- A sustained increase in revenues and a disciplined control over spending, allowed the Company was able to obtain better figures than those originally forecasted.

- The increase in revenues obtained from associates via the equity method, as due to good levels of performance on the part of Bancolombia, Grupo Argos, Grupo Nutresa and Proteccion during the second quarter.

- As for our core subsidiaries, Suramericana created a new company called VaxThera for producing vaccines, and SURA Asset Management scored a double-digit growth with its lines of business.

- As an investment manager, Grupo SURA is making progress with its stock repurchasing initiative on the one hand; and on the other, it divested Clover Health, which represented revenues of USD 7.6 million.

Grupo SURA has now reported its consolidated results for the first half of the year, which show a sustained and accelerated recovery of the companies that make up its investment portfolio. This produced operating earnings of COP 1.2 trillion (USD 329 million*) along with a net income figure of COP 672 billion (USD 186 million*), a remarkable growth compared to the same period last year, when the early impacts of the pandemic were beginning to be felt.

These positive figures at the end of the second quarter were underpinned by: (i) good levels of premium income on the part of Suramericana as well as an increase in fees and commissions in the case of SURA Asset Management; (ii) an all-time high in revenues obtained via the equity method, mainly from Bancolombia, Proteccion, Grupo Argos and Grupo Nutresa; and (iii) as well as a firm control over spending with the aim of enhancing the efficiencies of the SURA companies.

“Our consolidated results for the first half of the year reflect a recovery on the part of Suramericana and SURA Asset Management that has outpaced our previously budgeted levels, having posted growths in revenues from all their business lines, while operating costs increased by just 0.3% compared to the same period last year. I would also like to make special mention of our efforts to protect life and mitigate a higher claims rate due to the COVID pandemic, which have materialized in a much lower patient fatality rate for our Mandatory Health Care Subscribers (EPS SURA) (0.88%) than both their national (2.65%) and global (2.16%) counterparts at the end of Q2 ", stated Gonzalo Pérez, CEO of Grupo SURA

