*The Company explained to the investing public details of the operations to fulfill this agreement during the videoconference on June 20.

- The agreement was reached with JGDB, Nugil, International Holding Company (IHC), Grupo Nutresa and Grupo Argos, as part of a Memorandum of Understanding (MOU) first announced on May 24.

- The agreement establishes the conditions for a series of transactions through which Grupo SURA shall exchange its stake in Grupo Nutresa's food business for its own shares and those of Grupo Argos.

- The transactions contemplated in this agreement include a spin-off of Grupo Nutresa, a tender offer of shares and the exchange of shares in order to comply with that previously agreed upon.

Thursday, June 15, Grupo SURA, Grupo Nutresa, Grupo Argos, JGDB, Nugil and IHC, signed a framework agreement defining the terms and conditions for entering into a series of transactions that, once the pertinent corporate and regulatory authorizations are obtained, shall result in the following:

1. JGDB, Nugil and IHC shall become the controlling shareholders of Grupo Nutresa's food business,holding at least an 87% stake in its share capital.

2. JGDB, IHC y Nugil shall cease to be shareholders of Grupo SURA.

3. Grupo SURA and Grupo Argos shall cease to be shareholders of Grupo Nutresa.

4. Grupo Nutresa shall cease to be a shareholder of Grupo Argos and Grupo SURA.

With this in mind and for the purpose of providing greater clarity, the main activities and transactions required for implementing the agreement thus signed are highlighted below.

1. A Spin-off from Grupo Nutresa

Grupo Nutresa, subject to obtaining due approval from its Shareholders at their upcoming Meeting, shall split or divide its equity symmetrically into two companies that, for the purposes of this press release, shall be called Nutresa Alimentos (Nutresa Food in English) and Nueva Sociedad Portafolio (New Portfolio Company in English).

On the one hand, Nutresa Alimentos shall be the company holding Grupo Nutresa's equity related to its food business and, on the other hand, Nueva Sociedad Portafolio shall hold the investments that Grupo Nutresa currently has in both Grupo Argos and Grupo SURA. Nutresa Alimentos and Nueva Sociedad Portafolio shall be listed on the Colombian Stock Exchange.

The result of this spin-off will be that for each share that the shareholders hold in Grupo Nutresa, they will keep one (1) share in Nutresa Alimentos and will receive one (1) share in Nueva Sociedad Portafolio.

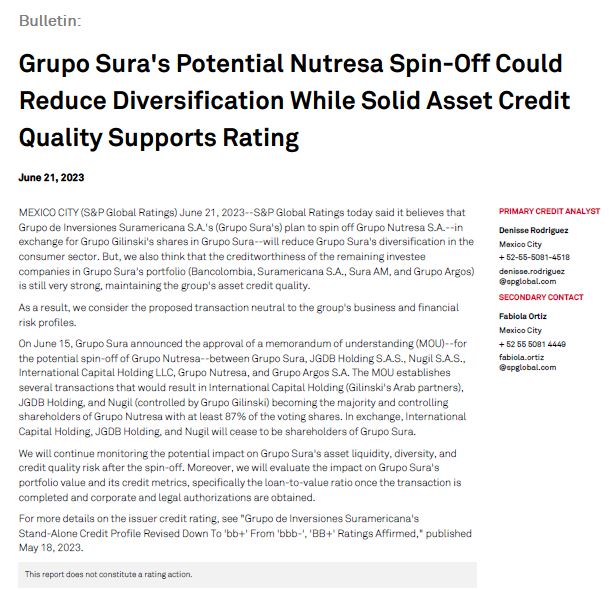

2. Setting up and making contributions to the Stand-Alone Trust

In accordance with the provisions of the Basic Legal Circular governing trust arrangements, as issued by the Colombian Superintendency of Finance, a Stand-Alone Trust Fund ("PA” for its abbreviation in Spanish), shall be set up to which Grupo SURA and Grupo Argos shall deliver their shares in Grupo Nutresa. In turn, JGDB, Nugil and IHC shall deliver to the Stand-Alone Trust the shares they own in Grupo SURA and, once the spin-off is approved, Nugil shall also deliver the shares it receives from Nueva Sociedad Portafolio.

