Rising inflation is also impacting the region. However, savings and a well-diversified portfolio of alternative investments are key tools in the face of rising prices.

By Valora Analitik for Grupo SURA*

The global increase in inflation continues as the year progresses, affecting both the economies of developed countries, as well as those that are on the way to becoming so.

In fact, the International Monetary Fund (IMF) projects a 5,7% rise in inflation for the advanced economies and another 8.7% for emerging markets and developing economies, which is 1.8% and 2.8% higher, respectively, than those estimated back in January of this year.

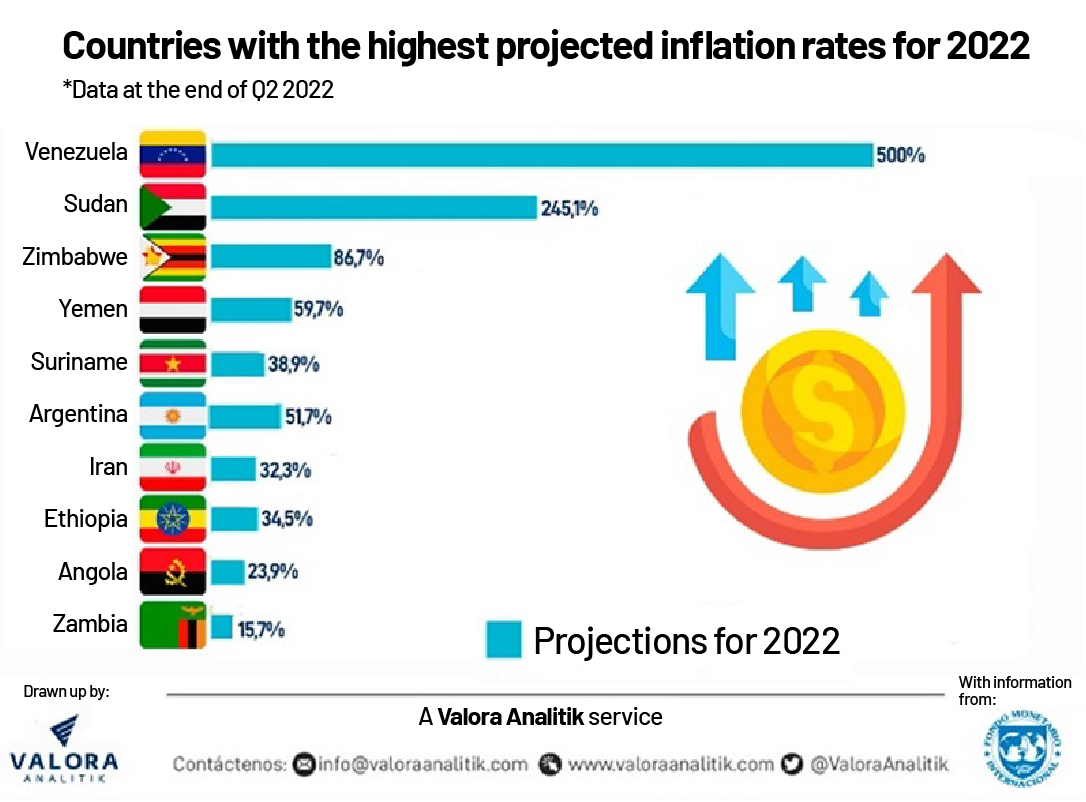

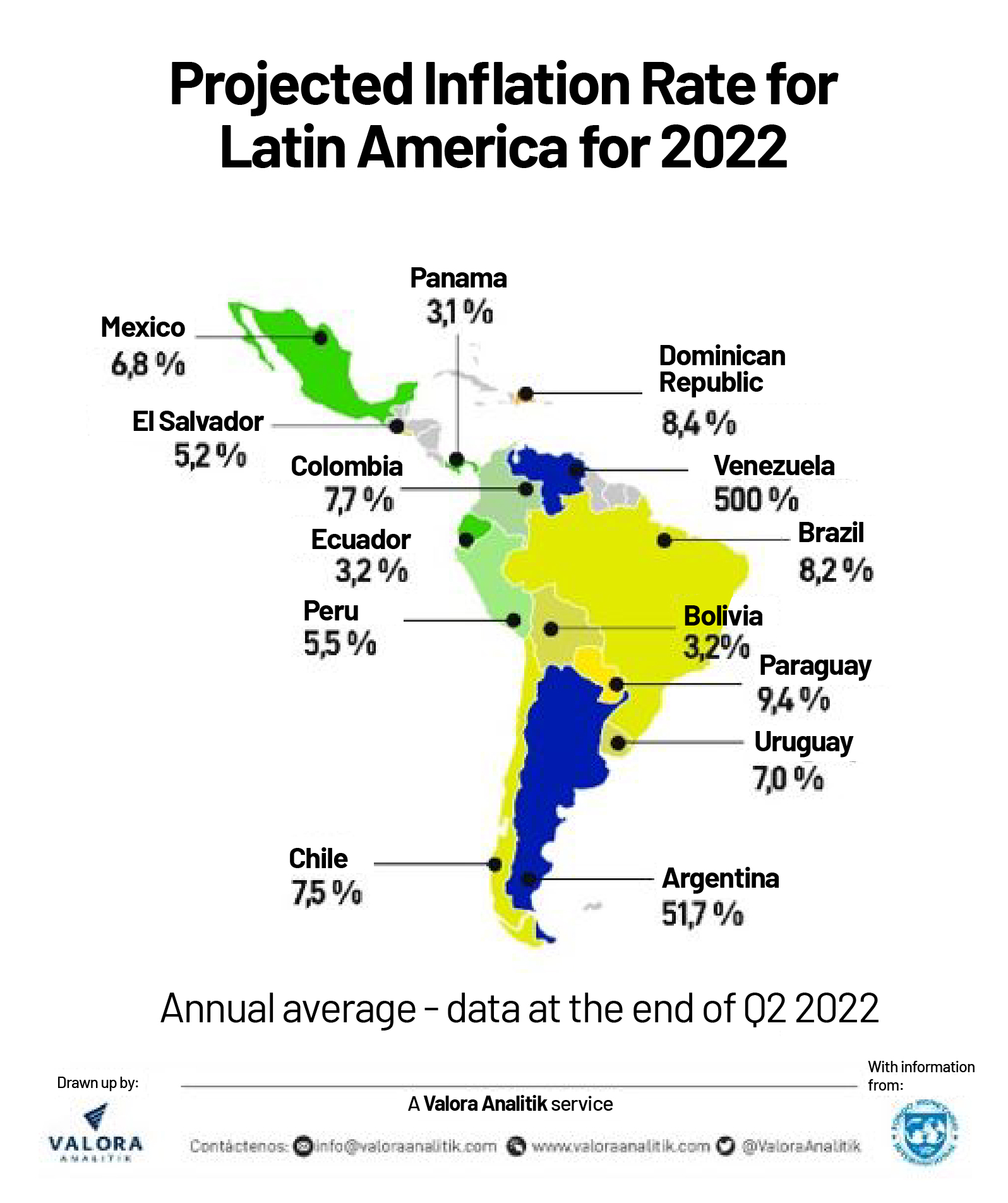

In terms of the 2022 global inflation projections, Venezuela shall lead all the other countries with the highest inflation rate recorded on a world-wide basis with an estimated 500 % according to the IMF. Argentina is also among the top 10 countries with the highest increases, as one of the main economies affected by this inflationary phenomenon, with a projected 51.7% increase for the year.

Also echoing this global trend is the most recent report of year-on-year inflation issued by the Organization for Economic Co-operation and Development (OECD), as measured by the Consumer Price Index (CPI), which rose to 9.6% in May 2022 from 9.2% last April, this largely driven by food and energy prices.

This is the largest price increase since August 1988. In fact, ten OECD countries have already recorded double-digit inflation increases, with the highest rates recorded in Turkey, Estonia and Lithuania.

