The macroeconomic environment throughout the region is posing both challenges and opportunities for financial institutions in terms of increasing access to credit for both individuals and companies.

By Valora Analitik for Grupo SURA*

In an effort to mitigate the adverse effects of the crisis unleashed by the Covid-19 pandemic as well as the impacts that still persist today four years later, several Latin American economies have implemented expansionary monetary policies, resulting in a gradual reduction of interest rates on the part of central banks.

This measure, combined with various economic stimulus initiatives, has had an impact on access to personal and business credit throughout the region, access which nevertheless remains volatile since although rates have fallen in most countries over the last year, their effect on access to credit for both individuals and companies is still being progressively transferred, so it will take time in order to observe the greater effects of this measure

This can be seen in the outlooks provided by rating agencies such as S&P, which also anticipate that the challenging economic prospects will put Latin American banks to the test, with moderate credit growth. Thus, profitability will continue to lessen, due to the deterioration of asset quality, which will force banks to continue strengthening their levels of provisions.

Access to credit for companies and individuals

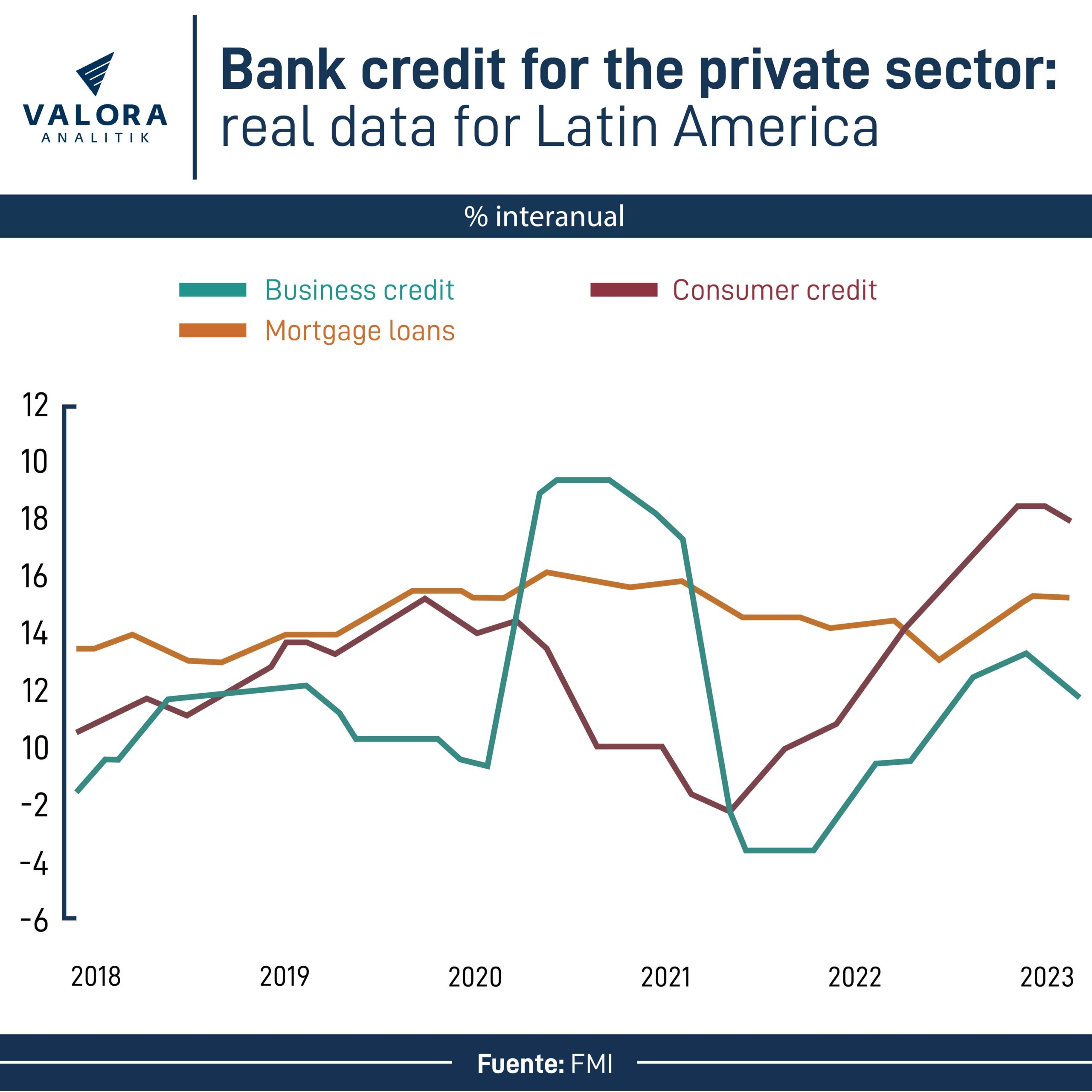

S&P's outlook highlights that credit throughout the region continues to be awarded mainly to large and medium-sized corporate entities that have greater creditworthiness, while appetite for smaller companies and microcredit remains low. Overall, credit growth in this segment is also limited, and asset quality continues to weaken as a result.

On the consumer side, banks have faced a deterioration in the asset quality of credit cards and personal credit, so their appetite in this segment is being restricted and they are expected to focus more on secured credit.

