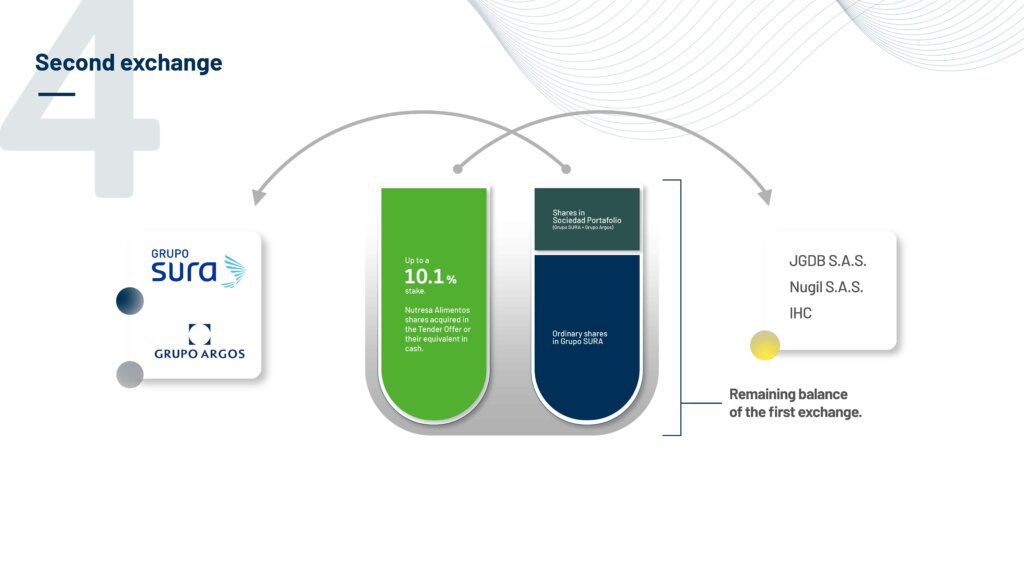

Once the aforementioned tender offer is concluded, the parties will move forward with the second stage of the direct share swap whereupon the Framework Agreement shall be duly completed. This shall represent benefits for Grupo SURA's shareholders and provide a greater focus on the financial service sector for the Company's portfolio.

