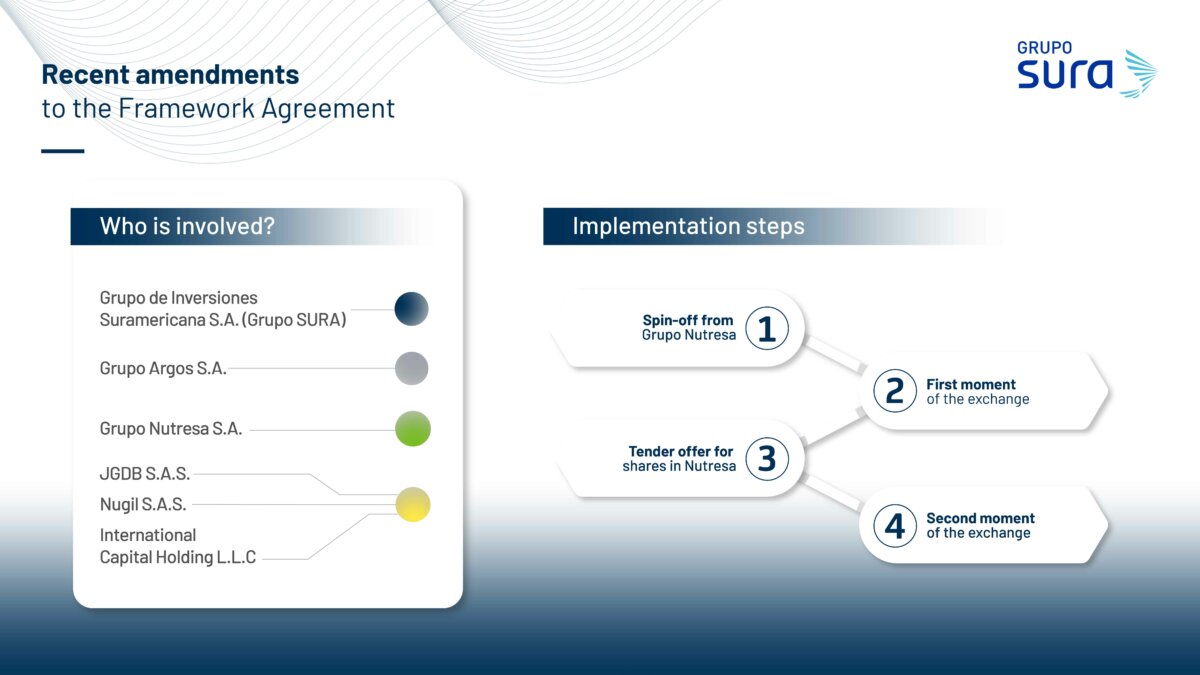

This addendum amends the Agreement announced last June with a view to moving the transaction forward more quickly and efficiently

This Monday, Grupo SURA signed, along with Grupo Nutresa, Grupo Argos, JGDB, Nugil and IHC, an addendum to the Framework Agreement dated June 15, 2023. This amends certain terms and conditions to expedite the exchange of Grupo Nutresa shares, in keeping with an authorization issued by the Company's Board of Directors and announced last September.

In spite of the changes with some of the steps involved, this process will still result in the following:

- JGDB, Nugil and IHC shall become controlling shareholders of Grupo Nutresa's food business, holding at least an 87% stake in its share capital.

- JGDB, IHC y Nugil shall cease to be shareholders of Grupo SURA.

- Grupo SURA and Grupo Argos shall cease to be shareholders of Grupo Nutresa.

- Grupo Nutresa shall cease to be a shareholder of Grupo Argos and Grupo SURA.

The following is a description of this process including the main activities and operations required for implementing the addendum to the Framework Agreement for the exchange of shares.