3. Tender offer for shares in Nutresa Alimentos

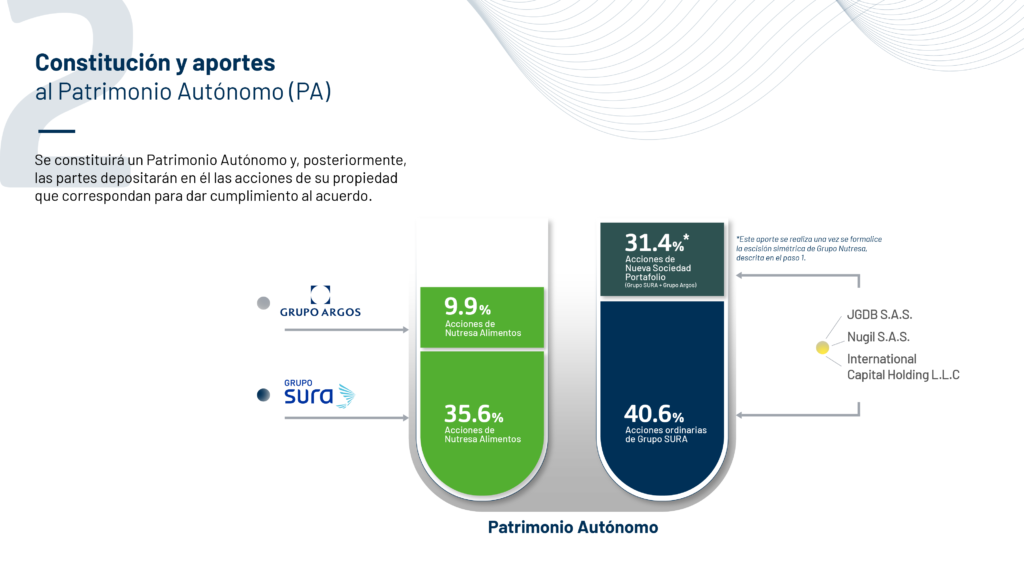

Grupo SURA and Grupo Argos shall then jointly launch, in the proportion of 78% and 22%, respectively, a tender offer directed at all shareholders of Nutresa Alimentos in which these may voluntarily participate and choose between the following options:

a) Selling their shares in Nutresa Alimentos at a price of USD 12 per share payable according to the conditions to be defined in the prospectus corresponding to the Tender Offer, and/or

b) Exchanging their shares in Nutresa Alimentos, receiving shares in Grupo SURA and the Nueva Sociedad Portafolio (set up with shares in Grupo SURA and Grupo Argos). The aforementioned,under the same terms in which Grupo SURA and Grupo Argos agreed in the negotiation with Nugil, JGDB and IHC, and as stipulated in the agreement. The terms and conditions of this exchange shall be published in the Tender Offer Prospectus

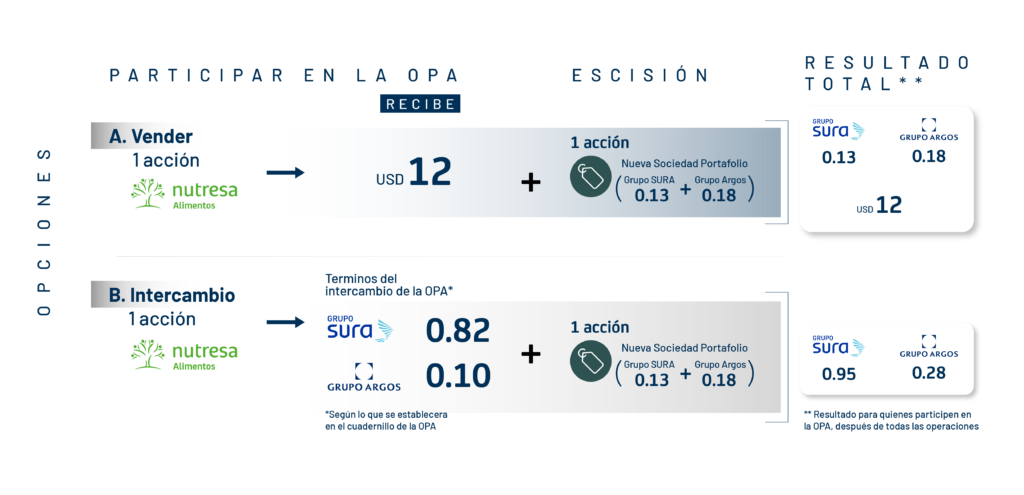

4. Final contribution to the Stand-Alone Trust

Once the tender offer is concluded, the offerors (Grupo SURA and Grupo Argos) shall deliver to the Stand-Alone Trust the amounts awarded as received for up to 10.1%, which is the percentage required to complete the agreed stake of JGBD, IHC and Nugil in Nutresa Alimentos this equal to at least 87%.

In the event that the amounts awarded as received through the Tender Offer exceed 10,1%, Grupo SURA and Grupo Argos shall be reimbursed with the corresponding value at the same price by IHC.