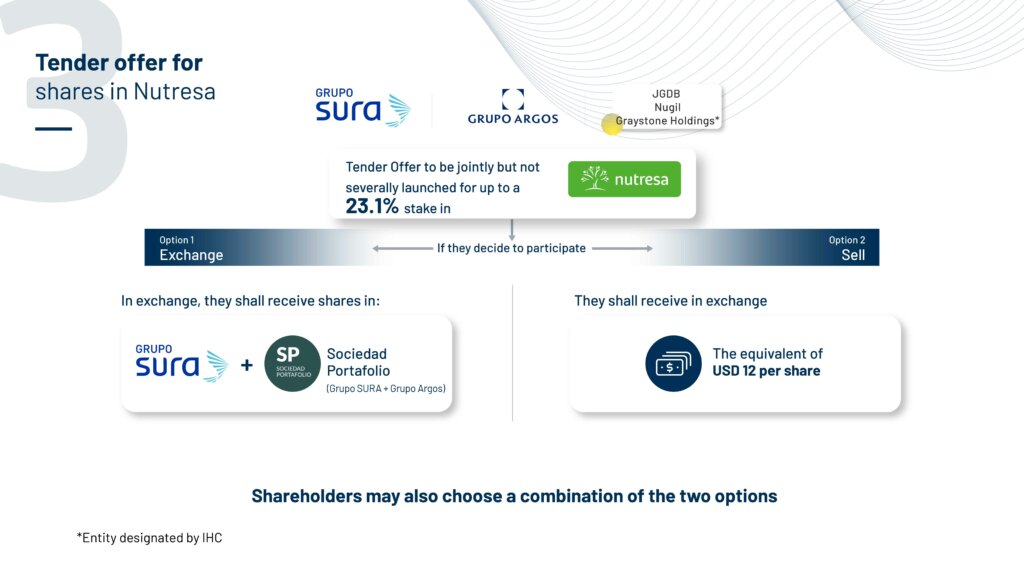

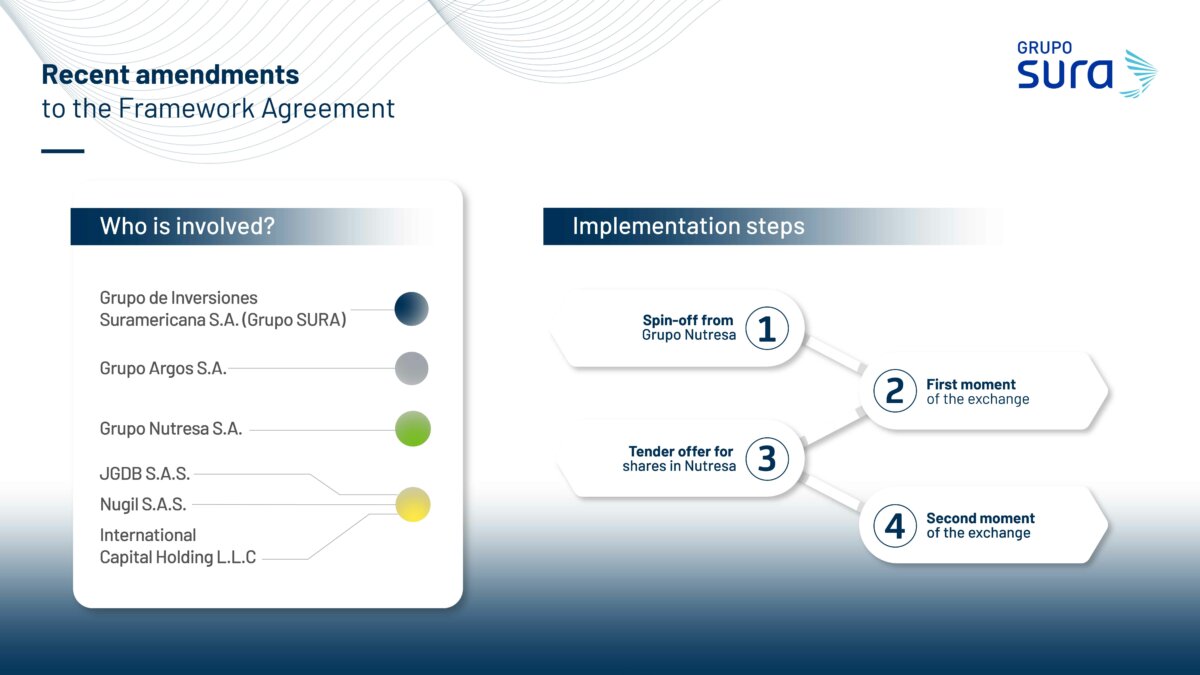

As part of the implementation of the Framework Agreement signed by the Company in June 2023, last March 9, Grupo SURA launched jointly but not severally with Grupo Argos, Graystone Holdings (entity delegated by IHC), JGDB Holding and Nugil a tender offer for up to 23.1% of Grupo Nutresa’s outstanding ordinary shares.

This percentage corresponds to all the shares in Grupo Nutresa shares owned by shareholders other than the parties to the Framework Agreement, who, through the tender offer, will have the option of selling their investments in this food company under the same terms and conditions in which the parties agreed to exchange their shares.

The acceptance period, in which Grupo Nutresa shareholders may express their desire to participate in this tender offer, will begin on March 18 and end on April 3, 2024.

In this tender offer, Grupo SURA and Grupo Argos will acquire up to 10.1% of Grupo Nutresa´s outstanding shares, which is the percentage of shares needed for JGDB, IHC and Nugil to complete their 87% stake in Grupo Nutresa, in compliance with the Framework Agreement. In the event that acceptances are received in excess of that percentage, the excess shares will be purchased outright by Graystone, JGDB and Nugil.

