fact that more favorable macroeconomic conditions are appearing to signal tentative “winds of change” in the economic cycle. However, other factors such as adverse weather effects, uncertainty with the regulatory environment and low investor confidence would hinder a more consistent economic reactivation going forward," stated Clavijo.

Visions of the World Bank and ECLAC

Overall, the World Bank forecasts that growth in Latin America and the Caribbean will slow further to 1.8% in 2024, before rebounding to 2.7% in 2025 as interest rates stabilize and inflation falls. Commodity prices are projected to support the region's exports, although moderate growth in China could limit the demand for key commodities.

Indermit Gill, Chief Economist and Senior Vice President of the World Bank, said, “Four years after the shocks caused by the pandemic together with conflicts, inflation and monetary tightening, it would appear that global and regional economic growth is finally stabilizing.

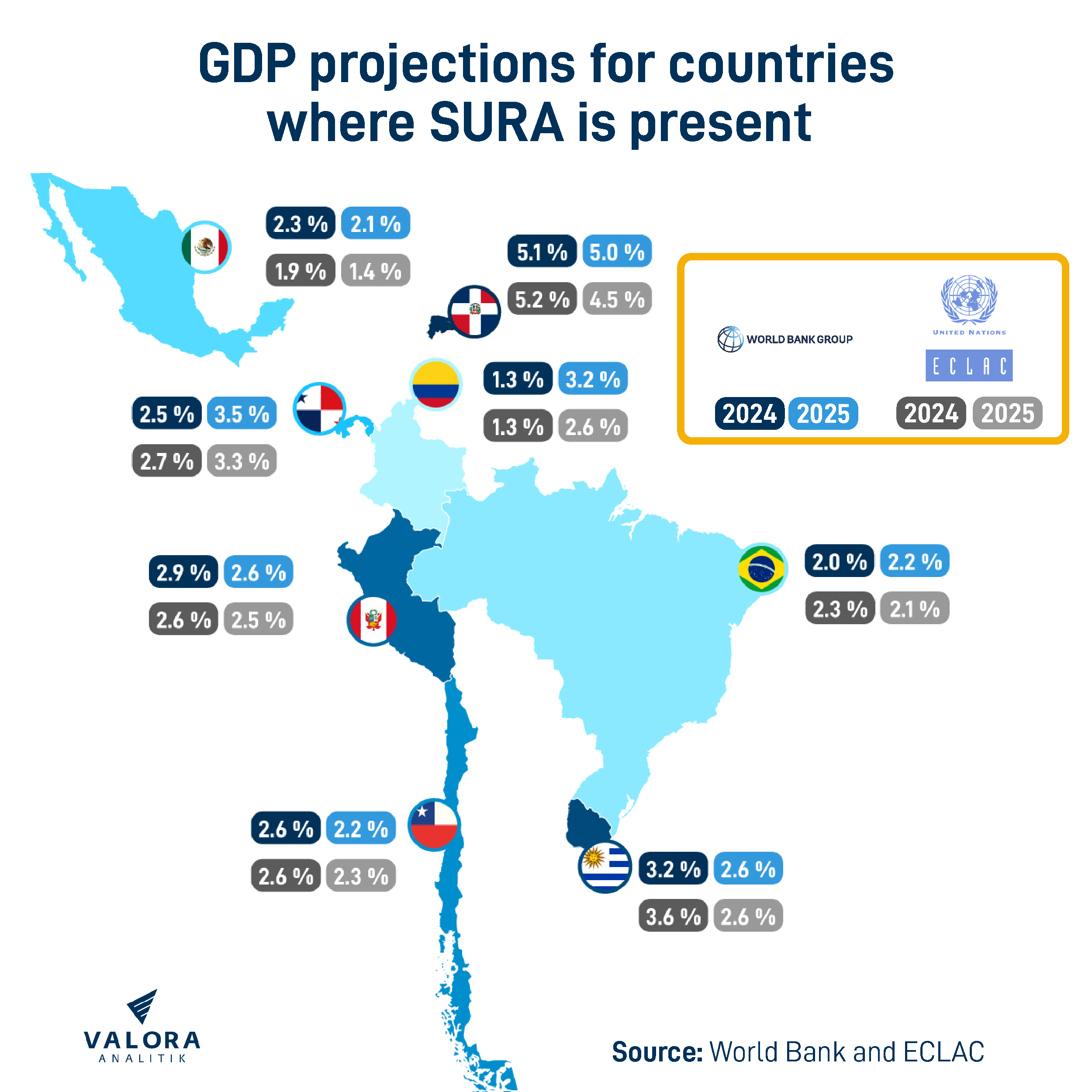

Brazil's GDP growth is set to end up at a tempered 2% in 2024 and 2.2% in 2025, supported by monetary policy rate cuts and a recovery in private consumption and investment. Mexico's projected growth shall slow to 2.3% in 2024 and 2.1% in 2025, constrained by a tight monetary policy, despite the expected decline with inflation and interest rates. On the other hand, Argentina’s growth is expected to shrink at 3.5% for 2024, but recover to 5% for 2025 as economic imbalances are addressed and inflation declines. In Colombia, growth is expected to increase to 1.3% in 2024 and 3.2% in 2025, driven by the recovery of private consumption and exports. Chile's projected growth of 2.6% in 2024 and 2.2% in 2025 will be supported by a strong external demand for green energy commodities and interest rate cuts. For its part, Peru is projected to grow by 2.9% in 2024 and 2.6% in 2025, as lower inflation and cuts to the monetary policy rate are set to boost private consumption.

In its regional analysis, the Economic Commission for Latin America and the Caribbean (ECLAC) highlighted that the country with the highest growth forecast for this year is the Dominican Republic with a figure of around 5.2%, followed by Venezuela with 5% and Costa Rica with another 4%. On the other hand, Haiti and Argentina are the only countries with negative growth projections, with declines of 3% and 3.6%.