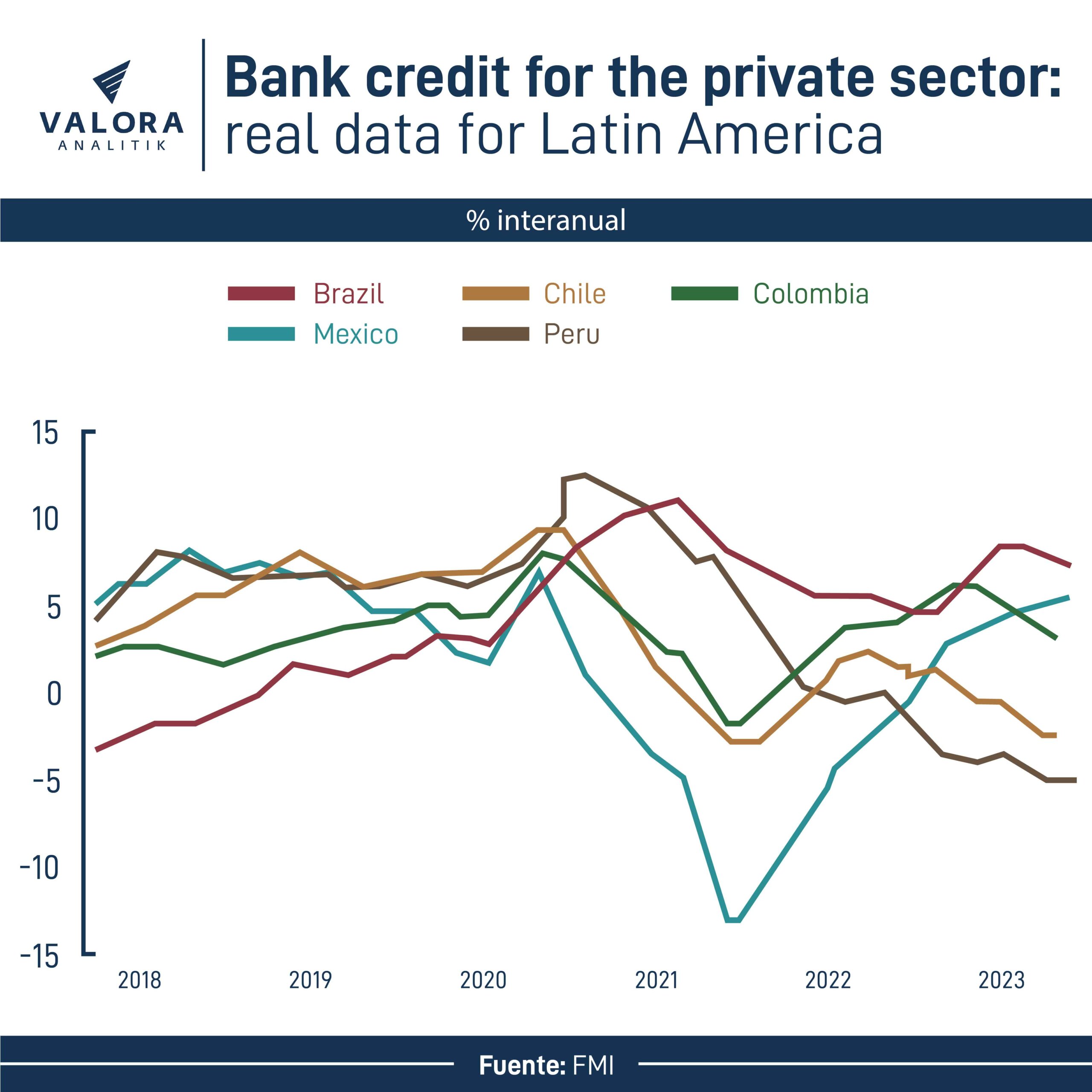

The International Monetary Fund (IMF) agrees, noting that in Latin America, lower rates of credit growth have been observed in almost all sectors since the end of 2022, although mortgage lending appeared to show greater resilience.

Also in the case of all those countries for which data has been made available (Brazil, Chile, Colombia, Mexico and Peru), foreign currency credit grew at higher rates compared to local currency credit, due to their lower cost in terms of interest rates, although the degree of dollarization in terms of these types of credit remains at levels similar to those seen before the pandemic.

In this regard, Laura Clavijo, head of Bancolombia's Economic Research team, explains that "the feeling is that the variables and sectors that have been contracting since 2023 will somehow not fully recover in 2024, rather this will be a gradual process, since interest rate expectations and how these are transmitted to the market will take a little more time".

