This sector has recently undergone a significant transformation, driven by technological innovation, regulatory changes and the growing demand for insurance products. Projections for the coming years are positive.

By Valora Analitik for Grupo SURA*

The worldwide insurance industry has shown a sustained growth, driven by an expanding middle class, greater awareness of the importance of insurance as well as advances in digital technology.

This is what the Swiss Re Institute reveals with its growth projections for 2024 and 2025 as part of its annual World Insurance Sigma report that analyzes the industry´s present and future . Consequently, it is projecting that the volume of premiums, excluding life insurance, shall reach USD 4.6 trillion in 2024 and USD 4.8 trillion in 2025.

Meanwhile, with regard to life insurance, Swiss Re Institute forecasts a 2.9% growth in this sector's premiums by the end of 2024, reaching a total of USD 3 trillion. Meanwhile, for 2025 a growth of 2,7% is expected.

Jérôme Haegeli, chief economist at the Swiss Re Group, stated the following regarding this outlook for the Life and Non-Life branches of insurance, "The global economy has given us a surprise on the upside, which should drive an increased demand for insurance. The Life Insurance sector, in particular, is one to watch, as higher interest rates could drive up investment income and consumer demand for annuities, offering more people a secure income for their retirement."

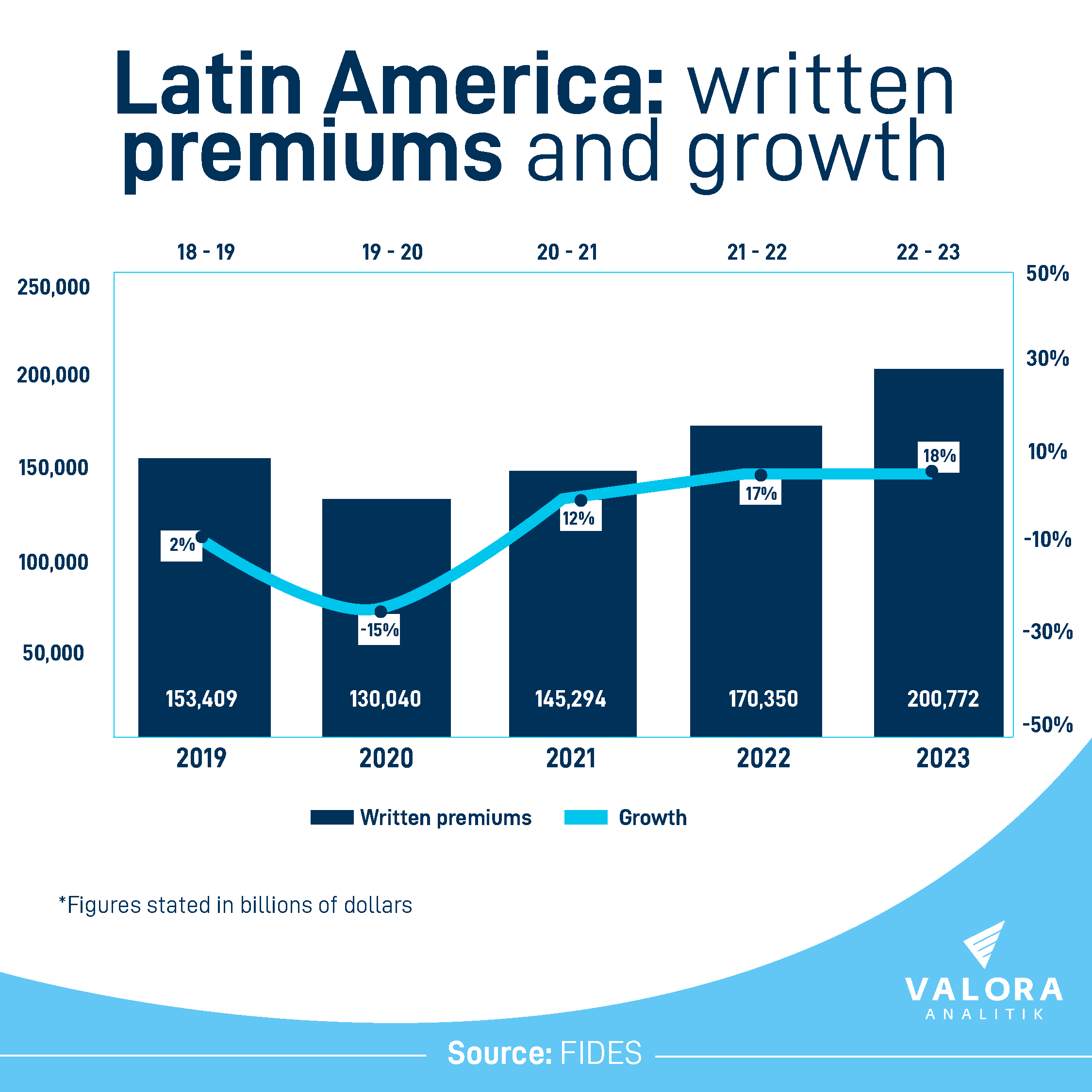

On the other hand, according to figures from the Inter-American Federation of Insurance Companies (FIDES), the insurance market in Latin America and the Caribbean reached a premium volume of approximately USD 200,772 million in 2023, for a year-on-year growth of 18%, thereby marking an upward trend.