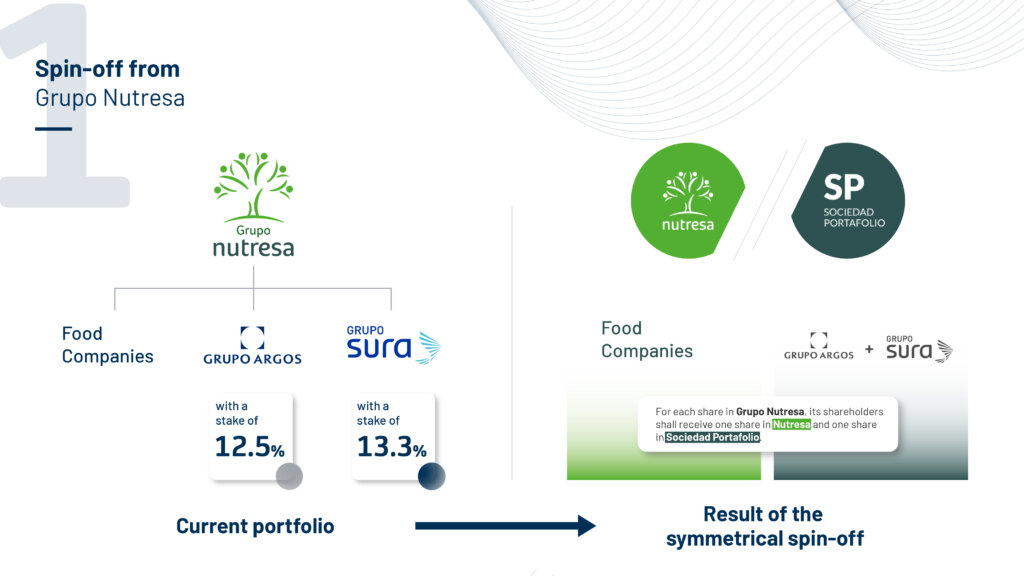

1 Spin-off from Grupo Nutresa

After obtaining approval of its Shareholders' as well as the Colombian Superintendency of Finance, as reported through the Relevant Information Reporting channel in September and November, respectively, Grupo Nutresa will split or divide its equity symmetrically into two companies that, for the purposes of this explanation, shall be called Nutresa Alimentos and Sociedad Portafolio S.A.

On the one hand, Nutresa Alimentos shall be the company holding Grupo Nutresa's equity as relates to its food business and, on the other hand, Sociedad Portafolio S.A. shall hold the investments that Grupo Nutresa currently has in both Grupo Argos and Grupo SURA. Nutresa Alimentos and Sociedad Portafolio S.A. shall be listed on the Colombian Stock Exchange (BVC).

The result of this spin-off will be that for each share that the shareholders hold in Grupo Nutresa, they will keep one (1) share in Nutresa Alimentos and will receive one (1) share in Sociedad Portafolio S.A.

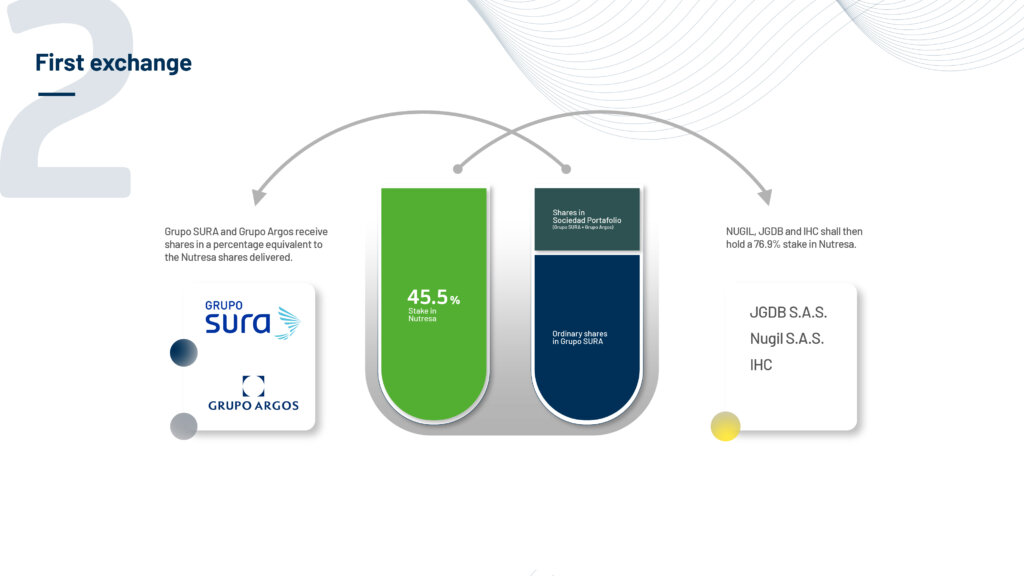

2 First exchange

Once the spin-off is completed, a first exchange of shares will take place in which Grupo SURA and Grupo Argos will directly deliver to Nugil, JGDB and IHC all the shares that these own in Nutresa Alimentos, representing approximately a stake of 45.5%, which will give JGDB, Nugil and IHC a 76.9% stake in Nutresa Alimentos.

In turn, JGDB, Nugil and IHC will deliver to Grupo SURA and Grupo Argos a number of shares owned by these in Sociedad Portafolio and in Grupo SURA equivalent to a 45.5% stake in Nutresa Alimentos that they receive, according to the terms of the Framework Agreement.

The second exchange of shares shall occur after the Tender Offer is completed, as described below.

3 Tender offer for shares in Nutresa Alimentos

Given the first direct exchange, Grupo SURA, Grupo Argos and a company to be appointed by IHC will jointly launch a Tender Offer for 23.1% of the shares in Nutresa Alimentos, in which the shareholders of this company will be able to choose between the following options:

- Selling their shares in Nutresa Alimentos at a price of USD 12 per share payable according to the conditions to be defined in the prospectus corresponding to the aforementioned Tender Offer, and/or

- Exchanging their shares in Nutresa Alimentos and receiving shares in Grupo SURA and Sociedad Portafolio (set up with shares in Grupo SURA and Grupo Argos). The aforementioned, under the same terms in which Grupo SURA and Grupo Argos agreed in the negotiation with Nugil, JGDB and IHC as stipulated in the Agreement. The terms and conditions of this exchange shall be published in the Tender Offer Prospectus.

- Shareholders may also sell a portion of their stakes and exchange another.