"The increase in this inflationary trend is concentrated in just a few products, but which account for a large share of the basic baskets of goods for these countries," explained Juan Pablo Espinosa, Director of Economic, Sectorial and Market Research at Bancolombia.

The current situation with global inflation has its roots in 2020, following the economic shutdowns given the lockdown measures introduced to mitigate the impacts of Covid-19, but which in Latin America were exacerbated by social protests and strikes that placed added pressure on supply chains in countries such as Chile, Peru and Colombia, among others.

The increase in food and energy prices have been the main reasons given for the current inflation, but this comes as a consequence of a series of several factors, namely the rise in international oil prices; the delay in the normal flows of goods due to the global container crisis; the war in Ukraine, which began in February 2022; and the shortage of raw materials, fertilizers and other basic inputs for the agricultural industry in different countries, among others.

Latin America, more affected than other regions

The IMF forecast of a 8.7% increase in inflation for the emerging markets, a group that includes the Latin American economies, shows 2,8% increase in this indicator compared to before the Russian invasion of Ukraine.

The region has also been particularly affected by the trade balance on the part of importers as well as the pressure placed on producers due to export prices being transferred to domestic markets

For this reason, "increasing inflationary pressure may also lead authorities to resort to subsidies or other forms of support for households or businesses," said the Director of the IMF Research Department, Pierre-Olivier Gourinchas, a decision that would put even more pressure on the fiscal health of Latin American countries.

In this sense, the risk of inflation expectations moving away from the ranges expected by central banks would provoke a more restrictive interest rate response to curb the appetite for consumption and domestic credit, while encouraging savings.

The impact of savings and alternative investments for combating inflation

With inflation at multi-decade highs, institutions such as Swiss RE see "inflationary recessions" in many major economies over the next 12 to 18 months.

Consequently, this Group noted that, in the midst of the current difficult conditions, the rise in central bank interest rates, aimed at securing price stability over economic growth, is a notably favorable aspect on two particular fronts; since it shall help avoid a 1970s-style stagflation and for insurers, the increase in interest rates is favorable for improving returns on their investments in inflation-indexed fixed-rate securities.

For this reason, in the context of high volatility and inflation, investments play an important role, since they are a tool that allows for "counteracting" inflation by locating an investment instrument that yields equal or more than this index.

"The market offers different alternatives such as fixed income, equities, real estate assets, infrastructure, private debt, ETFs or currency hedges, which can help to build up an interesting portfolio with which to hedge against inflation," stated Susana Torres Valero, an expert in international markets at the Universidad Nacional Autónoma in Mexico.

Foreign exchange hedges, in particular, have attracted much interest in recent weeks in view of the depreciation of Latin American currencies against the US dollar, since they are a mechanism that allows dollar market participants to protect themselves against the risk of sharp future increases with the exchange rate.

But since higher inflation is a worldwide phenomenon, the course of which is still uncertain and difficult to control, the best alternative for private individuals is to make the most appropriate decisions for managing their money.

Bancolombia explains that in this type of situation it is essential to prioritize savings over spending in order to better cope with the situation.

Some key recommendations include drawing up a budget, setting spending priorities, controlling spending and strengthening the ability on the part of households to save, so that it does not affect their capacity to meet their obligations or their quality of life.

"Financial well-being is not necessarily tied to one's income level, but rather it is about being able to make choices that allow you to enjoy life according to your expectations. Savings is a key tool here, because it allows households to adapt to different stages of the economic cycle," stated Cristina Arrastía, Chief Business Officer at Bancolombia.

Finally, another recommendation is that, in times of high inflation, it is not a good idea to keep money in cash, without resorting to investment alternatives, because it loses its value. For this reason, it is important to seek expert advice to see which alternatives offer returns, based on one´s own personal situation and expectations in the short, medium and long term.

*This article was prepared by the Valora Analitik staff for Grupo SURA. Its content is of a purely journalistic nature and does not compromise any specific positions taken or recommendations made by our Organization.