Jorge Claude, the President of FIDES, pointed out that the region is facing a period full of opportunities, highlighting areas such as life insurance, which is facing a demographic change that must be absorbed and transformed into an opportunity for companies.

In turn, health insurance is also providing opportunities throughout the region in terms of the coverage and benefits offered. Another area to be discovered is climate change-linked insurance, which requires greater diversification to be provided to both individuals and companies.

Technological innovation and digitalization are driving growth

Access to underserved markets is a priority for insurance companies in Latin America. Several factors have facilitated this expansion, including improved technological infrastructure, favorable regulatory policies and strategic alliances.

As a result, technology has been a key catalyst in the evolution of the insurance industry. Digitalization has enabled insurance companies to improve their operating processes, offer customized products and access underserved markets, highlighting the following trends:

- Insurtechs: have revolutionized the industry by introducing digital platforms that facilitate the contracting and management of insurance policies. These companies use technologies such as artificial intelligence, big data and blockchain to optimize customer experience and reduce operating costs.

- Telematics and usage-based insurance: this technology involves the use of devices to monitor the insured party's behavior and has gained popularity in automobile insurance. Usage-based insurance allows companies to offer rates according to the behavior of the insured party, encouraging safe driving.

Expansion and growth in the Latin American markets

The Latin American insurance market is growing and is expected to continue to do so in the coming years. This is due to a number of factors, such as economic growth, the rise of the middle class and an increased awareness of the importance of insurance, as well as the advantages provided by digitalization.

Consequently, the main drivers of the growth of the regional insurance market in the coming years will be: GDP growth per capita, increased insurance penetration, the development of new insurance products and the expansion of distribution channels.