Through this Tender Offer, Grupo SURA and Grupo Argos aim to acquire a 10.1% stake in Nutresa Alimentos as required for JGDB, Nugil and IHC to complete a minimum 87% stake in said Company.

Furthermore, and as part of the executed Addendum, the parties to the Framework Agreement reached the following agreements regarding the results of the Tender Offer:

- Should the percentage of acceptances obtained through the Tender Offer exceed the aforementioned 10.1% stake in Nutresa, the shares exceeding this percentage will be acquired directly by IHC, at a price of USD $12 as defined in the Agreements.

- In the event that the acceptances do not reach a 10.1% stake in Nutresa Alimentos, Grupo SURA and Grupo Argos may pay the difference in cash, at a rate of USD 12 per share.

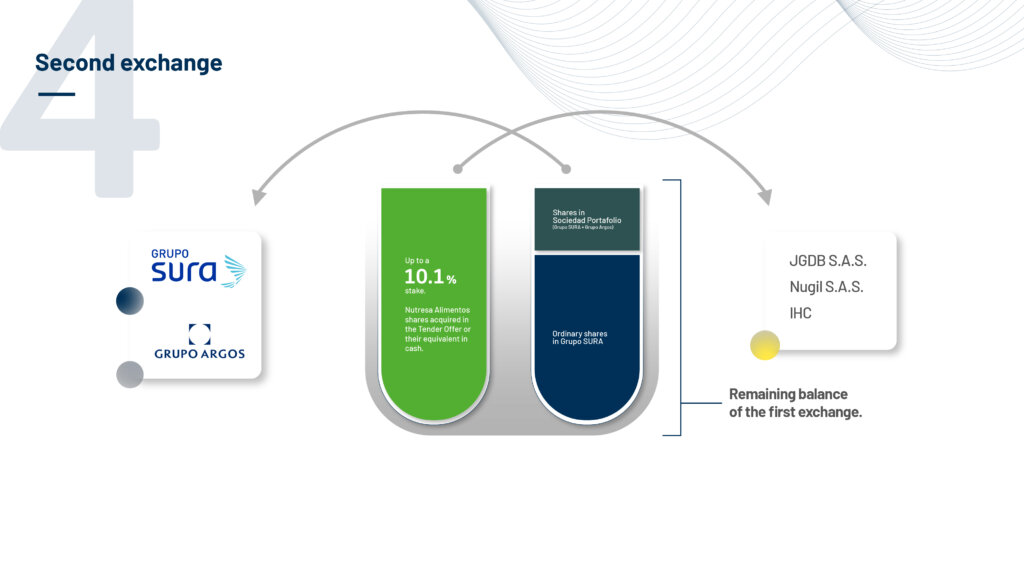

4 Second direct exchange

Once the Tender Offer is completed, Grupo SURA and Grupo Argos will deliver to JGDB, Nugil and IHC the shares in Nutresa Alimentos that were acquired in the aforementioned Tender Offer, up to a maximum stake of 10.1%, or its cash equivalent.

Simultaneously, JGBD, Nugil and IHC will deliver the shares in Grupo SURA and Sociedad Portafolio S.A. that they still own and that were not delivered in the first exchange. Once all this is concluded, the following effects will be seen:

- Grupo SURA will receive its own shares and those of Sociedad Portafolio.

- Grupo Argos will receive shares in Sociedad Portafolio and Grupo SURA.

In turn, JGDB, IHC and Nugil will be controlling shareholders of Nutresa Alimentos and will not retain any equity interests in Grupo SURA or Sociedad Portafolio S.A.

In order to comply at all times with all applicable rules and regulations, and with the prior authorization of the Colombian Superintendency of Finance, part of the shares that Grupo SURA and Grupo Argos are due to receive as part of the exchange shall be temporarily deposited to independent stand-alone trusts. The shares deposited therein shall not have any voting rights while these stand-alone trusts exist.

Grupo SURA's premise for implementing this agreement has always been to ensure that all parties obtain a satisfactory result under fair conditions and that this operation generates value for the Company and its shareholders.

"At Grupo SURA we continue to make positive progress in order to speed up and make more efficient the implementation of the Framework Agreement for the exchange of the Company's shares in Grupo Nutresa. This transaction shall bring about benefits to all of our shareholders while allowing us to continue strengthening a more focused portfolio of financial services throughout Latin America.” stated Gonzalo Pérez, Chief Executive Officer of Grupo SURA

Benefits of this transaction for Grupo SURA and its shareholders

In this regard, Ricardo Jaramillo, Grupo SURA´s Chief Business Development and Finance Officer, commented that "this transaction will create value since it will allow us to maintain a growing dividend per share along with adequate debt levels all this with a more focused portfolio, but with a diversity of geographies, businesses, channels and risk levels. In this way we continue to move toward greater levels of sustainable profitability in order to achieve a return in excess of the cost of capital for all our shareholders."

Upon completing the transaction as set forth in the aforementioned Agreement, Grupo SURA shall report the analyses that are to be duly performed on the new structuring of its portfolio, as well as any additional information it considers to be relevant.