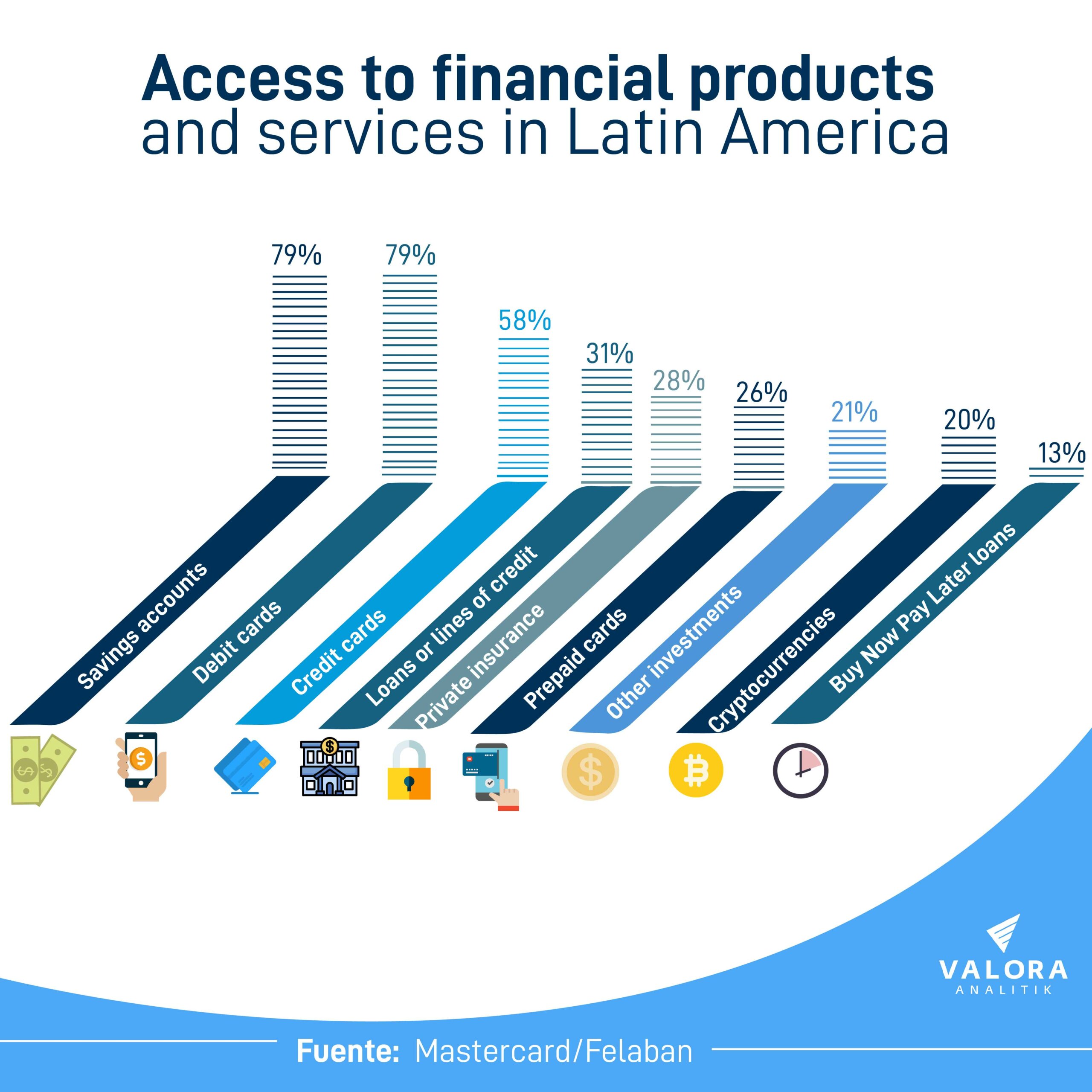

In terms of access to credit instruments or products for individuals in the region, MasterCard revealed in a recent report that the majority of Latin Americans (79%) do have access to basic financial services, but there is still room for these to achieve a more advanced level of financial inclusion.