Brazil

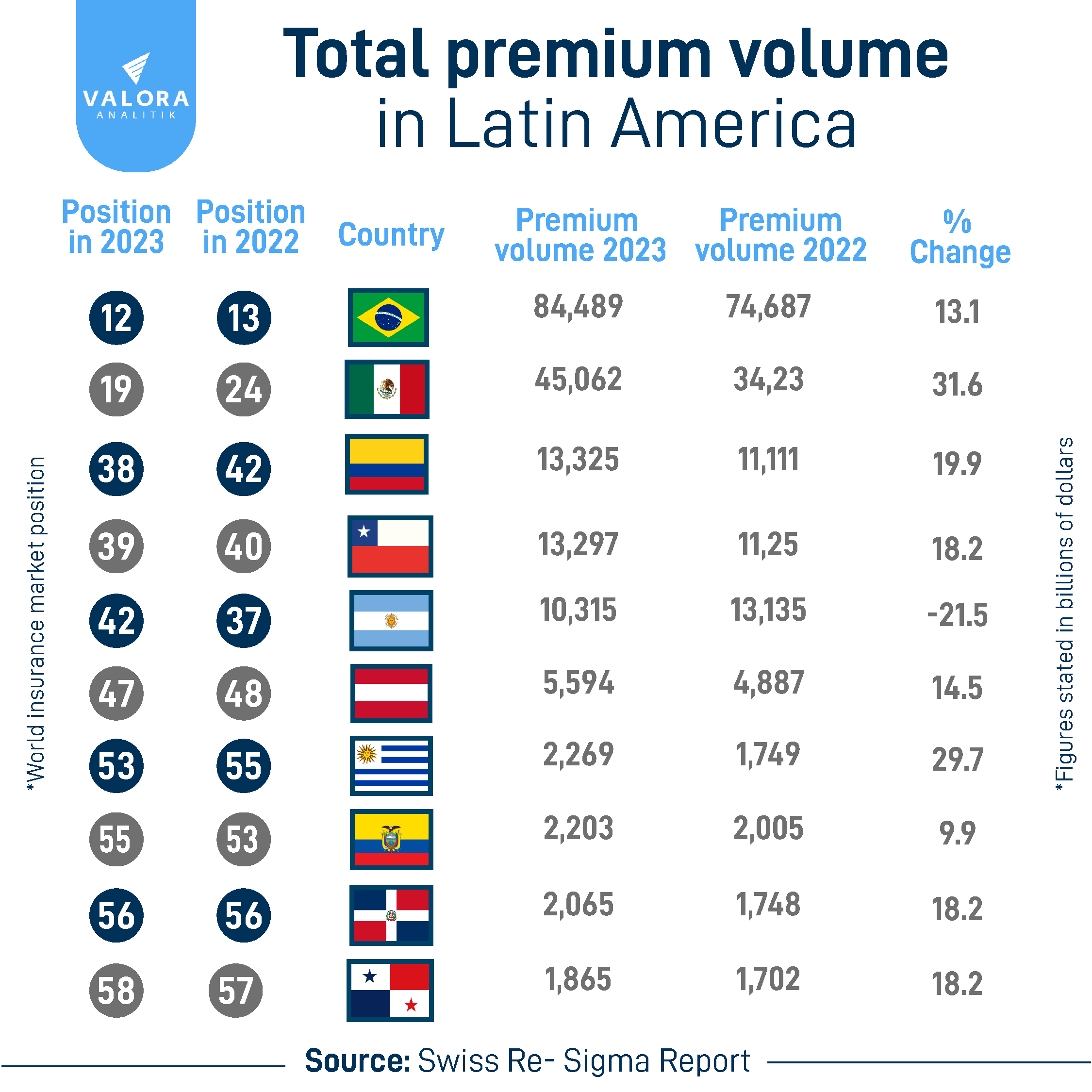

Brazil, with its vast market and economic diversity, represents great potential for the insurance industry. In 2023, the Brazilian insurance market recorded a premium volume of approximately USD 85,000 million, for a year-on-year growth of 13.1% in dollars. Life, auto and health care insurance are the most important segments.

The larger companies in this country have focused their efforts on expanding into underserved markets, using digital channels and microinsurance to reach low-income populations and rural areas.

In turn, the integration of insurtechs has been crucial for the modernization of the sector. Startups such as Thinkseg and Minuto Seguros have introduced digital platforms that facilitate the handling and taking out of insurance policies, thereby enhancing accessibility and efficiency.

Mexico

Mexico, Latin America's second largest economy, has also shown a sound growth with its insurance industry. Last year, the Mexican market reached a premium volume of approximately USD 45.000 million for a year-on-year growth of 31.6%. Auto, life and health care are the predominant branches of insurance in this part of the world.

Here, it is worth noting the measures taken by the Mexican National Insurance and Bonding Commission (CNSF), which has introduced regulations that promote competition and financial inclusion. This has allowed new players to enter the market along with greater product diversification.

Several companies have established alliances with insurtechs to develop innovative products and improve customer experience. Telematics and usage-based insurance have gained popularity, especially in the auto insurance segment.

Colombia

Colombia has seen a significant growth in its insurance industry, with an increase in insurance penetration and product diversification, thereby consolidating its position as the third largest in the region. In 2023, Colombia reported a total premium volume of USD 13,325 million, for a growth of 19.9% that year.

The main drivers of this growth were GDP growth per capita, increased insurance penetration and the development of new insurance products.

Life together with property and casualty insurance, the latter including health care and auto, have been the main drivers of this growth. Companies such as SURA have launched innovative products such as digital health care insurance and microinsurance in order to reach underserved segments. Consequently, digitization has allowed greater product accessibility and customization.

Chile

Chile, in fourth place, is one of the most developed insurance markets in the region, with a greater insurance penetration and a sophisticated financial infrastructure. In 2023, insurance penetration in Chile reached 4.7% of GDP, the highest in the region. Premium volume exceeded USD 13,297 million, for an 18% increase.

Life and health care insurance have dominated the Chilean market, driven by an older population and growing health awareness.

There, the adoption of digital technologies has enabled insurers to improve operating efficiencies while offering customized products. Telemedicine and digital health insurance have gained traction, particularly with respect to other markets.

Challenges and opportunities

Although the insurance industry in Latin America presents a positive outlook, it also faces challenges that must be addressed to ensure sustainable growth. These include:

- Regulation and compliance: Regulatory differences between countries could complicate regional expansion. Companies must adapt to diverse regulations so as to ensure compliance.

- Education and awareness: lack of financial education and awareness of the importance of insurance continues to be an obstacle, especially in underserved markets.

- Accessibility and cost: making insurance accessible and affordable for all sections of the population remains a challenge. Microinsurance and digital solutions can help overcome this barrier.

- Technological innovation: technology shall continue to be a key driver of growth. Artificial intelligence, big data and blockchain are providing opportunities for improving operating efficiencies and personalizing products.

- Expanding into underserved markets: the growing middle class and greater urbanization are providing opportunities for further expansion. Microinsurance and products tailored to local needs can help capture this segment.

- Strategic alliances: collaborations between traditional insurers and insurtechs can accelerate innovation and enhance customer experience. Alliances with fintechs can also facilitate financial inclusion and access to insurance.

Consequently , the future of the insurance industry in Latin America remains promising, with sustained growth driven by large markets such as Brazil, Mexico, Colombia, Chile and Uruguay, that are showing significant progress, each with its own challenges and opportunities.

*This article was prepared by the Valora Analitik staff for Grupo SURA. Its content is of a purely journalistic nature and does not compromise any specific positions taken or recommendations made by our Organization.