- This result reflects the positive growth of the Suramericana and SURA Asset Management lines of business, as well as revenues obtained from the equity method.

- Controlling net income ended the first half of the year at COP 823 billion; however, in comparable terms (pro forma) this came to COP 1.4 trillion, after excluding the amount of deferred tax relating to the Nutresa transaction.

- The Framework Agreement signed on June 15 shall allow Grupo SURA to focus in greater detail on its financial services as an investment manager.

On Monday, august 14, Grupo SURA reported to the market its financial results for the first half of the year. The Company increased its total consolidated revenues by 32%, which ended up at COP 19.1 trillion. This was mainly driven by:

- The double-digit growth in written premiums in all of Suramericana's segments.

- The positive dynamics of SURA Asset Management's fee and commission income corresponding to its Savings and Retirement.

- Higher returns on the insurers' and pension funds' proprietary investments.

- An increase in Grupo SURA's revenues from the equity method, which at the end of H1 totaled COP 1.1 trillion.

"We saw, at the end of the first half, a sound level of operating earnings thanks to the positive business dynamics of all our portfolio companies and their focus on profitable growth. We also continue to implement the Grupo Nutresa Framework Agreement, which will create added value for both Grupo SURA and its shareholders, while we move forward in focusing our portfolio on the financial services we provide," stated Gonzalo Pérez, CEO of Grupo SURA.

The positive levels of performance on the part of Grupo SURA's different lines of businesses, as well as having diversified its portfolio, led to COP 2.6 trillion in operating earnings, for an increase of 54% compared to the first half of last year.

Controlling net income totaled COP 823,157 million, for a drop of 17%, this due to the non-recurring effect of the deferred tax relating to the Nutresa transaction, as recorded in accordance with our accounting policy and which does not represent a cash outflow. On a comparable basis, the pro forma bottom line closed this past first half at COP 1.4 trillion, 46% higher than that recorded at the end of the same period last year.

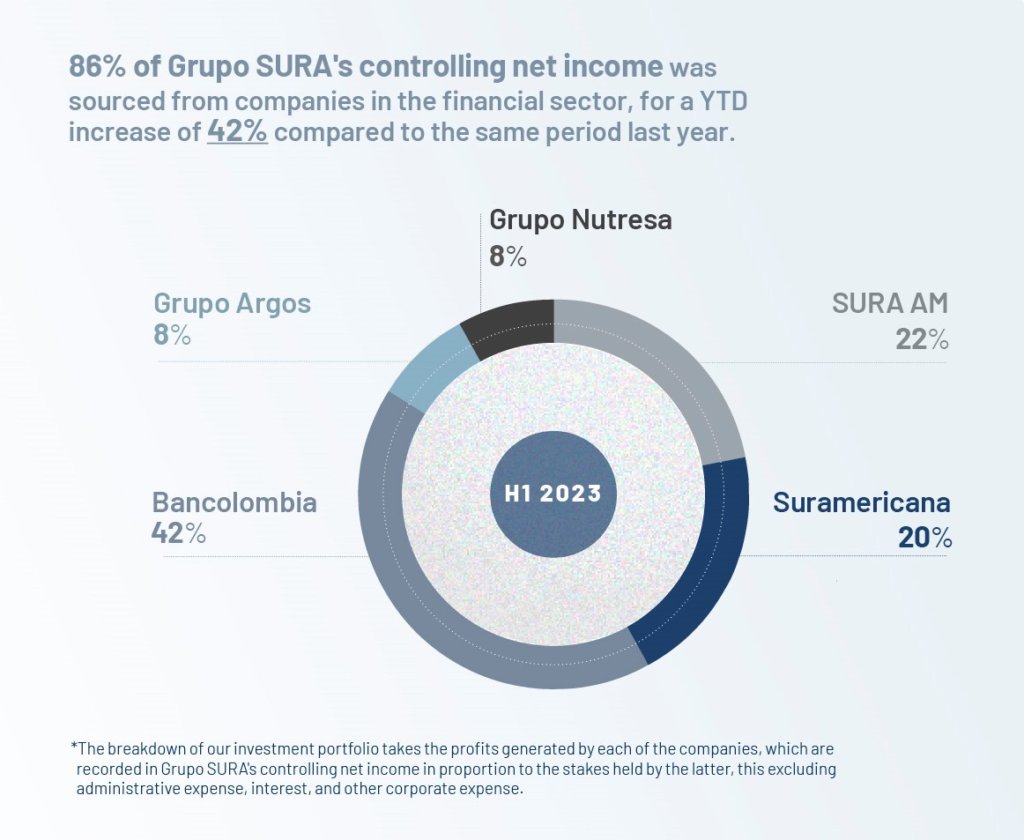

It should be noted that our portfolio companies that cater to the financial sector contributed 84% of the controlling net income at the end of H1 , as shown below:

Subsidiary performance

Regarding Suramericana, which specializes in insurance, trend and risk management, ended the first half of the year with a net income of COP 471,251 million, up by 81%, thanks to the increase in premium income in the Life (18%), Health Care (23%) and Property and Casualty (16%) segments, as well as a 73% rise in investment income.

On the other hand, SURA Asset Management's controlling net income amounted to COP 493,593 million, driven by the growth in fee and commission income, higher returns on the pension funds' own investments (legal reserves) and the efforts made to control operating costs and expense during the first half of the year.

Financial implications of the Framework Agreement

Concerning the transaction associated with the Framework Agreement, signed last June 15, it should be noted that this shall have an effect on Grupo SURA's financial statements. For this past quarter, deferred taxes were posted, which had a consequent impact on the Company’s net income for the period. Once the transaction is finalized and the associated effects are normalized, the Company will reflect positive figures, as well as good levels of performance and a sound investment portfolio.

“Beginning this past second quarter, we are seeing the first effects of the Nutresa Transaction in the Company’s financial statements, and these are set to continue as different milestones are met. We are convinced that this transaction shall create added value for Grupo SURA and its shareholders, and we will continue on the path towards ensuring a level of profitability in excess of the cost of capital," explained Ricardo Jaramillo, Grupo SURA´s Business Development and Finance Officer.

The Company has indicated that this Framework Agreement was reached in equitable conditions among all parties, while generating added value for Grupo SURA shareholders, by increasing their stakes and providing higher earnings and equity per share.

Recent Highlights:

- On June 21, S&P Global Ratings declared the effect of the transaction contemplated in the Framework Agreement on Grupo SURA's credit rating to be neutral. This ratings agency stated that the strength of the remaining companies in the investment portfolio remains solid.

- Suramericana announced to the market that it has signed the corresponding agreements for selling off its operations in Argentina and El Salvador, thereby optimizing its capital management function in order to consolidate and maintain a regional footprint in the remaining seven countries where it is present.

- SURA Asset Management consolidated SURA Investments, a Latin American investment platform offering its expert support in wealth and asset management for individuals, companies, and institutions with a global reach.

- SURA was evaluated in May as the sixth best organization to work for in Colombia, according to this year´s independent survey conducted by the Merco Talento firm.

- Grupo SURA, in partnership with the Bolivar Davivienda Foundation, launched the third annual call for proposals, #PensarConOtros, for the purpose of building citizenship and democracy in Colombia. The deadline for receiving applications is August 28.

1 This change includes the accounting effects of having consolidated the fund management firms Protección and AFP Crecer as well as the insurer Asulado as subsidiaries of SURA Asset Management as of the end of 2022.

2 The breakdown of our investment portfolio takes the profits generated by each of the companies, which are recorded in Grupo SURA's controlling net income in proportion to the stakes held by the latter, this excluding administrative expense, interest, and other corporate expense.