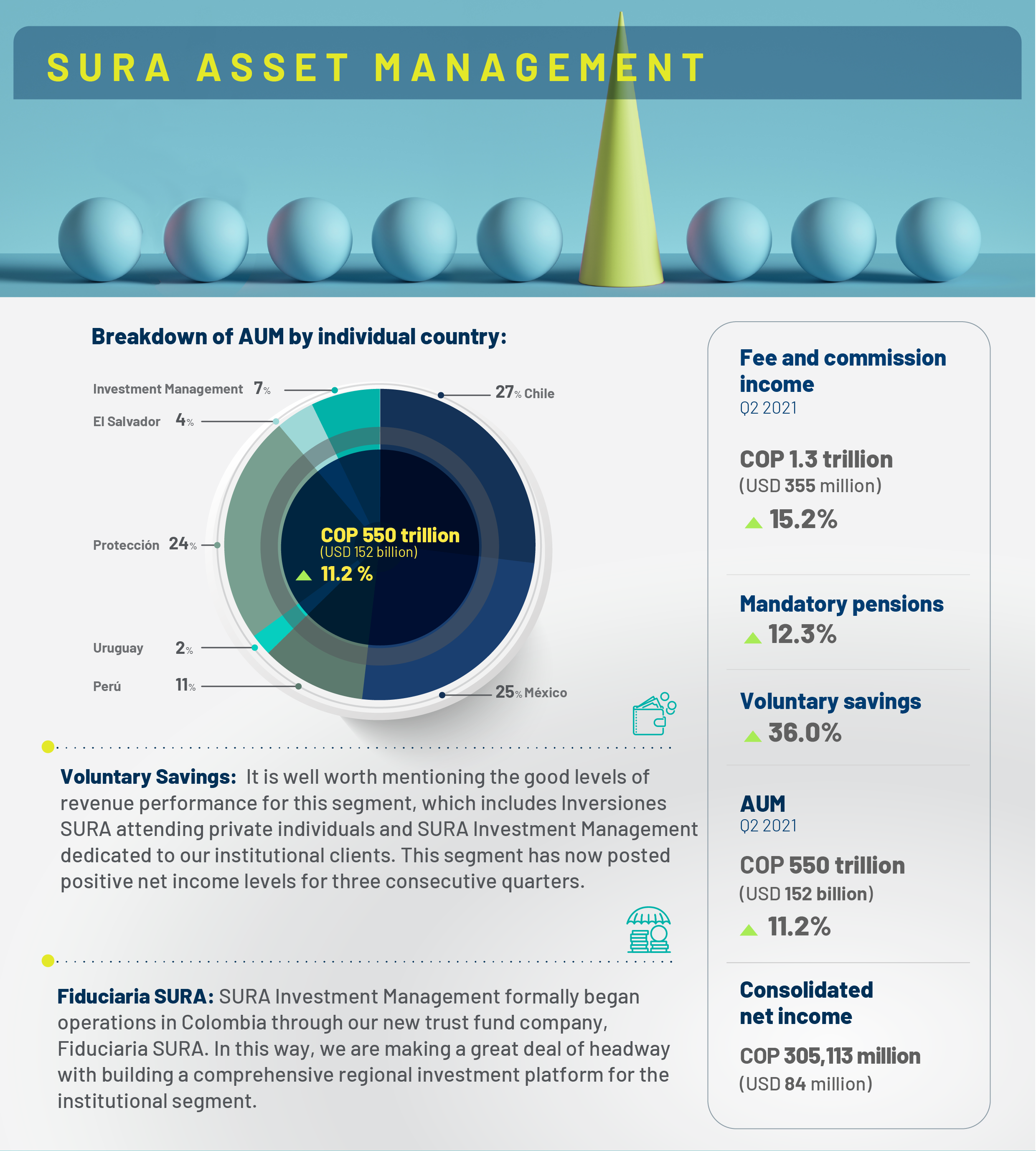

The more relevant milestones for this first half of the year, included projects aimed at driving our sustainable profitability on a subsidiary level such as the newly created company VaxThera , specializing in biotechnology that shall help us to independently produce biologics for Colombia and the rest of Latin America, with a projected investment of USD 54 million on the part of Colombian subsidiary of Suramericana. Likewise, special mention is made of the momentum that SURA Asset Management's line voluntary savings for private individuals is enjoying through Inversiones SURA which now has a total of 1.7 million clients throughout the region, for a growth of 14.5% compared to the same period last year, while AFP Integra (Peru), by winning the tender for the second time, began in June to recruit workers with the goal of reaching 800,000 new clients, a commitment to sustainability in Retirement Savings.

Financial results at the end of Q2 2021

As for our consolidated results, it is worth noting the 14.6% growth in revenues compared to the first half of last year, these totaling COP 11.7 trillion (USD 3,220 million*). Similarly, our efficiency efforts have kept down operating expense which have increased by just 0.3%, thereby partially mitigating the impact of a higher claims rate due to the COVID pandemic, which has affected Suramericana´s Life Insurance segment.

On the other hand, revenues from associates via the equity method rose to an all-time high of 322.9%, thereby adding COP 648 billion (USD 179 million*) to our consolidated bottom line. This was mainly thanks to Bancolombia and a notable improvement with the health of its loan portfolio, a recovery with the streams of revenues from Proteccion and Grupo Argos as well as the continued good levels of performance from Grupo Nutresa.

“The consolidated figures for this second quarter clearly point to a more stable performance for all our investments. Our premium income recorded increases of 10.2% for the first half and 13.2% for the quarter, whereas fee and commission income scored growths of 16% for the first half and a record 23% for the quarter. This confirms the benefits of a well-balanced portfolio in terms of both business and geographical diversification, thereby providing us with the financial strength required as we transition towards the full recovery of our business”, stated Ricardo Jaramillo, Chief Business Development and Finance Officer for Grupo SURA .

Financial results on a subsidiary level

SURA Asset Management (an expert player in the pension, savings and investment as well as the asset management industries), recorded a 15.2% growth in its fee and commission income, which stood at COP 1.3 trillion (USD 355 million*), given the double-digit increase corresponding to the Retirement and Voluntary Savings segments (which consolidate Inversiones SURA and SURA Investment Management). Furthermore, the latter investment firm has recorded positive levels of operating earnings for the last three straight quarters. Our Mexican operations contributed significantly to the final result, given the growth in volume of its Assets under Management, while Chile is seeing a recovery with the local employment rate and wage base.

On the other hand, SURA AM's consolidated Assets under Management (AUM) rose by 11.2% on an annual basis. This is a significant achievement given the amount of pension withdrawals that took place in both 2020 and 2021 in Peru and Chile. All in all, SURA AM's consolidated net income closed at COP 305,113 million (USD 84 million*).