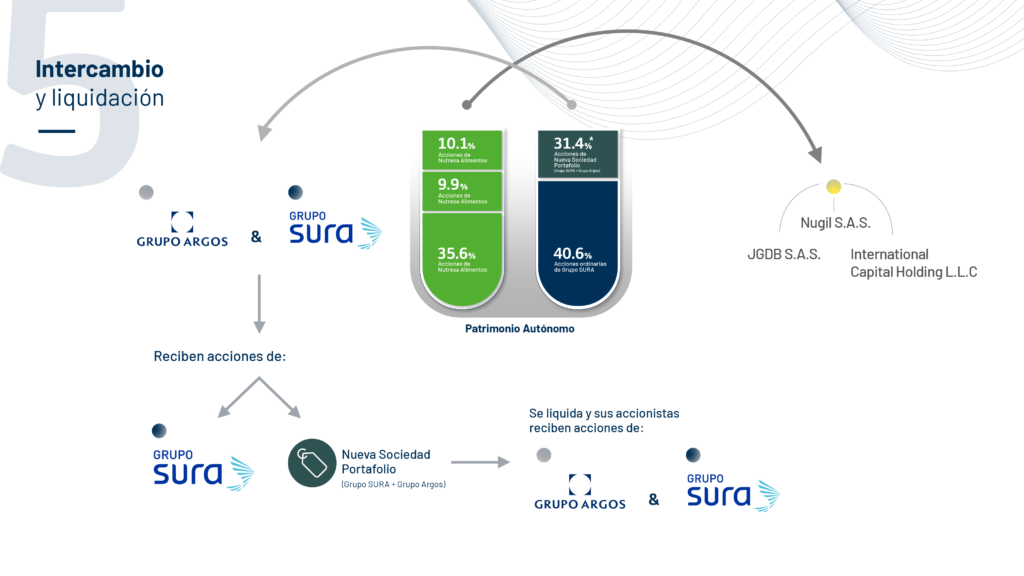

5. Exchange and Settlement

Subsequently, the Stand-Alone Trust shall reimburse the amounts made by the parties, resulting in the exchange of shares in which JGDB, IHC and Nugil shall become controlling shareholders of Nutresa Alimentos, while Grupo SURA and Grupo Argos shall receive shares in Nueva Sociedad Portafolio and in Grupo SURA that previously belonged to Nugil, JGDB and IHC.

Once this exchange is carried out, Nueva Sociedad Portafolio shall be liquidated with the following effects:

a) Grupo SURA shall receive its own shares as well as those of Grupo Argos, thereby increasing its stake in the latter company.

b) Grupo Argos shall receive its own shares as well as those of Grupo SURA, thereby increasing its stake in the latter company.

c) The other shareholders of Nueva Sociedad Portafolio will receive shares in Grupo SURA and Grupo Argos.

In order to comply at all times with all applicable rules and regulations, and with the prior authorization of the Colombian Superintendency of Finance, part of the reimbursements that Grupo SURA and Grupo Argos are due to receive shall be temporarily contributed to independent stand-alone trusts. The shares deposited therein shall not have any voting rights while these stand-alone trusts exist.

"This agreement, like all the decisions we make at Grupo SURA, is in keeping with our purpose of creating added value for all our shareholders and society at large. Our main interest is to achieve conditions that enhance our strategy and strengthen the trust that we have inspired for the last 78 years, this based on our way of doing business," stated Gonzalo Alberto Pérez, CEO of Grupo SURA.

Upon completing the transaction as set forth in the aforementioned agreement, Grupo SURA shall report the analyses that are to be duly performed on the new structuring of its portfolio, as well as any additional information considered to be relevant.

Mr. Perez went on to comment "It is important to highlight that Grupo SURA's strategy remains in force. We are an investment manager in pursuit of sustainable profitability and our objective is to help ensure a more harmonious level of social development while creating economic value, this through a well-balanced management of our four capitals: natural, social, human and financial".

S&P declared the effect of the transaction on the Company's credit rating to be neutral.

On June 21, S&P Global Ratings issued its opinion on the transaction contemplated in the Framework Agreement and its effects on Grupo SURA's credit rating. In this regard, it declared the transaction to be neutral with respect to the Company's financial and business risk profiles.

The ratings agency considered that, although the spin-off regarding Grupo Nutresa shall reduce diversification in the consumer sector, the strength of the remaining companies in the investment portfolio (Suramericana, SURA Asset Management, Bancolombia and Grupo Argos) remains very high, which maintains the credit quality of the Group's assets.

S&P stated that it shall continue to monitor the potential impact of the spin-off on the Company's asset liquidity, diversity and credit quality risk. Similarly, once the required corporate and legal approvals are obtained and the transaction is completed, this ratings agency will evaluate the impact of the transaction on the value of Grupo SURA's portfolio and its credit metrics.