The purchase price per share will be USD 12, payable in cash or through a combination of shares in Grupo SURA and Sociedad Portafolio. Grupo Nutresa´s shareholders who decide to participate in this tender offer may also receive a portion in cash and another portion in the form of the aforementioned shares. The ratio for this latter option, is that 1 Grupo Nutresa share is equivalent to 0.7438 of Grupo SURA´s ordinary shares and 0.5650 of Sociedad Portafolio´s shares.

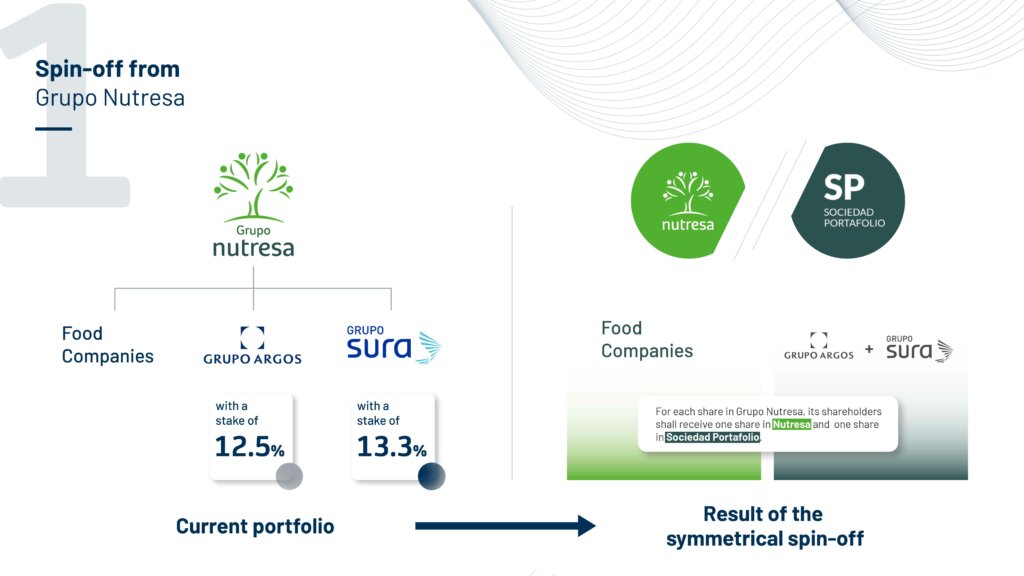

It is worth recalling that Sociedad Portafolio is the company resulting from the spin-off from Grupo Nutresa as contemplated in the Framework Agreement the purpose of which was to separate its food business from its investment portfolio. Consequently, Sociedad Portafolio manages shares in Grupo SURA and Grupo Argos and as of January 9, 2024, began trading on the Colombian Stock Exchange.

The tender offer for Nutresa shares complies with that defined in Decree 0079 of 2024 issued by the Colombian Ministry of Finance, which establishes the legal conditions for share swaps and guarantees equal treatment to minority shareholders.

Once the tender offer is settled and completed, the parties will continue with the second stage of the direct share swap, in which Grupo SURA and Grupo Argos will deliver the Grupo Nutresa shares they acquire through the offer, in exchange for the Grupo SURA and Sociedad Portafolio shares still owned by JGDB, Nugil and IHC.

With this, Grupo SURA shall complete the last step of the transaction defined in the Framework Agreement and then make headway with focusing on its investment portfolio, while generating value for its shareholders.

"This transaction will mean that Grupo SURA shall repurchase almost 30% of its outstanding shares, which will reflect positively on individual metrics such as equity and earnings per share. Once the Agreement is completed, we will have a portfolio that is more focused on the financial service sector and on the prevailing growth opportunities, thereby providing us with a strong financial position that will allow us to continue delivering an increasing dividend while continuing on a path towards obtaining a return above the cost of capital," stated Ricardo Jaramillo, the Company's Chief Business Development and Finance Officer.

