- As a result of the sound dynamics of our portfolio companies, Grupo SURA's recurring revenues as well as its recurring operating income both rose by 7% compared to the same period last year, excluding exchange rate effects.

- These results reflect the gain on the sale of the Nutresa stake, which is the outcome of long-term value creation for our shareholders, as well as higher revenues obtained from Grupo Argos via the equity method thanks to having carried out several transactions.

- Now that the Framework Agreement has been successfully completed, Grupo SURA is making headway as an investment manager by focusing its investment portfolio on financial services.

This past Wednesday, Grupo SURA reported its financial results for this first quarter of the year. The Company posted consolidated revenues amounting to COP 13.6 trillion, thanks to higher levels of operating performance on the part of the Suramericana and SURA Asset Management lines of business in Latin America, as well as the extraordinary effects associated with the materialization of Grupo SURA's strategy as an investment manager with a long-term view.

It is also worth noting the increase in revenues via the equity method these standing near COP 1 trillion, with COP 407 billion provided by Bancolombia as well as a greater contribution on the part of Grupo Argos following several portfolio transactions. Consequently, Grupo SURA's operating income reached COP 6 trillion, with controlling net income amounting to COP 4.9 trillion and adjusted return on equity (adjusted ROE) standing at 9.7% on a LTM basis.

"Grupo SURA's first quarter results were driven by increase revenues from SURA Asset Management and Suramericana, as well as by the gain recorded on the share swap related to the Nutresa transaction, now that the Framework Agreement has been successfully completed. This allowed us to reflect the growth of this latter Company for a span of more than 40 years in which it formed part of our investment portfolio. These recurring figures are the result of the positive dynamics of our different lines of business, which reaffirms the strength of our portfolio with a greater focus on the financial service sector", stated Ricardo Jaramillo Mejía, Grupo SURA´s Chief Executive Officer At the end of Q1 2024, recurring operating income came to COP 9 trillion, up by 7% in local currency, while operating income also rose by 7% thereby totaling COP 1.3 trillion, this excluding exchange rate effects. On the other hand, recurring controlling net income came to COP 635 billion, 14% lower than for the same quarter last year, this due to higher interest and taxes.

To ensure comparability with the same period last year, the following non-recurring effects must be taken into account: the gain obtained with the Nutresa - Grupo SURA share swap; the increase in revenues obtained from Grupo Argos via the equity method given several transactions, especially that of its subsidiary Cementos Argos in the United States; the appreciation of the Colombian peso against other Latin American currencies; and the elimination of Nutresa from the equity method in 2023.

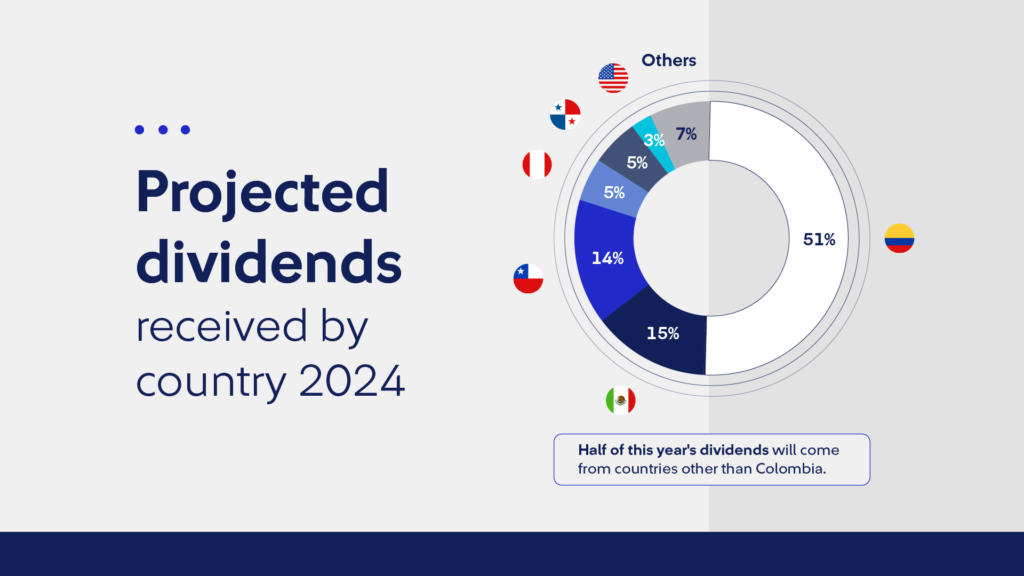

This year, the Company expects to receive dividends from its investments amounting to close to COP 2 trillion, of which almost half comes from operations outside Colombia and 90% of this corresponds to its investments in financial services, through SURA Asset Management, Suramericana and Bancolombia. Furthermore, Grupo SURA projects an operating cash flow of close to COP 1 trillion this year, which allows us to maintain our ongoing financial flexibility and ensure adequate levels of indebtedness and solvency.

It is important to point out that, after concluding all those transactions relating to the Framework Agreement, including the shares received in the share swaps and those to be received with the winding up of Sociedad Portafolio, Grupo SURA shall have received 31.8% of its total outstanding shares, which is one of the largest investments made by the Company in its entire history.

"This is probably the largest share buyback ever carried out by a listed Company in Colombia and, as such, shall have a direct effect on creating greater shareholder value that in turn shall be reflected in an increase of the main metrics per share. With this, we shall have a more focused Company with a greater growth potential throughout the region," concluded Ricardo.

Subsidiary performance:

SURA Asset Management, specializing in pension, savings, and investment management, posted a 10% growth in fee and commission income, excluding exchange rate effects, and ended this past first quarter with a controlling net income of COP 318 billion, up by 54%, thanks to higher yields on the fund management firm's own investments (legal reserves) and its ongoing expense controls.

Suramericana, specializing in insurance as well as trend and risk management, recorded an 11% increase in its written premiums (in local currencies) and ended this first quarter with a net income of COP 257 billion, for a 19% drop compared to the same period last year, due to a higher claims rate in the Life Insurance segment and lower investment yields on its portfolio due to lower inflation throughout the region.

Recent Highlights:

- Grupo SURA has appointed a new Chief Executive Officer. The Board of Directors appointed Ricardo Jaramillo Mejía as Chief Executive Officer of Grupo SURA as of May 1, after serving as Chief Business Development and Finance Officer for the past 8 years.

- The Framework Agreement Now Completed. With the second direct share swap, the Framework Agreement signed on June 15, 2023, was duly completed. With this, the Company's ownership structure evolved while making headway with its portfolio's focus on financial services, for the benefit of all shareholders.

- Credit risk ratings. On March 27, 2024, S&P Global ratified the Company's "BB+" rating, with a negative outlook.

- Dividend per share 2024. Grupo SURA's General Assembly of Shareholders declared a dividend payment of COP 1,400 per share for 2024, 9.4% higher than for last year and the highest in its history.

- Progress made regarding our ongoing sustainability. SURA was ranked in top position from the insurance sector and sixth overall in the 2024 MERCO ESG Responsibility ranking. Consequently, we have been among the 10 best-performing organizations in this area in Colombia for the last 9 consecutive years.

- VaxThera has now completed the construction of its vaccine manufacturing plant. This Colombian biotechnology company, one of Suramericana's investments, completed the construction of the first stage of the vaccine packaging and finishing plant in Rionegro (Antioquia), which has a production capacity of 100 million biologics per year and shall provide almost 500 direct jobs.