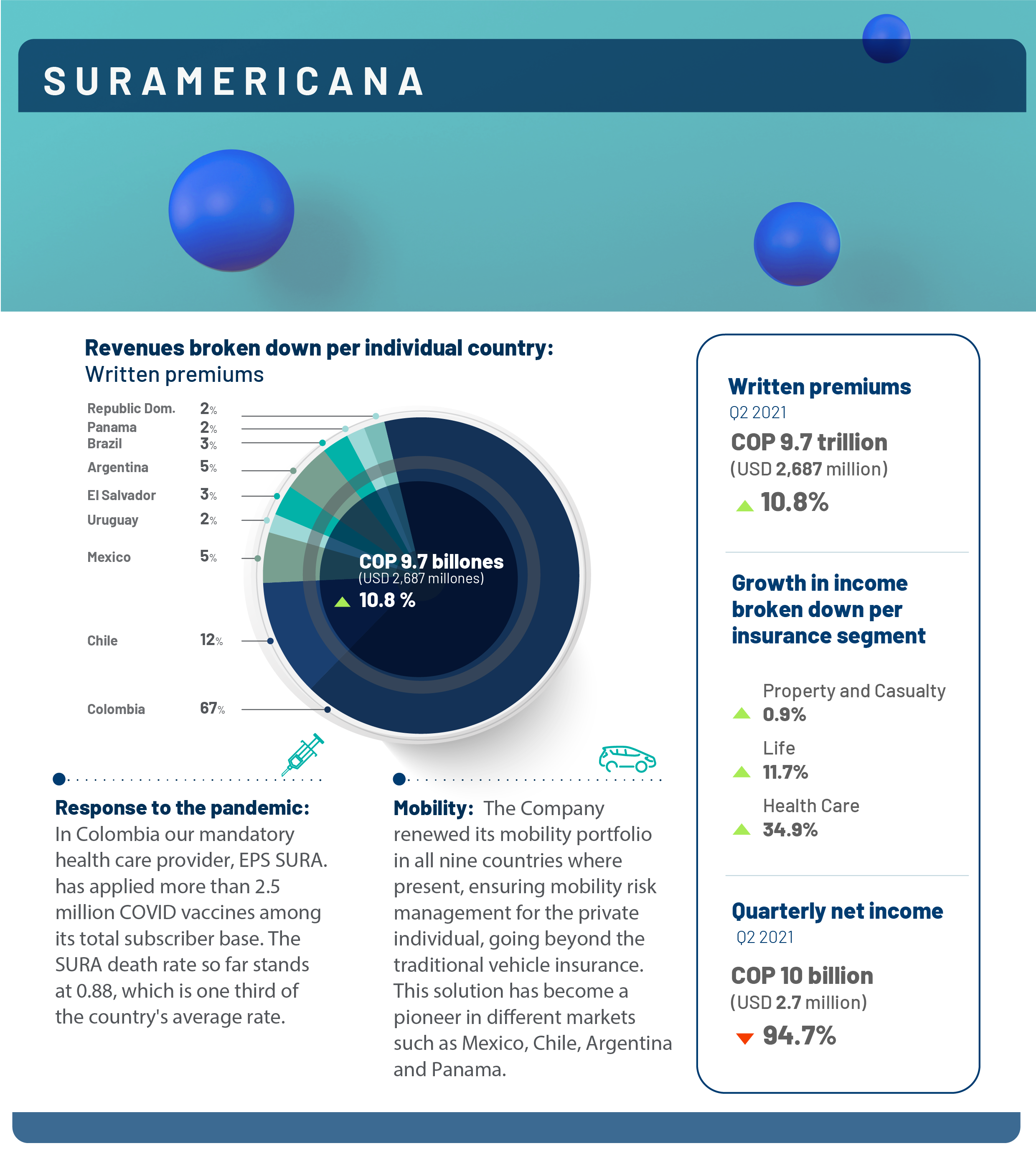

For its part, Suramericana (specializing in insurance and trend/risk management) posted a growth of 10.8% in written premiums, which reached COP 9.7 trillion (USD 2.687 million*), this driven by: (i) good levels of sales with the Life Insurance segment; (ii) the recovery seen with mobility solutions throughout the region, in the light of the current economic upturn and its consequent effect on the Property and Casualty segment; as well as (iii) positive sales on the part of the Health Care segment, which today has more than 4.4 million mandatory health care subscribers in Colombia (EPS SURA).

Likewise, all the Suramericana Companies have made an effort to rein in spending, which has mitigated the impact of the pandemic, mainly regarding the results posted by the Life Insurance segment. All in all, the Company's net income returned to positive territory during the second quarter to reach COP 10 billion (USD 2.7 million*).

These better-than-projected figures are allowing Grupo SURA to make headway amid the effects of the pandemic, as it transitions towards the flows recorded in 2019. The Senior Management team of the company shall continue striving to safeguard the Organization´s financial strength as an investment manager.

Other recent highlights:

- Grupo SURA is advancing with its scheduled stock buy-backs on the Colombian Stock Exchange. The total number of shares repurchased at the end of Q2 2021 came to COP 30 billion, this consisting of 1.3 million ordinary shares and 234 thousand preferred shares.

- SURA Asset Management also managed to reduce its indebtedness by another COP 320 billion, as part of its de-leveraging plan.

- Grupo SURA divested its position in Clover Health , a company included in the SURA Ventures portfolio. This transaction provided income of USD 7.6 million which, compared to the amount initially invested represents an annual effective return of 17.6% compared to the initial dollar-denominated investment and another 25.9% effective annual return in pesos. This investment increased in value by 2.6 in pesos.

- On the Health Care front, we continue to strive to cushion the impact that the pandemic has had on the region. In Colombia particularly, our mandatory health care provider, EPS SURA has helped with the nationwide vaccination process, by applying 2.5 million doses. Furthermore, the SURA case fatality rate currently stands at 0.88%, which is a third of the national rate (2.61%) and lower than the global rate (2.16%) at the end of Q2 2021.

- Suramericana renewed its mobility portfolio in all nine countries where present, ensuring against mobility risk for the private individual, going beyond the traditional vehicle insurance. This solution has become a pioneer in different markets such as Mexico, Chile, Argentina and Panama.

- SURA Investment Management formally began operations in Colombia through our new trust fund company, Fiduciaria SURA. This is yet another step towards building a comprehensive regional investment platform for the institutional segment.

Re-stated amounts in dollars:

* Figures taken from the Comprehensive Income Statement using the average exchange rate for Q2 2020: 3,622.282.