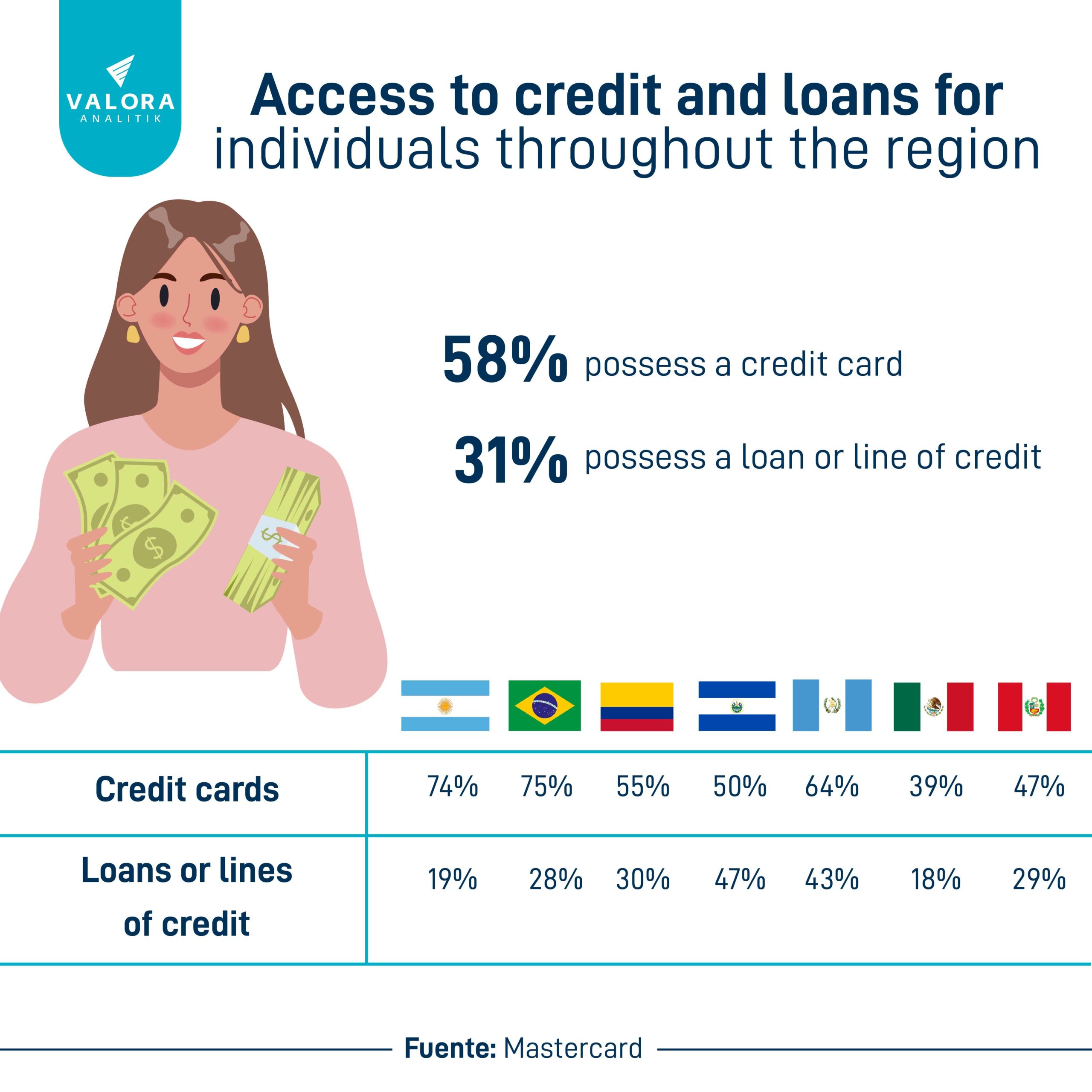

This report reveals that 58% of Latin Americans have a credit card, but only three out of 10 have access to other forms of credit such as loans, insurance or investment products.

In Colombia, for example, 30% possess a loan or a line of credit while 55% possess an active credit card. By comparison, Brazil is the country with the highest use of credit cards, with 75% of users paying with credit cards and only 28% using other means of borrowing.

"Financial inclusion is not evenly distributed: only 59% of low-income respondents and 40% of respondents living on the outskirts of large cities reported having an account, which overall translates into large gaps," highlighted Marcelo Tangioni, CEO of MasterCard Brazil.

He added that more than three-quarters (80%) of customers who used a prepaid card used it as their first product, while 67% of these card users went on to access loan products and 36% to make investments.

"The use of cards for everyday transactions, rather than for large expenses, had the greatest impact, because people gradually picked up the habit," stated this MasterCard executive.

Developing greater access to credit: challenges and opportunities

Against this backdrop, the region faces the following short- and medium-term challenges that financial institutions, as well as individuals and companies, must face in the short and medium term:

- Increased credit availability: lower interest rates have encouraged financial institutions to offer more loans to individuals and companies. This has expanded the financing options available in the region.

- Technological innovation: the proliferation of financial technologies (Fintechs) has facilitated access to credit through online platforms, mobile applications and other digital channels. This has especially benefited those who traditionally experienced difficulties in accessing financial services (both the unbanked or underbanked population).