Prior progress with the Framework Agreement:

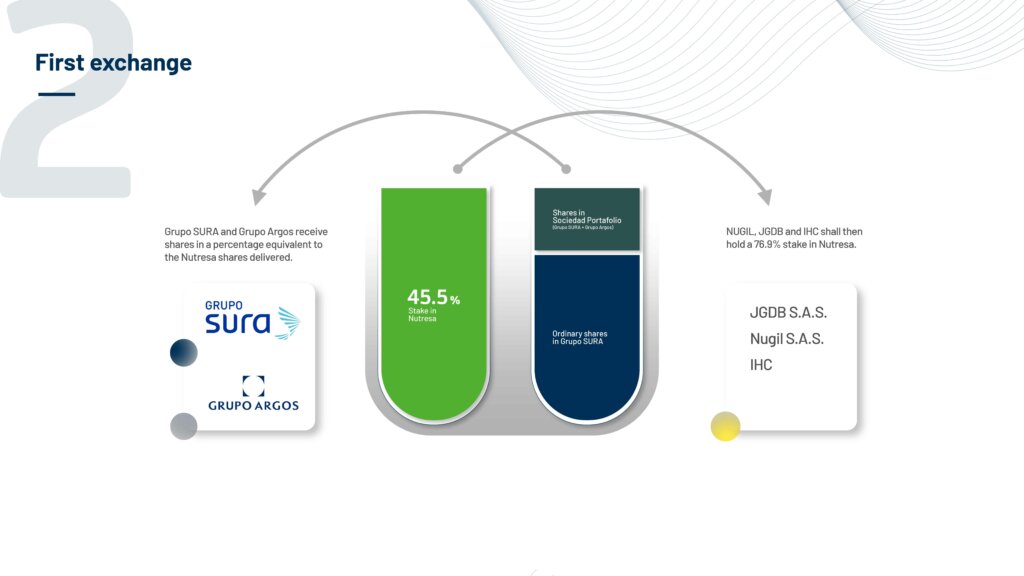

As the market was duly informed, on February 6, 2024, the first direct share swap was carried out, as contemplated in the Framework Agreement, and as previously authorized by the Colombian Superintendency of Finance, whereby:

- Grupo SURA delivered to Nugil, JGDB and IHC all the shares it owns in Nutresa.

- JGDB, Nugil and IHC transferred to Grupo SURA 27.8% of the Company's ordinary shares, which Grupo SURA shall treat as repurchased shares.

- Grupo SURA received from Nugil, JGDB and IHC a 11.8% stake in the total outstanding shares belonging to Sociedad Portafolio.

Since Grupo SURA will at no time exercise control over Sociedad Portafolio, part of the shares received in this swap will be temporarily deposited in a stand-alone trust, which will be irrevocably instructed not to exercise the voting rights inherent to these shares.

Regarding the Grupo SURA shares received by Grupo Argos as part of this swap, this latter Company shareholder has already begun to transfer part of these shares to another stand-alone trust, with the same instruction of not exercising their inherent voting rights.

On the other hand, the Framework Agreement signed on June 15, 2023, was amended for the purpose of speeding up these operations and making them more efficient, this through the signing of three additional addenda on December 11 and 18, 2023 and February 2, 2024. In this respect, the divestiture of Grupo SURA’s stake in Grupo Nutresa continues, in exchange for receiving its own shares and those of Sociedad Portafolio; at the same time, JGDB, IHC and Nugil cease to be shareholders of Grupo SURA and are the controlling shareholders of Grupo Nutresa, with this food company ceasing to be a shareholder of Grupo SURA.

Previously, on December 15, 2023, Grupo Nutresa informed the market that after obtaining approvals from its General Assembly of Shareholders as well as the Colombian Superintendency of Finance, it formalized the spin-off of its equity symmetrically into two companies: Grupo Nutresa and Sociedad Portafolio.

Grupo SURA's premise for implementing this agreement has always been to ensure that all parties obtain a satisfactory result under fair conditions and that this operation generates value for both the Company and its shareholders. Therefore, the further implementation of this Agreement will allow us to further develop Grupo SURA's ownership structure and on focusing its investment portfolio on the financial service sector.

Step-by-step implementation of the Framework Agreement signed in June 2023