The Commission reiterated that the region's economic growth, which it considers to be modest, is tied to inflationary pressures around the world that have not yet reached pre-pandemic levels, in addition to the interest rates of the world's main central banks, which remain high and hinder the possibility of foreign investment inflows.

Daniel Titelman, Head of Economic Development at ECLAC, said that "although the region's GDP growth is set to end up at 1.8% this year and 2.6% next year, it still remains low. The challenge remains how to break the low-growth “trap'".

Meanwhile, after reaching a peak in June 2022, inflation with the economies of both Latin America and the Caribbean has tended to decline steadily, from the 9.2% recorded at that time, the median regional inflation rate closed at year-end 2023 at 3.7%. One element to highlight is that the median inflation rate in June 2024 is slightly higher than that observed at the end of 2023 (3.9%), which could indicate a slowing with the rate of inflation throughout the region this year. A similar dynamic is observed when analyzing the population-weighted average of regional inflation, which went from 4.6% at year-end 2023 to 4.5% in June 2024.

"As a result of recent trends, this modest economic growth in the region continues to be conditioned by an uncertain international context, marked by higher levels of inflation as well as interest rates that also remain high worldwide, which tends to delay a return to normal inflationary dynamics and the cycle of monetary policy easing in the main advanced countries," added Titelman.

Opportunities and risks

These forecasts are exposed to several risks: Including the possibility of global financial conditions becoming tighter, high levels of local debt and a slowing growth rate on the part of China, which will affect the region's exports. Extreme weather events related to climate change also represent a risk. Conversely, stronger economic activity in the United States could have a positive impact on Central America and the Caribbean.

To conclude, while Latin America shall face economic difficulties in 2024, it is expected to show a gradual recovery in 2025, supported by declining inflation and accommodative monetary policy. The region's economic performance shall depend on a combination of domestic and international factors, and commodity prices and global demand will play a role in this outlook.

*This article was prepared by the Valora Analitik staff for Grupo SURA. Its content is of a purely journalistic nature and does not compromise any specific positions taken or recommendations made by our Organization.