- Diversification of financial products: financial institutions have diversified their products and services so as to adapt these to the specific needs of the different segments of both the population and the business sector. This includes loans for housing, education, automobiles, among others.

- Stimulating economic growth: expanded access to credit can boost consumption and investment, which in turn can contribute to the region´s economic growth.

- Financial inclusion: the expansion of credit, especially through digital platforms, can promote financial inclusion by offering services to those who have historically been excluded from the traditional financial system.

- Support for entrepreneurs: easier access to credit can foster entrepreneurship and support the growth of small and medium-sized enterprises, which are key to the region's economies.

- Risks of over-indebtedness: greater availability of credit may also increase the risk of individuals and companies incurring obligations that exceed their ability to pay off the money owed.

- Inequality: in spite of the progress made so far, there are still disparities in accessing credit among different population groups and regions in Latin America. Economic and social inequality, as well as highly informal job markets, can limit access to credit for certain segments.

- Economic volatility: the region faces challenges that may affect financial stability and credit availability, such as volatility prevailing in the financial markets, inflation and political uncertainty.

To conclude, while financial systems are encouraged to improve access to credit in Latin America, there are still challenges that must be addressed jointly to ensure that such access is equitable, sustainable and beneficial for the region's economic growth.

*This article was prepared by the Valora Analitik staff for Grupo SURA. Its content is of a purely journalistic nature and does not compromise any specific positions taken or recommendations made by our Organization.